News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

From "Estée Lauder's son-in-law" to "Trump loyalist," how might the crypto stances of potential successors impact the market?

YoungHoon Kim, recognized as the world’s highest-IQ individual, believes Bitcoin will expand 100-fold within a decade and evolve into a global reserve asset. He argues Bitcoin’s limited supply and resistance to inflation make it a natural foundation for the future financial system, even suggesting “American Bitcoin” could surpass tech giants.

Kazakhstan launched the Alem Crypto Fund, a state-backed digital asset reserve, partnering with Binance Kazakhstan to acquire BNB, aiming for long-term strategic investments and enhancing the country’s position in regulated crypto finance.

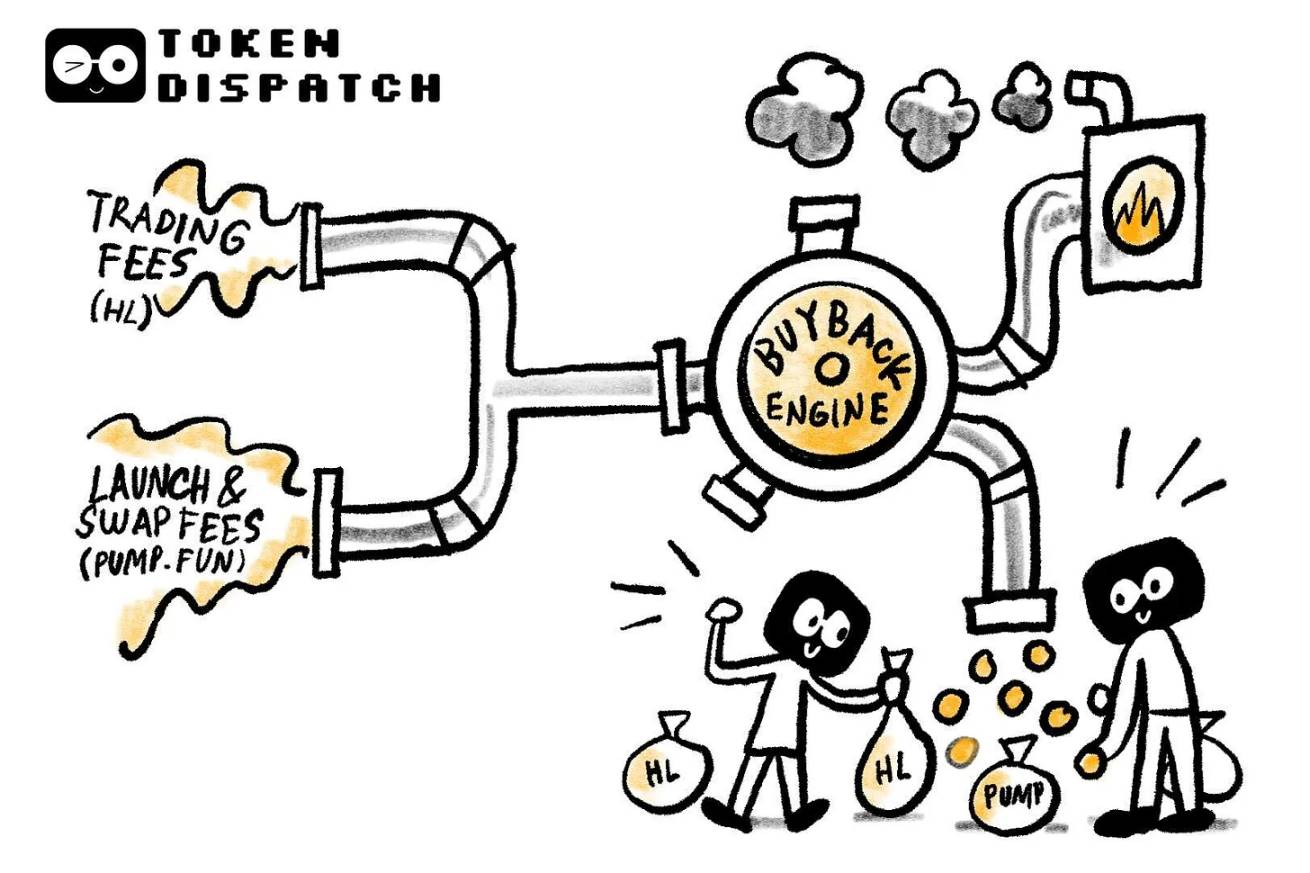

Cryptocurrency projects are attempting to replicate the long-term success path of Wall Street’s "dividend aristocrats," such as Apple, Procter & Gamble, and Coca-Cola.

