The worst performing Ethereum investment products of all cryptocurrencies

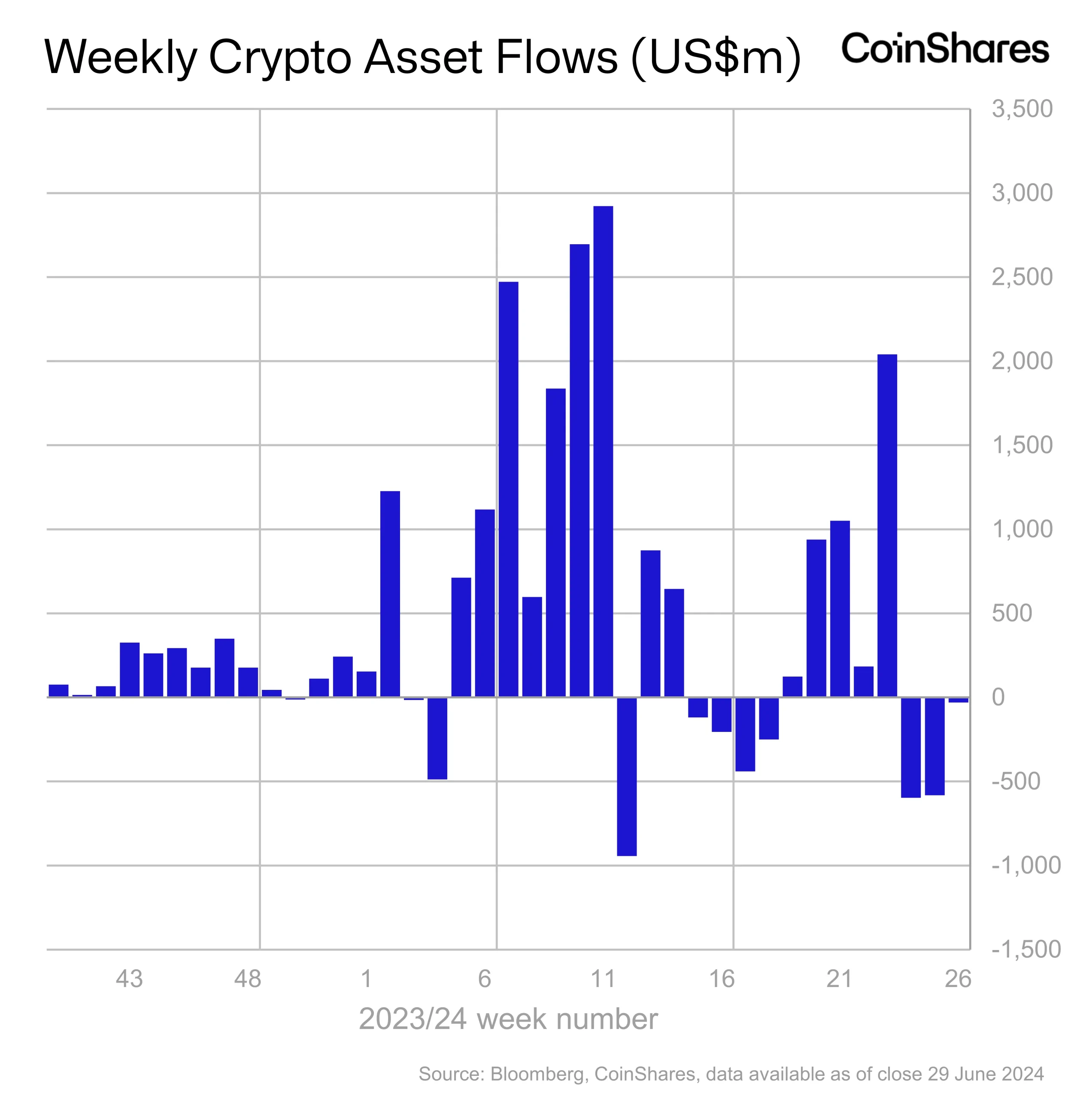

CoinShares, a digital asset manager, reported a third consecutive week of outflows from institutional crypto products.

According to the latter report for digital asset fund flows in the past week, these products have seen outflows worth $30 million.

"Digital asset investment products saw a third straight week of outflows totaling $30 million", the report claims. Despite this trend, the magnitude of outflows has decreased compared to previous weeks. Many vendors recorded minor inflows, but these were overshadowed by Grayscale's strong outflows of $153 million.

However, not all regions are experiencing negative trends. In the US, Brazil and Australia, receipts were reported at $43 million, $7.6 million and $3 million, respectively.

READ MORE:

BRICS: Bitcoin Could Completely Change World Finance - IMFIn contrast, outflows were strong in Germany ($29 million), Hong Kong ($23 million), Canada ($14 million) and Switzerland ($13 million).

Bitcoin (BTC) , the largest cryptocurrency by market cap, along with other altcoins such as, Left (LEFT) и Litecoin (LTC) , managed to pull in $18 million, $10 million, $1.6 million, and $1.4 million in revenue, respectively. Chainlink (LINK) и XRP also recorded inflows of $0.6 million and $0.3 million.

However Ethereum (ETH) faced significant challenges, experiencing its worst week since August 2022. Ethereum saw outflows worth $61 million, bringing the total for the past two weeks to $119 million, making it the worst-performing asset in terms of net flows for the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services