News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Bitcoin Price Targets Upside Breakout – Can Bulls Push Price Beyond Key Levels?

Newsbtc·2025/10/01 13:27

Discover How Tether Boosts US Stablecoin Adoption via Rumble

In Brief CEO Paolo Ardoino unveils Tether's USAT, promoting it on the Rumble platform. Rumble aims to launch a Tether-backed crypto wallet by year-end. Tether explores growth in telecommunications and energy sectors.

Cointurk·2025/10/01 13:24

While the Market Punishes XRP and SUI, AVAX is Attracting Whale-Level Investment

Cryptonewsland·2025/10/01 13:18

SWIFT Develops Blockchain Platform With Consensys for 24/7 Real-Time Cross-Border Bank Payments

Cryptonewsland·2025/10/01 13:18

$3.9B in Token Unlocks Set for October

October will see over $3.9B in token unlocks, with ASTER, SUI, and XPL leading the pack, according to CryptoRank.Why These Unlocks MatterProjects to Watch Closely

Coinomedia·2025/10/01 13:06

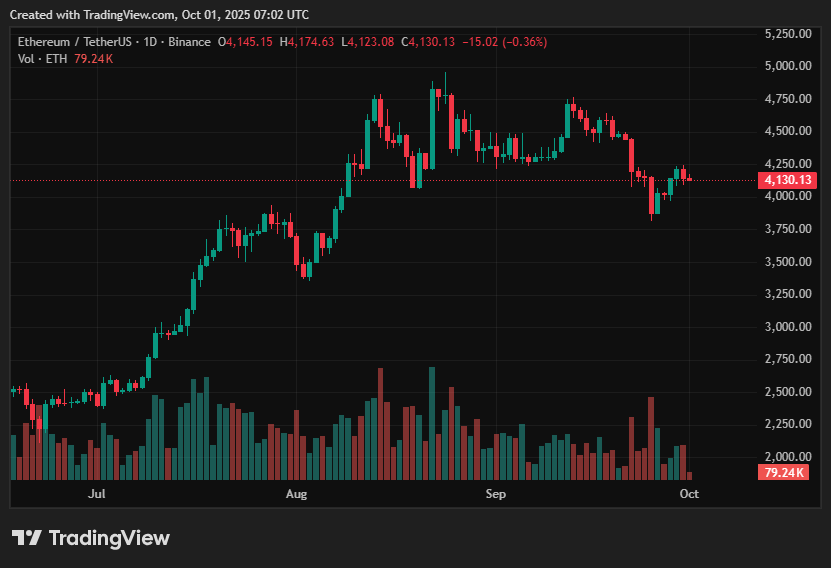

Ethereum price prediction: Can ETH break $4,600 and target $5K?

CryptoNewsNet·2025/10/01 13:00

Bitcoin rally looms with projections hinting at $200,000 surge

CryptoSlate·2025/10/01 13:00

Ripple CTO David Schwartz Steps Down After Years of Leadership

Cointribune·2025/10/01 12:51

Monero (XMR) Flashes Bullish Reversal Pattern– Could This Breakout Spark a Rally?

CoinsProbe·2025/10/01 12:39

Flash

23:30

U.S. House Representatives draft bill to exempt stablecoin transactions under $200 from taxesMembers of the U.S. House of Representatives have drafted a bill aimed at exempting capital gains tax on crypto stablecoin transactions under $200. (Watcher.Guru)

23:06

After Japan's rate hike, BTC surges to $88,000 and Arthur Hayes sees this as bullishAfter Japan raised interest rates, the price of BTC surged to $88,000. Arthur Hayes called this move a bullish signal and highlighted the significant weakening of the yen. (Cointelegraph)

22:49

Key BTC Support Level Emerges: 88,121 Becomes the Focus of Bull-Bear BattleMember indicators show that the current price is testing the key support level at 88121, where the chip concentration is as high as 4.65. Buying slightly outweighs selling (buy/sell ratio 1.07), indicating strong market support at this price level. Combined with the candlestick pattern, the appearance of a tweezer bottom further confirms the effectiveness of the support. On the 1-hour candlestick chart, EMA24 and EMA52 are in a bullish alignment, and the price is above the moving averages, suggesting an overall strong trend. Although trading volume has declined, the RSI has broken through the upward trendline, hinting that short-term rebound momentum is building up. Subscribe to become a member to access real-time chip distribution and precise support and resistance analysis, helping you seize opportunities ahead of others!Data sourced from PRO members [BTC/USDT perpetual contract on a certain exchange, 1-hour candlestick], for reference only and not to be considered as investment advice.

News