News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Earnings Season Begins, Key CPI Data and Other Essential Highlights This Week

101 finance·2026/01/11 21:06

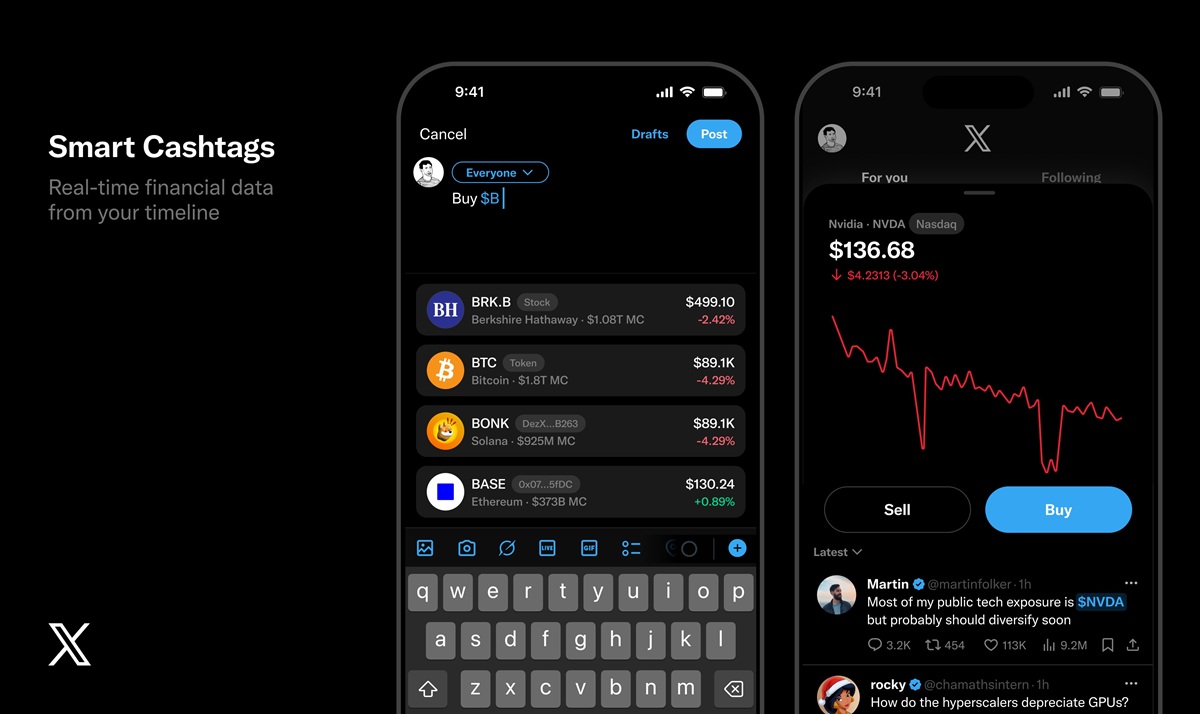

Solana Integrates Into X App, Pushing Social Media Closer to On-Chain Finance

CryptoNewsNet·2026/01/11 20:57

A stablecoin with a state seal: Why Wyoming’s $FRNT matters now

CryptoNewsNet·2026/01/11 20:57

Bullish Development May Be on the Way for Bitcoin and Altcoins in Japan

BitcoinSistemi·2026/01/11 20:48

Expert warns ’not a great look’ for XRP after this pattern emerges

CryptoNewsNet·2026/01/11 20:45

New Cryptocurrency Features Coming to X (Twitter)! Here’s What You Absolutely Need to Know

BitcoinSistemi·2026/01/11 20:33

Bitcoin and XRP Price Prediction Ahead of Supreme Court Tariffs Ruling on Jan 14, 2026

CryptoNewsNet·2026/01/11 20:33

Will Monero Be Next Zcash? Top Trader Says It Has Best-Looking Chart

CryptoNewsNet·2026/01/11 20:33

Saylor Teases New Bitcoin Buy as Strategy BTC Holdings Hit Record Highs

Cryptoticker·2026/01/11 20:27

Satoshi-Era Miner Moves Millions in Bitcoin After 15 Years of Silence

BeInCrypto·2026/01/11 19:48

Flash

02:37

Trump: I know nothing about Powell being investigated; his work at the Federal Reserve has not been outstanding.Foresight News reported, citing NBC, that Trump stated in a phone interview that he knew nothing about the Department of Justice investigation and once again criticized Powell. "I know nothing about this matter, but he is obviously not doing a good job at the Federal Reserve, nor is he doing a good job with the building project." When asked how he would respond to Powell's claim that the subpoena was government pressure on the Federal Reserve to cut interest rates, Trump said, "No, I wouldn't even consider doing it that way. The real pressure on him should be the reality of interest rates being too high. That's the only pressure he faces." Previously, according to The New York Times, U.S. federal prosecutors have launched an investigation into Powell regarding the renovation project at the Federal Reserve headquarters.

02:37

Polymarket and Kalshi Founders Make Forbes Under 30 Self-Made Wealthy ListBlockBeats News, January 12, Forbes released the 2025 Under 30 Self-Made Billionaires List, according to which, among the top 13, 9 are from the artificial intelligence industry, while the remaining 4 are involved in the prediction market.

The young billionaires who started in the prediction market include the 27-year-old founder of Polymarket and 2 co-founders of Kalshi who are 29 years old, as well as the 29-year-old co-founder of Stake.

02:36

Trump: DOJ Investigation of Powell Unrelated to Interest Rates and Not InvolvedAccording to Odaily, citing NBC reports, Trump stated that the Department of Justice's investigation into Powell is unrelated to interest rates. In addition, Trump denied involvement in the subpoena issued by the Department of Justice to the Federal Reserve.