News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Bitcoin Options Tied to BlackRock’s IBIT Are Now Wall Street’s Favorite

CryptoNewsNet·2025/09/30 11:45

Sonic (S) Defends Key Support – Will This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/09/30 11:36

Hedera (HBAR) Defends Key Support – Could This Pattern Trigger An Upside Breakout?

CoinsProbe·2025/09/30 11:36

After Plasma and Falcon, how can one participate in USD.AI, the highly anticipated "next-generation miracle mining project"?

This year, Framework has led investments in two stablecoin projects: one is Plasma, which has surpassed 10 billion, and the other is USD.AI.

BlockBeats·2025/09/30 11:34

What will happen to bitcoin if the US government shuts down?

Traders who rely on U.S. employment data to determine whether the Federal Reserve will cut rates again may need to wait for a while.

BlockBeats·2025/09/30 11:33

Chainlink, Swift and UBS succesfully pilot tokenized fund solution to revolutionize $100 trillion industry

CryptoSlate·2025/09/30 11:33

Bitcoin and Ethereum ETFs see over $1B in inflows as crypto looks set to stage comeback

Coinjournal·2025/09/30 11:33

How A U.S. Government Shutdown Could Affect The Bitcoin Price?

Cryptoticker·2025/09/30 11:24

Uptober 2025: Will Bitcoin and Ethereum Lead a Crypto Rally?

Cryptoticker·2025/09/30 11:24

DeFi Father Andre Cronje Makes a Major Comeback, Flying Tulip Public Offering Set to Launch Soon

With a $200 million endorsement, a new force is accelerating its entry into the perpetual contract sector.

ForesightNews·2025/09/30 11:01

Flash

19:19

The European Central Bank says a digital euro could be launched within the next three years.Jinse Finance reported that on Friday, the digital euro received support from the Council of the European Union, which endorsed a design scheme featuring both online and offline functionalities. The European Central Bank stated that it may launch the digital euro within the next three years.

18:25

Northern Data has sold its bitcoin mining business to a company operated by Tether executives.According to a report by Jinse Finance, citing the Financial Times, Northern Data, supported by Tether, has sold its bitcoin mining business to Peak Mining, a company operated by Tether executives. The buyers—Highland Group Mining Inc., Appalachian Energy LLC, and 2750418 Alberta ULC—are directly linked to Tether's leadership. Records from the British Virgin Islands show that Highland Group Mining is controlled by Tether co-founder and chairman Giancarlo Devasini and the company's CEO Paolo Ardoino. Canadian documents indicate that Devasini is the sole director of Alberta ULC. The equity structure of Appalachian Energy LLC, registered in Delaware, remains opaque, with no publicly listed directors.

