News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ethereum is not perfect, but it is the optimal solution.

At least four Chinese-funded financial institutions and their branches, including Guotai Junan International, have withdrawn from applying for a Hong Kong stablecoin license or have suspended related attempts in the RWA sector.

All primary market participants will have on-chain redemption rights, allowing them to burn $FT at any time and redeem up to the equivalent value of their original principal.

All primary market participants will have on-chain redemption rights, allowing them to burn $FT at any time and redeem up to the equivalent of the original principal.

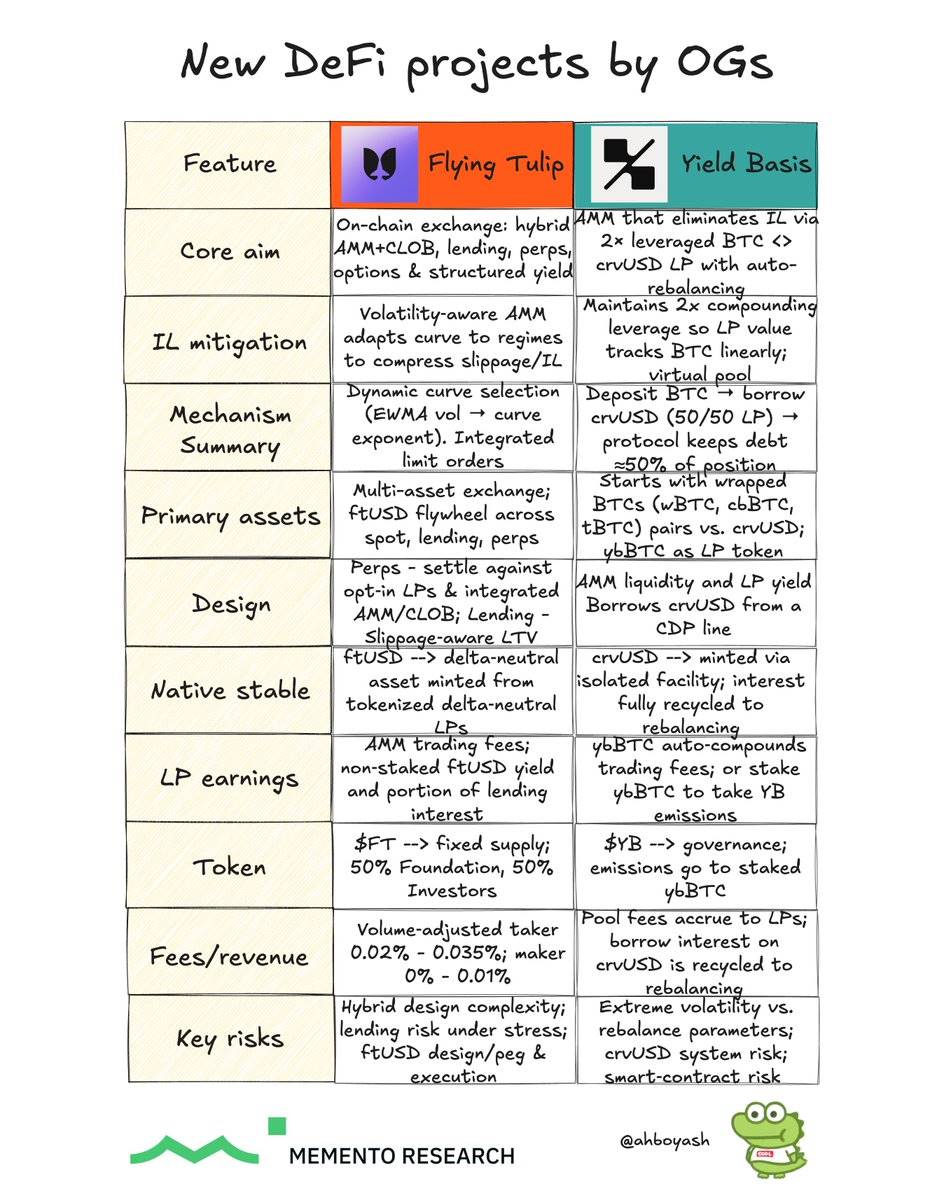

Aiming to address the challenges of on-chain liquidity.

- 02:41Japanese bond yields rise as market focuses on this week's economic dataJinse Finance reported that Japanese government bond yields have risen due to persistent market expectations of a near-term rate hike by the Bank of Japan. The Bank of Japan's Policy Board is scheduled to hold a meeting from December 18 to 19 to make its final interest rate decision of the year. To gauge economic strength, investors will focus on economic indicators, including household spending data set to be released on Friday. The yield on 2-year Japanese government bonds rose by 1 basis point to 1.015%, while the 10-year yield increased by 2 basis points to 1.875%. (Golden Ten Data)

- 02:35Hyperunit whale holding billions of dollars leverages to go long on ETHAccording to Jinse Finance, Arkham monitoring shows that the Hyperunit whale, holding billions of dollars, is currently leveraging long positions on ETH. This whale, who shorted during the market crash on October 10 and earned $200 million, recently unlocked $361 million worth of ETH and deposited all of it into AAVE. He then used these ETH as collateral to borrow $160 million USDT, and has already deposited all the USDT into an exchange.

- 02:29Data: The crypto market rebounds across the board, NFT sector leads with nearly 12% gain, BTC surpasses $91,000ChainCatcher News, according to SoSoValue data, the crypto market has rebounded across the board, with 24-hour gains generally ranging from 3% to 12%. Among them, the NFT sector performed exceptionally well, rising by 11.87%. Within the sector, Pudgy Penguins (PENGU) surged 24.59%, and SuperVerse (SUPER) increased by 21.72%. In addition, Bitcoin (BTC) rose 6.61%, breaking through $91,000; Ethereum (ETH) rose 8.01%, surpassing $3,000. It is worth noting that MAG7.ssi rose 6.89%, DEFI.ssi increased by 9.46%, and MEME.ssi was up 8.12%. In other sectors, the DeFi sector rose 9.14% in 24 hours. Within the sector, Chainlink (LINK) and MYX Finance (MYX) rose 13.60% and 15.68%, respectively; the Meme sector increased by 8.72%, with Pepe (PEPE) and Pump.fun (PUMP) rising 13.61% and 17.26%, respectively; the Layer1 sector rose 7.09%, with Sui (SUI) up 20.39%; the Layer2 sector increased by 6.74%, with Optimism (OP) up 10.16%; the PayFi sector rose 6.53%, with Stellar (XLM) up 9.10%; the CeFi sector increased by 6.17%, with a certain exchange Coin (BNB) up 6.58%. Crypto sector indices reflecting historical sector performance show that the ssiNFT, ssiDeFi, and ssiRWA indices rose by 13.94%, 10.64%, and 8.15%, respectively.