News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Behind the limited rewards lies an infinite game. The essence of trading competitions is a collective prisoner's dilemma—whether to achieve a Nash equilibrium or fall short, this uncertain game further excites traders’ nerves.

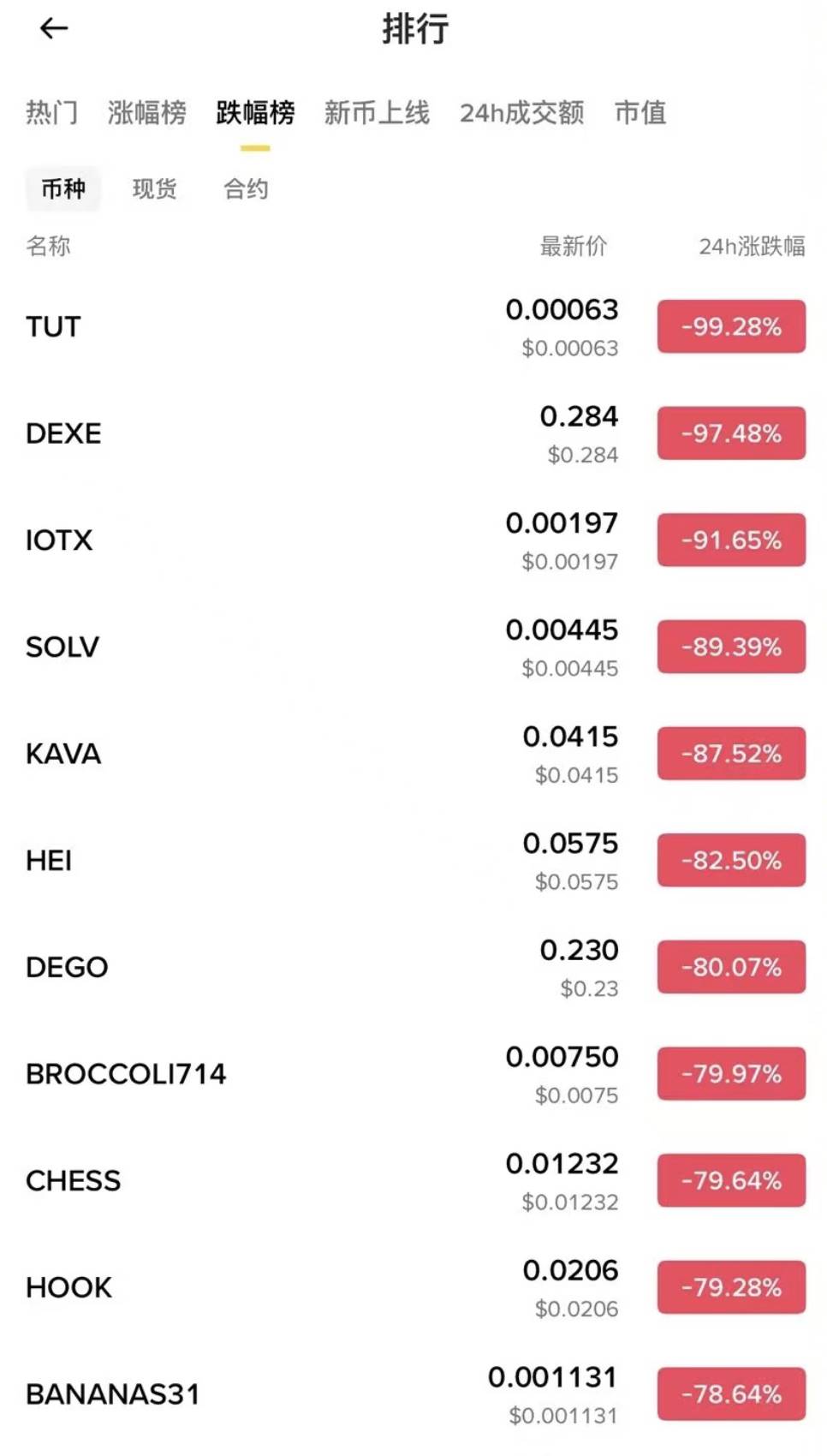

After the sharp drop early this morning, funding rates on major CEX and DEX platforms indicate that the market has clearly turned bearish.

When a wallet address is no longer just an asset credential, but an identity; when a profile picture is no longer just a JPEG, but a community signal; when a joke can spark collective creation and meme propagation, the spirit of decentralization has already taken root culturally. It does not need to be explained, but rather used, imitated, and recreated.

This year, as the popularity of the DePIN sector continues to rise, IoTeX has achieved several key milestones in the third quarter of 2024, attaining impressive results that have further solidified its position as a leader in the DePIN ecosystem.

Accurately shorting for a profit of 80 millions, on-chain data reveals suspicious funds linked to Garrett Jin.

Survival is everything.