News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Psy enables Web2 business models to achieve economic viability in Web3, driving the diverse application of business-to-agent AI. The protocol's testnet features internet-scale size and high-speed performance, while offering Bitcoin-level security guarantees.

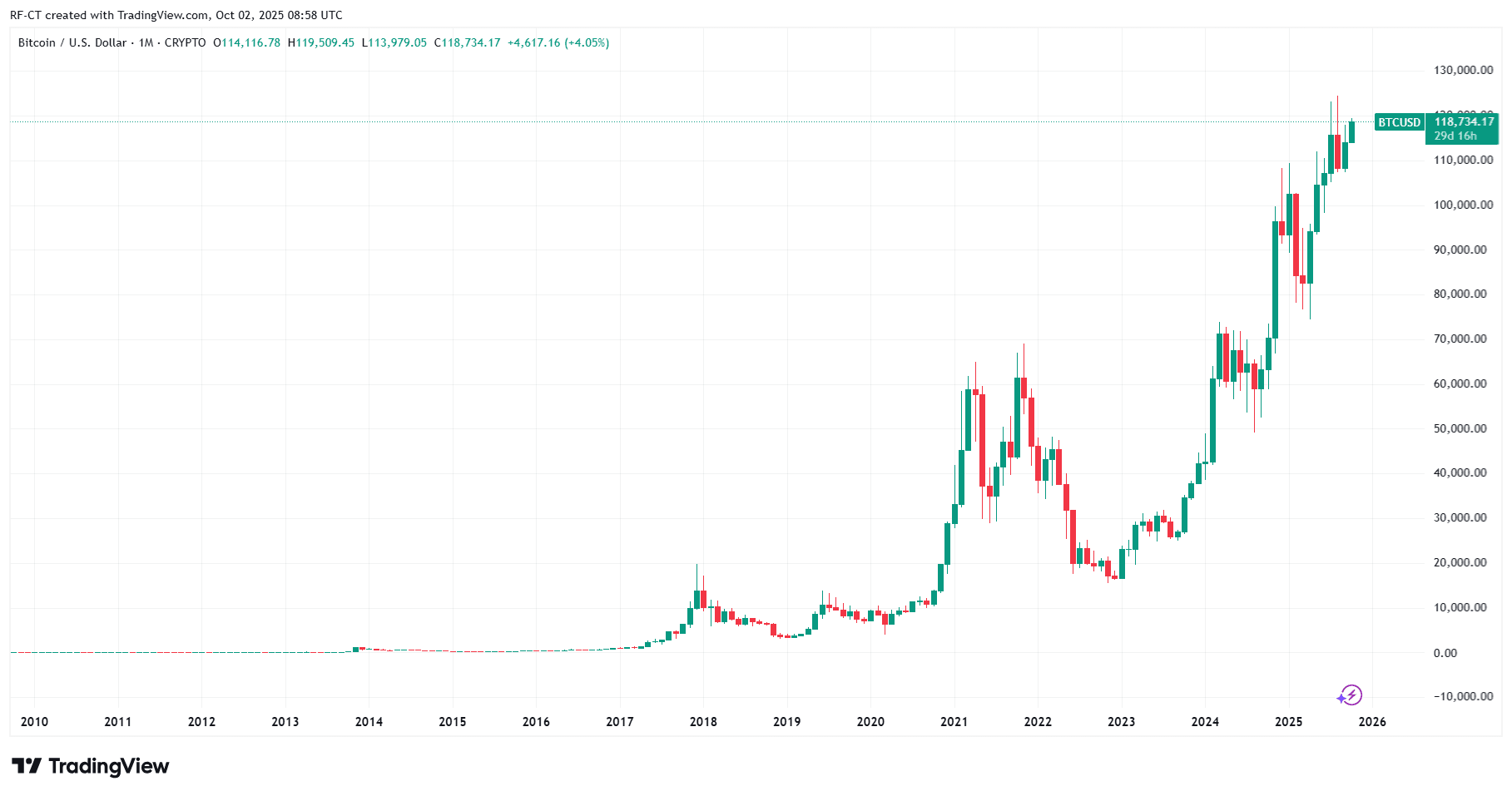

Bitcoin price predictions remain bullish as BTC trades near $119K. Fidelity and Bitwise have just purchased $238.7 million worth of Bitcoin, boosting market confidence.

Dr. Xiao Feng stated that the launch of the EAG initiative marks a crucial moment for the "breakout" of Ethereum's application layer. The establishment of such an alliance aims to unite various forces to welcome the arrival of the "1995 moment" for Ethereum and even the entire blockchain world—a new era characterized by an explosion of applications.