News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

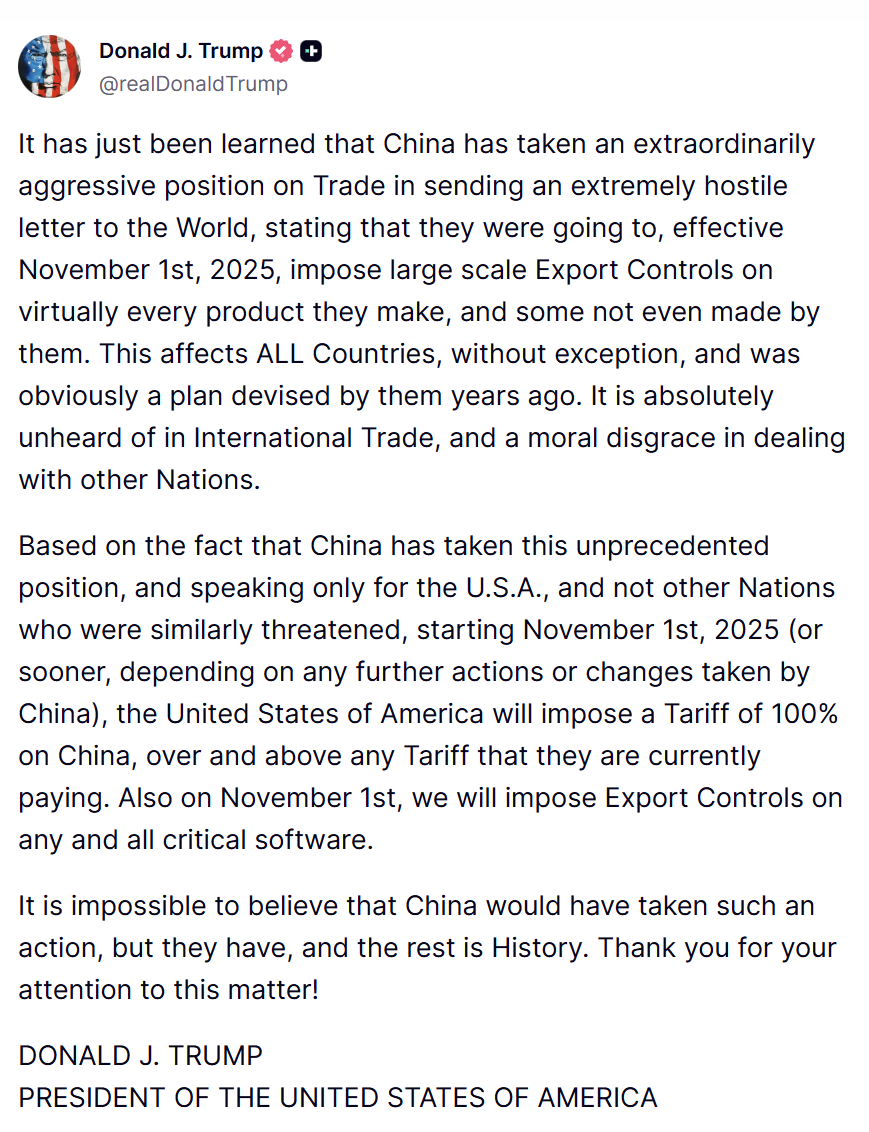

US–China Tariff Fears Hit Bitcoin Treasury Stocks

CryptoNewsNet·2025/10/11 04:03

$16B in Longs Liquidated as Wall Street Sell-Off Extends BTC, ETH, Broader Crypto Market Meltdown

CryptoNewsNet·2025/10/11 04:03

Banks Join Crypto : Stablecoin Pilot Backed By G7 Currencies

Cointribune·2025/10/11 04:00

$9.4B Wiped Out In Crypto Sell-off After Trump’s Warning

Cointribune·2025/10/11 04:00

Analyst Says $110K Is Bitcoin’s New Bottom, Sees Path Toward $150K

DeFi Planet·2025/10/11 03:57

Is This the True Reason Behind the $20 Billion Crypto Market Liquidation?