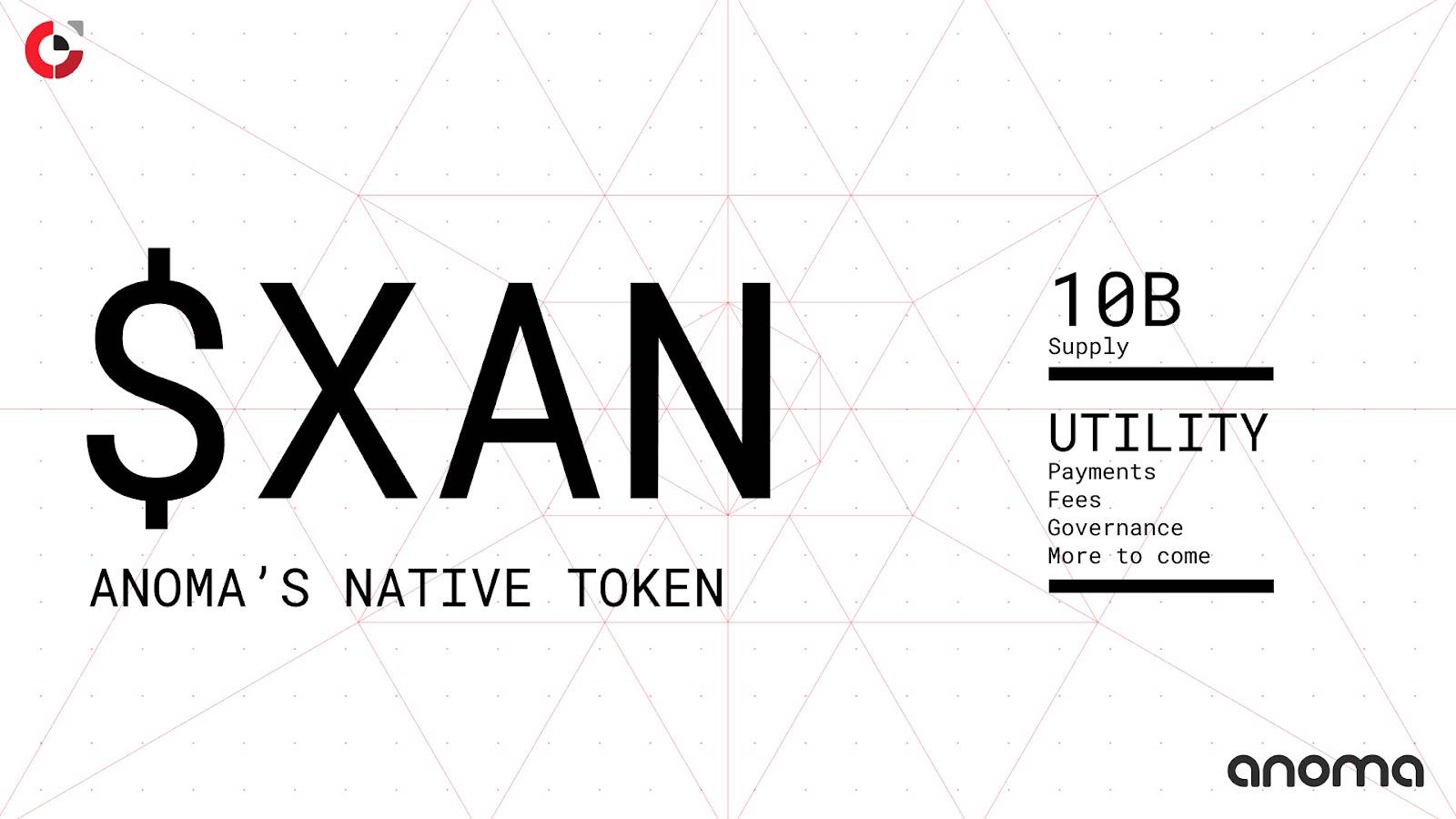

After supporting the Ethereum mainnet, Anoma will first support key Ethereum Layer 2 networks before expanding to other ecosystems.

Hedera (HBAR) risks losing its 2-month Golden Cross as bearish momentum builds. Trading at $0.215, the token could slip toward $0.198 unless it breaks above $0.230 resistance.

The SEC halted QMMM trading on September 29 after a 2,000% stock surge triggered by its $100 million crypto treasury plan, raising concerns over social media-driven market manipulation and broader corporate crypto adoption trends.