News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

We are also keeping an eye on some emerging projects, such as Hyperliquid. This project is reminiscent of the early development stage of Solana.

Plasma's subsidy of tens of millions of dollars.

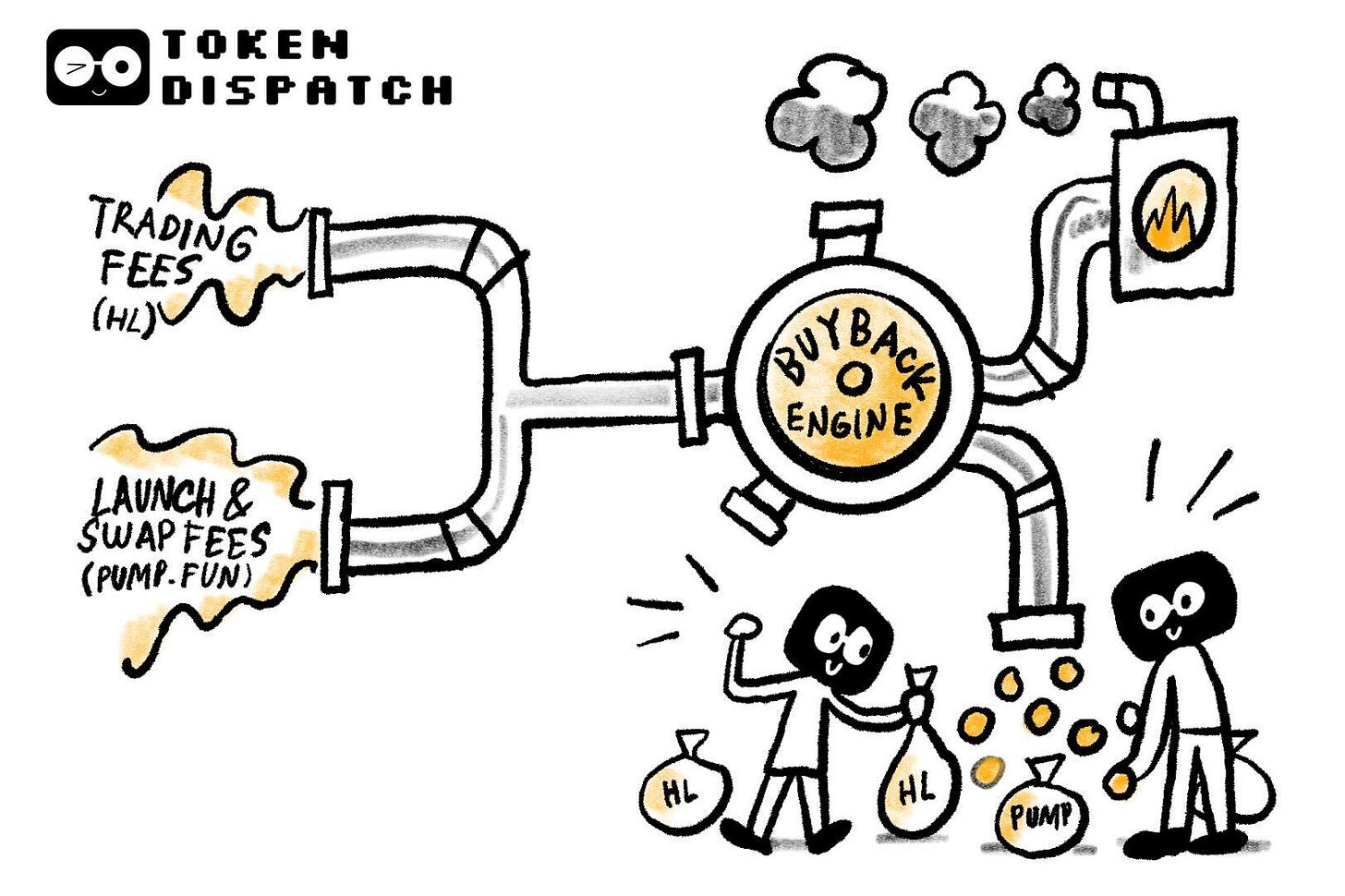

Exploring how Hyperliquid and Pump.fun leverage Apple’s buyback experience.

The BOB Gateway unlocks Bitcoin liquidity and earning opportunities for 11 major public blockchains by bridging native Bitcoin to LayerZero's wBTC-OFT standard.

As DeFi giants dominate and the efficiency of traditional financing models declines, can this full-stack trading ecosystem break the deadlock through innovative mechanisms?

The approval or rejection of Litecoin and SOL, which are the first to be decided, may determine subsequent market expectations.