In the financial market, surviving is always more important than making money

BlockBeats·2025/10/11 03:44

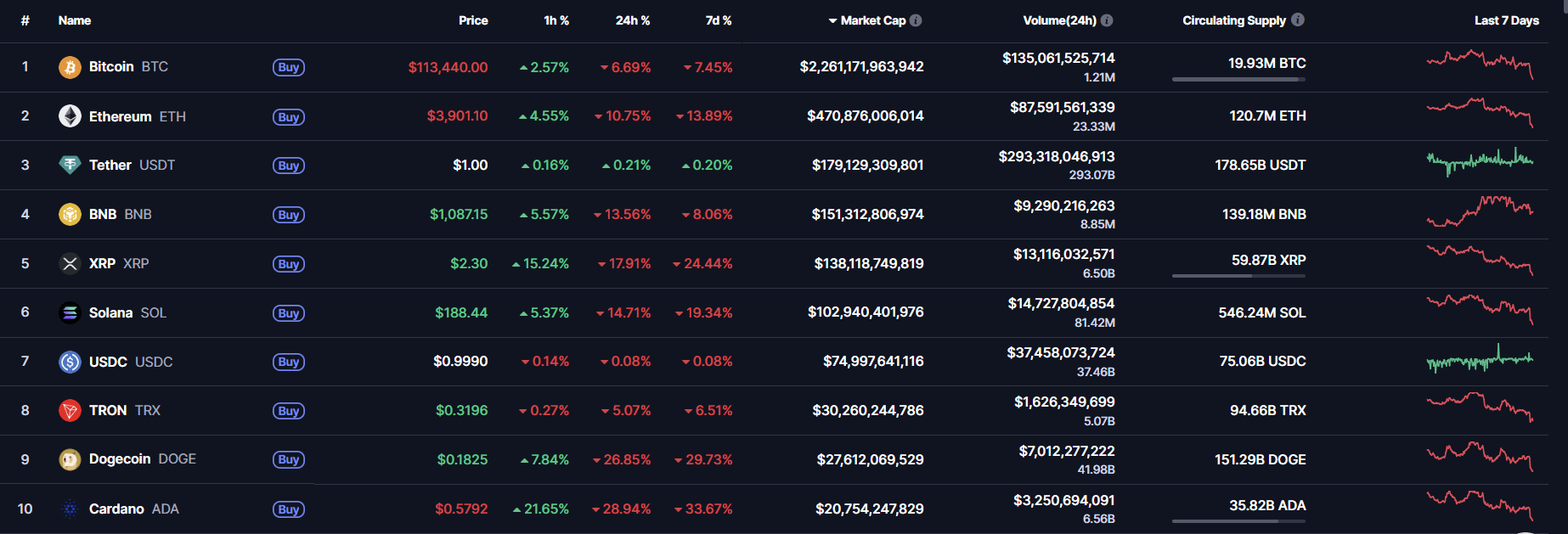

Bitcoin Crashes Hard After Trump’s 100% Tariff on China Announcement

Cryptoticker·2025/10/11 03:42

BREAKING: Ethereum Crashes Below $4K as Crypto Market Suffers Massive Selloff

Cryptoticker·2025/10/11 03:42

Breaking: Bitcoin Crash Fueled by Exchanges Dumping Millions in Crypto

Cryptoticker·2025/10/11 03:42

XRP Price Crashes 17% as Crypto Market Meltdown Deepens

Cryptoticker·2025/10/11 03:42

Flash

01:48

BTC treasury company Hyperscale Data launches equity offering plan to raise up to $50 millionAccording to Deep Tide TechFlow, on December 20, PRNewswire reported that Hyperscale Data, a bitcoin treasury company listed on NYSE American under the New York Stock Exchange, announced the launch of an equity offering ATM financing plan. The company will periodically sell common stock to raise up to $50 million in funds. This financing plan will appoint Spartan Capital Securities as the sales agent. The net proceeds from the fundraising will be used to continue purchasing bitcoin, as well as to develop Hyperscale Data's data center in Michigan, and for general corporate purposes.

01:40

U.S. Senator Cynthia Lummis will leave office after her term ends in 2027Foresight News reported, according to The Block, that U.S. Senator Cynthia Lummis will not seek re-election, with her term ending in January 2027. She has long been involved in congressional-level crypto regulatory legislation and has worked with Kirsten Gillibrand to promote the establishment of a digital asset regulatory framework, clarifying the regulatory roles of agencies such as the SEC and CFTC. The related legislation is still being advanced in the Senate Banking Committee and Agriculture Committee, and will subsequently require a vote by the full Senate and coordination with the House version.

01:35

CryptoQuant: Bear Market May Have Started, Mid-Term Support Level Expected at $70,000BlockBeats News, December 20, On-chain analysis firm CryptoQuant released a report stating that Bitcoin demand growth has significantly slowed, signaling a possible bear market ahead. Since 2023, Bitcoin has experienced three major on-chain demand surges—driven by the launch of a U.S. spot ETF, the outcome of the U.S. presidential election, and the Bitcoin Treasury Company bubble—but since early October 2025, demand growth has been below the trend level. This indicates that much of the new demand in this cycle has already materialized, and a key pillar of price support has disappeared as a result.

On the other hand, the derivatives market has also confirmed a weakening risk appetite: the funding rate of perpetual futures (365-day moving average) has dropped to the lowest level since December 2023. Historically, such a decline reflects a decreased willingness to maintain long positions, a pattern that typically occurs in a bear market rather than a bull market.

Technically, the price structure has deteriorated along with weak demand: Bitcoin has fallen below its 365-day moving average, a key long-term technical support level that has historically served as a dividing line between bull and bear markets.

However, downside references indicate a relatively small bear market magnitude: Historically, the Bitcoin bear market bottom has aligned closely with the realized price, currently around $56,000, indicating a potential retreat of up to 55% from recent highs—the smallest retreat in history. The mid-term support level is expected to be around $70,000.

News