The initial options for the BlackRock Bitcoin ETF are 80% bullish, indicating an increasingly optimistic sentiment among investors

On November 20, the Nasdaq exchange listed options for BlackRock's iShares Bitcoin Trust ETF on Tuesday. Data shows that more than 350,000 contracts were traded, of which about 80% were bullish bets. Nine out of the ten most heavily traded options were betting on a rise. The option with the highest trading volume was a call option expiring in January with an exercise price of $55, followed by a call option expiring in December with an exercise price of $65, which is 25% higher than the ETF's closing price on Monday. Bitcoin reached a historical high of $94,032 on the day the options contract was listed.

Some investors expect that U.S. bitcoin ETF options will attract more capital inflows. Caroline Mauron, co-founder of Orbit Markets said that the volume of options transactions is "a good start and shows that connections between crypto-native ecosystems and traditional financial markets are increasingly strengthening." Although transaction volumes themselves are not enough to influence asset directionality yet positive news indeed boosts bullish sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A certain whale has rebuilt a position of 90.85 WBTC at an average price of $87,242.

Economist: December rate cut becomes highly probable again, Williams' remarks set the tone for the market

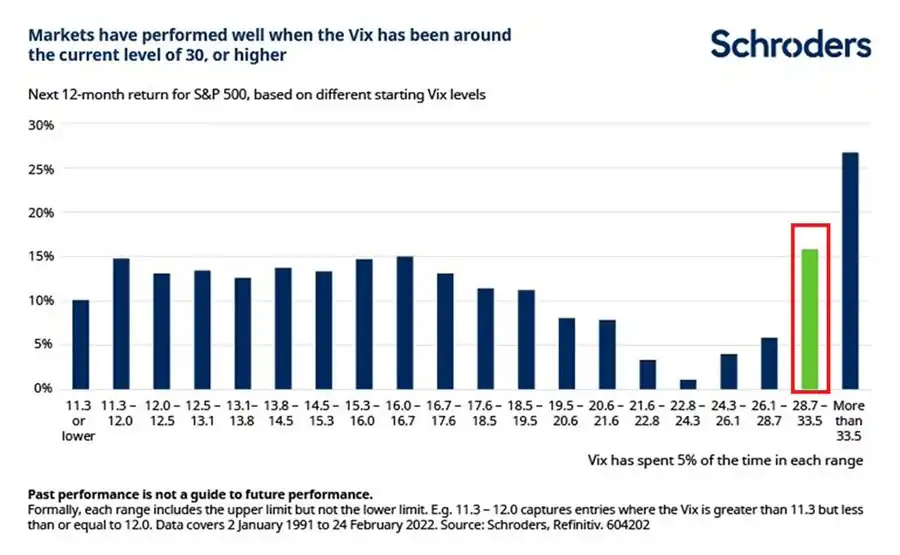

Analysis: When the volatility index VIX exceeds 28.7, the S&P 500 often delivers strong returns