News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

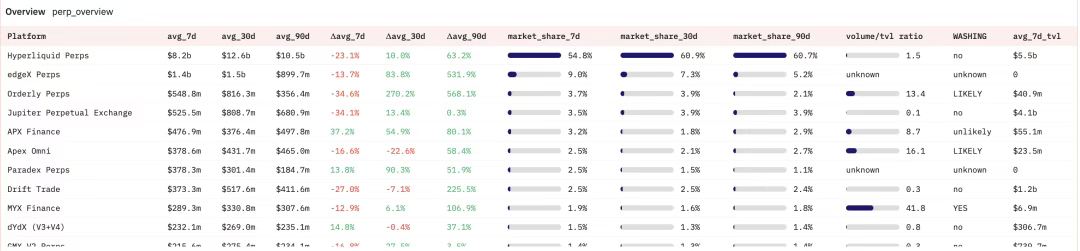

This article aims to inform everyone about the latest developments and future expectations. It serves as an introductory guide to Hyperliquid and also contains some in-depth insights into the overall ecosystem.

As Bitcoin reaches a record high, data shows XRP, BNB, and Litecoin often follow its momentum—setting up potential rallies if BTC hits $150,000.

NFT strategy tokens saw a general increase, with PunkStrategy reaching a new high; Solana ecosystem project Dupe launched its beta version; Stripe's CEO believes stablecoins will drive banks to raise interest rates; tokenized stock trading volumes have surged; MetaMask announced details of its on-chain rewards program. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

MetaMask’s Google login feature has sparked security concerns, prompting the company to defend its encryption design as secure yet optional for advanced users.

In Brief BNB outpaces XRP in value, reopening the "flippening" discussion. Momentum favors BNB, but XRP's ETF approval might change market dynamics. High probability for XRP ETF approval could boost its market position.