News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Solana ETF approvals rumored to arrive next week as issuers prepare for launch

CryptoSlate·2025/09/30 16:00

Crypto Price Analysis 10-1: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, CELESTIA: TIA, CARDANO: ADA

Cryptodaily·2025/09/30 16:00

Ethereum Breakout Near $4,000 Could Signal Renewed Momentum for Layer 2, DeFi and Altcoins

Coinotag·2025/09/30 16:00

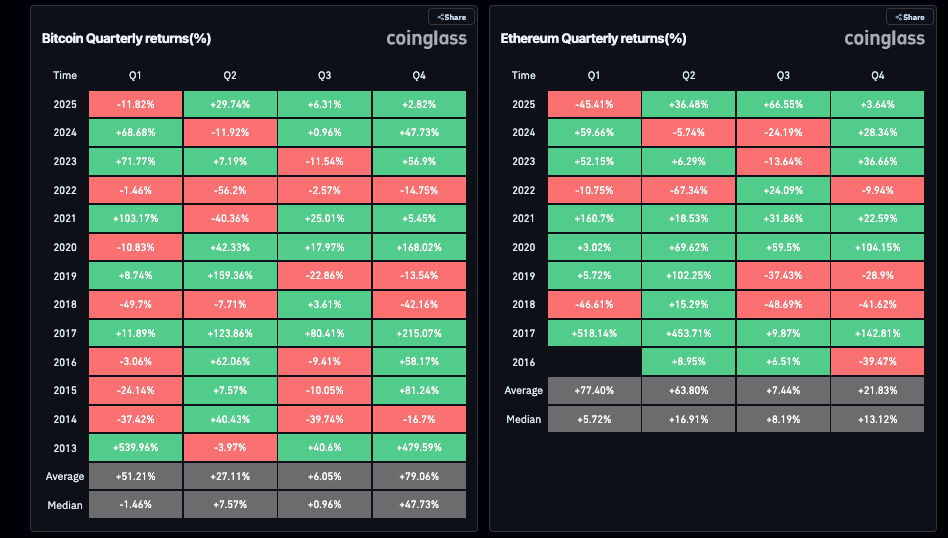

Ethereum Price Outperforms Bitcoin (BTC) in Highest Ever Q3 Rally: What’s Next?

Ethereum price climbed 66.8% in Q3 2025, significantly outperforming Bitcoin’s 6.3% gain, as treasury inflows reached $14.6 billion amid investor demand.

Coinspeaker·2025/09/30 16:00

Dogecoin Holds Above $0.22 Support, May Test $0.24 Resistance Before Potential Move Toward $0.34

Coinotag·2025/09/30 16:00

XRP Ledger just leveled up with Multi-Purpose Tokens

Kriptoworld·2025/09/30 16:00

Analysts Say Ethereum Could Reach $7K–$12K After Strongest Quarterly Close Above $4,000

Coinotag·2025/09/30 16:00

Ethereum May Rise After BitMine’s $1B Purchase; Analysts See Potential New Highs

Coinotag·2025/09/30 16:00

XRP ETF Launch Delayed by SEC Shutdown as Elliott Wave Charts Indicate Potential Bullish Breakout

Coinotag·2025/09/30 16:00

Uptober 2025: Altcoin ETFs Could Finally Arrive Mid-October

Kriptoworld·2025/09/30 16:00

Flash

07:54

Musk on "Trump Account": There will be no more poverty in the future, so there is no need to save moneyBlockBeats News, December 18th: Billionaire and Bridgewater Associates founder Dalio announced yesterday that he plans to match a $250 donation for each child in Connecticut. Previously, Michael Dell and his wife donated $250 each to children under 10 through the "Trump Accounts" initiative.

In response, Musk stated that this was certainly a generous act by the Dell family, but there will be no more poverty in the future, so there is also no need to save money. Musk has previously advocated for universal high income and firmly believes that artificial intelligence and robotics technology in the future can eliminate the need for human work.

Trump Accounts are a new type of child investment account introduced in the "Working Families Tax Cuts" Act signed by President Donald Trump in 2025, aimed at providing long-term savings and investment opportunities for American children to help them build wealth.

07:53

US CPI and ECB/BOE decisions to be announced tonight, market volatility may intensifyChainCatcher News, according to Golden Ten Data, tonight at 20:00 (UTC+8), 21:15 (UTC+8), and 21:30 (UTC+8), the interest rate decisions of the Bank of England and the European Central Bank, as well as the US November CPI, will be announced consecutively, marking the conclusion of 2025 and setting the tone for policies in 2026. It is expected that the market will experience volatility within an hour and a half, and investors should be mindful of risks.

07:49

CryptoQuant Analyst: Bitcoin Price Has Fallen Below the Short-Term Holder Cost BasisBlockBeats News, December 18, CryptoQuant analyst @AxelAdlerJr posted that the bitcoin price has fallen below the average purchase price of short-term holders (i.e., the STH-SOPR (30D) shown in the chart has dropped to 0.98). Two on-chain indicators show that the selling pressure from new market participants is increasing. The SOPR 30D indicator measures the average token sales of short-term holders: a value above 1 indicates profitable sales, while a value below 1 indicates sales at a loss. The chart shows that the 30-day SOPR moving average has dropped to the 0.98 area, which means that, on average, short-term holders are selling tokens at a loss. A further decline in this indicator will intensify selling pressure and lead to new local lows. Currently, there is a strong risk-averse sentiment in the market for short-term positions. Key reversal confirmation signals: price rebounds above the STH realized price and SOPR rises above 1.

News