News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Solana ETF approvals rumored to arrive next week as issuers prepare for launch

CryptoSlate·2025/09/30 16:00

Crypto Price Analysis 10-1: BITCOIN: BTC, ETHEREUM: ETH, SOLANA: SOL, CELESTIA: TIA, CARDANO: ADA

Cryptodaily·2025/09/30 16:00

Ethereum Breakout Near $4,000 Could Signal Renewed Momentum for Layer 2, DeFi and Altcoins

Coinotag·2025/09/30 16:00

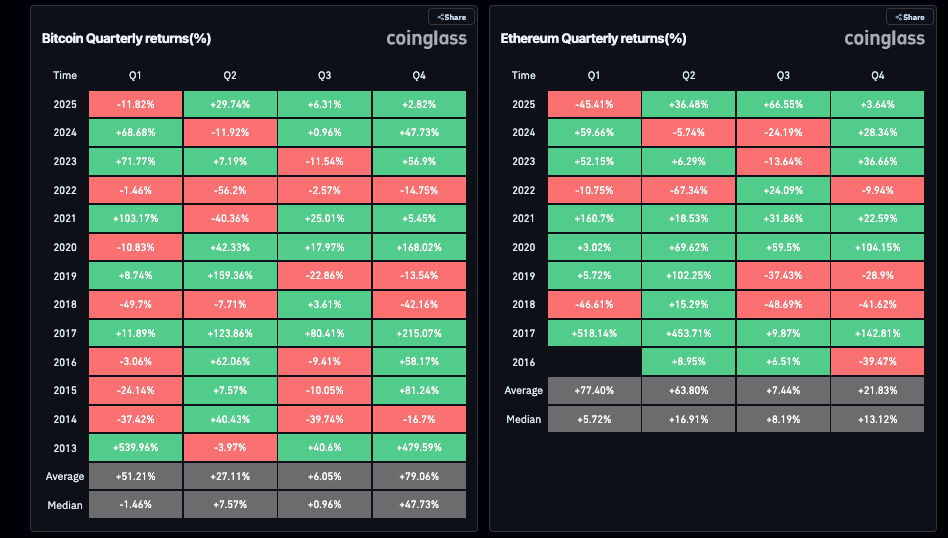

Ethereum Price Outperforms Bitcoin (BTC) in Highest Ever Q3 Rally: What’s Next?

Ethereum price climbed 66.8% in Q3 2025, significantly outperforming Bitcoin’s 6.3% gain, as treasury inflows reached $14.6 billion amid investor demand.

Coinspeaker·2025/09/30 16:00

Dogecoin Holds Above $0.22 Support, May Test $0.24 Resistance Before Potential Move Toward $0.34

Coinotag·2025/09/30 16:00

XRP Ledger just leveled up with Multi-Purpose Tokens

Kriptoworld·2025/09/30 16:00

Analysts Say Ethereum Could Reach $7K–$12K After Strongest Quarterly Close Above $4,000

Coinotag·2025/09/30 16:00

Ethereum May Rise After BitMine’s $1B Purchase; Analysts See Potential New Highs

Coinotag·2025/09/30 16:00

XRP ETF Launch Delayed by SEC Shutdown as Elliott Wave Charts Indicate Potential Bullish Breakout

Coinotag·2025/09/30 16:00

Uptober 2025: Altcoin ETFs Could Finally Arrive Mid-October

Kriptoworld·2025/09/30 16:00

Flash

06:32

Analysis: On-chain data shows sentiment recovery as the number of BTC liquidation addresses begins to decreaseBlockBeats News, December 21, data analyst Murphy stated that on-chain data shows signs of sentiment recovery. The number of addresses that shifted from "holding BTC" to "completely liquidated" surged between November 13 and 25, during which BTC experienced its fastest and largest price drop. The large number of liquidated addresses also reflected the market's panic and pessimism. However, during the period from December 1 to 18, BTC repeatedly tested the bottom, and the number of liquidated addresses began to decrease, which fully coincided with the bullish behavior and sentiment changes observed in the futures market.

06:30

Analysis: On-chain data shows a recovery in market sentiment, with the number of BTC withdrawal addresses starting to decreaseBlockBeats News, December 21st, Data analyst Murphy stated that on-chain data has seen signs of sentiment recovery. The number of addresses that switched from "HODLing BTC" to "completely exiting the market" within 30 days had surged between November 13th and 25th, during which the BTC price experienced its fastest and most significant decline. The increase in these sell-off addresses reflected the market's panic and pessimism.

However, starting from December 1st to the 18th, as BTC repeatedly tested its bottom, the number of sell-off addresses started to decrease, aligning perfectly with the bullish behavior and sentiment shift seen in the futures market.

06:23

Analysis: Bitcoin Relative to Gold RSI Drops to Nearly Three-Year Low, Seen as Bull-Bear BoundaryAccording to TechFlow, on December 21, as reported by Cointelegraph, the Bitcoin to gold (BTC/XAU) price has dropped to around the level of 20 ounces of gold, marking the lowest point since the beginning of 2024. At the same time, the weekly RSI indicator for this ratio has fallen to about 29.5 (oversold zone), approaching a three-year low. Data shows that this RSI oversold area has historically often appeared near bear market bottoms. Some analysts believe this could indicate that Bitcoin is undervalued and may have room for a rebound in the future. However, there are also opinions suggesting that if this key support is lost, it could signal a weakening trend.

News