15:53

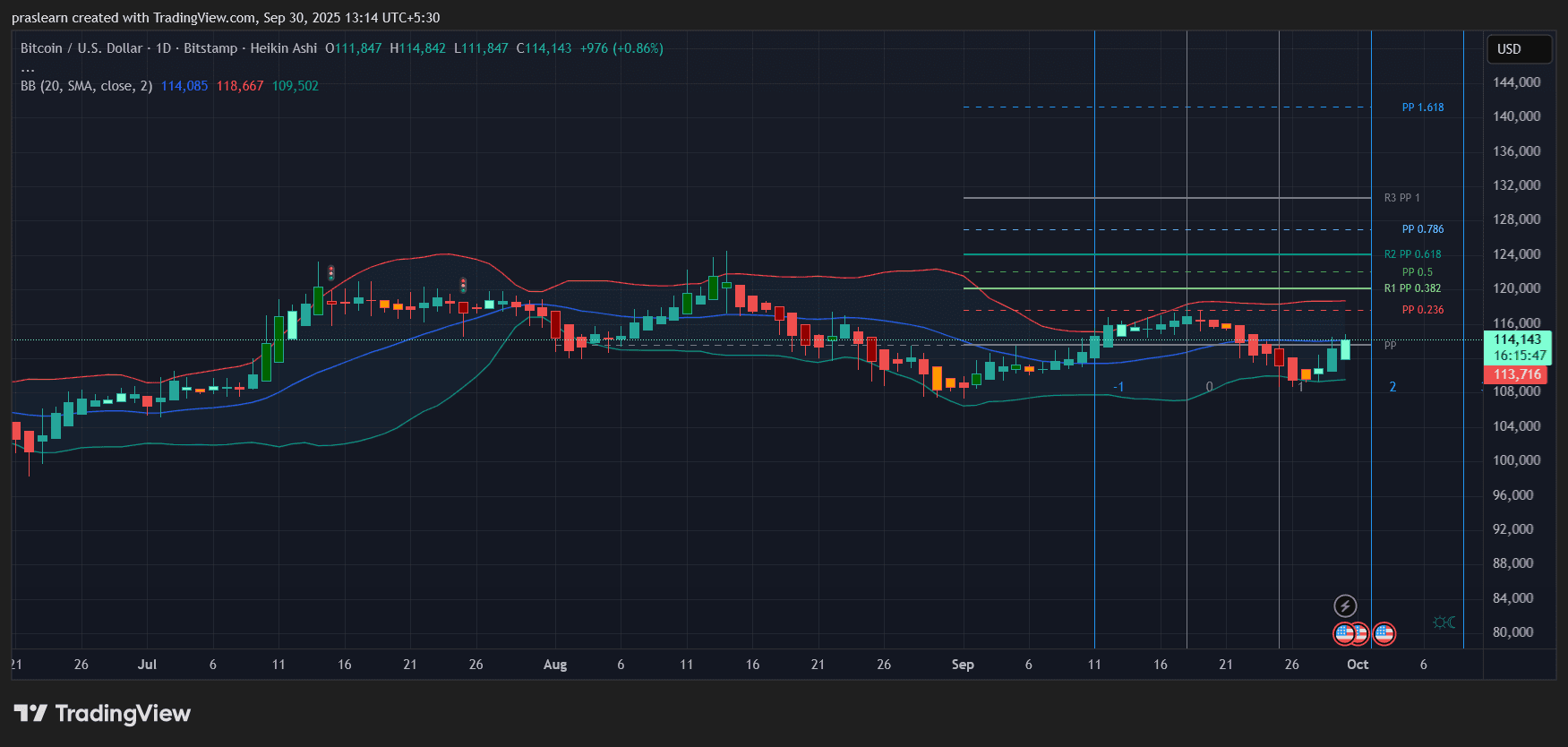

IOSG Founding Partner: 2025 will be the "worst year" for the crypto market, but BTC may reach $120,000–$150,000 in the first half of 2026PANews, December 21 – Jocy, founding partner of IOSG, posted on X that 2025 will be the "worst year" for the crypto market. OG investors will experience three waves of sell-offs. From March 2024 to November 2025, long-term holders (LTH) will cumulatively sell about 1.4 million BTC (worth $121.17 billions): First wave (end of 2023 to early 2024): ETF approval, BTC rises from $25,000 to $73,000; Second wave (end of 2024): Trump is elected, BTC surges toward $100,000; Third wave (2025): BTC remains above $100,000 for an extended period. Unlike the single explosive distributions in 2013, 2017, and 2021, this time it will be a multi-wave, sustained distribution. Over the past year, BTC has been consolidating at its peak for a year, something that has never happened before. Since the beginning of 2024, the number of BTC unmoved for over two years has decreased by 1.6 million (about $140 billions). However, the other side of risk is opportunity. In terms of investment logic: Short term (3-6 months): Fluctuation between $87,000 and $95,000, institutions continue to accumulate positions; Mid-term (first half of 2026): Driven by both policy and institutions, target $120,000-$150,000; Long term (second half of 2026): Increased volatility, depending on election results and policy continuity.

News