3 Altcoins That Reached All-Time Highs Today — January 7

These three crypto tokens reached new all-time highs today, driven by Bitcoin’s recovery. Can they sustain momentum or risk corrections?

Bitcoin’s recovery past $100,000 has sparked a significant uptick across several altcoins, with the impact evident in their fresh all-time highs. However, the potential for profit-taking among investors raises concerns, as such actions could lead to price corrections for these cryptocurrencies.

BeInCrypto has analyzed three crypto tokens that achieved a new all-time high (ATH) today and examined their future potential.

Fasttoken (FTN)

FTN price reached a new all-time high of $3.66 during intra-day trading before slightly retreating to $3.60. This milestone marks another significant step in the altcoin’s recent upward trend, drawing attention from investors seeking growth opportunities.

The continuation of FTN’s uptrend appears likely as long as the cryptocurrency maintains support above $3.50. Sustaining this level could create a foundation for further gains, driven by strong investor sentiment and favorable market conditions.

FTN Price Analysis. Source:

TradingView

FTN Price Analysis. Source:

TradingView

However, if FTN holders decide to sell, the altcoin may experience a decline. A drop to test the support at $3.24 could occur, which would invalidate the bullish outlook and signal a potential reversal.

Gate (GT)

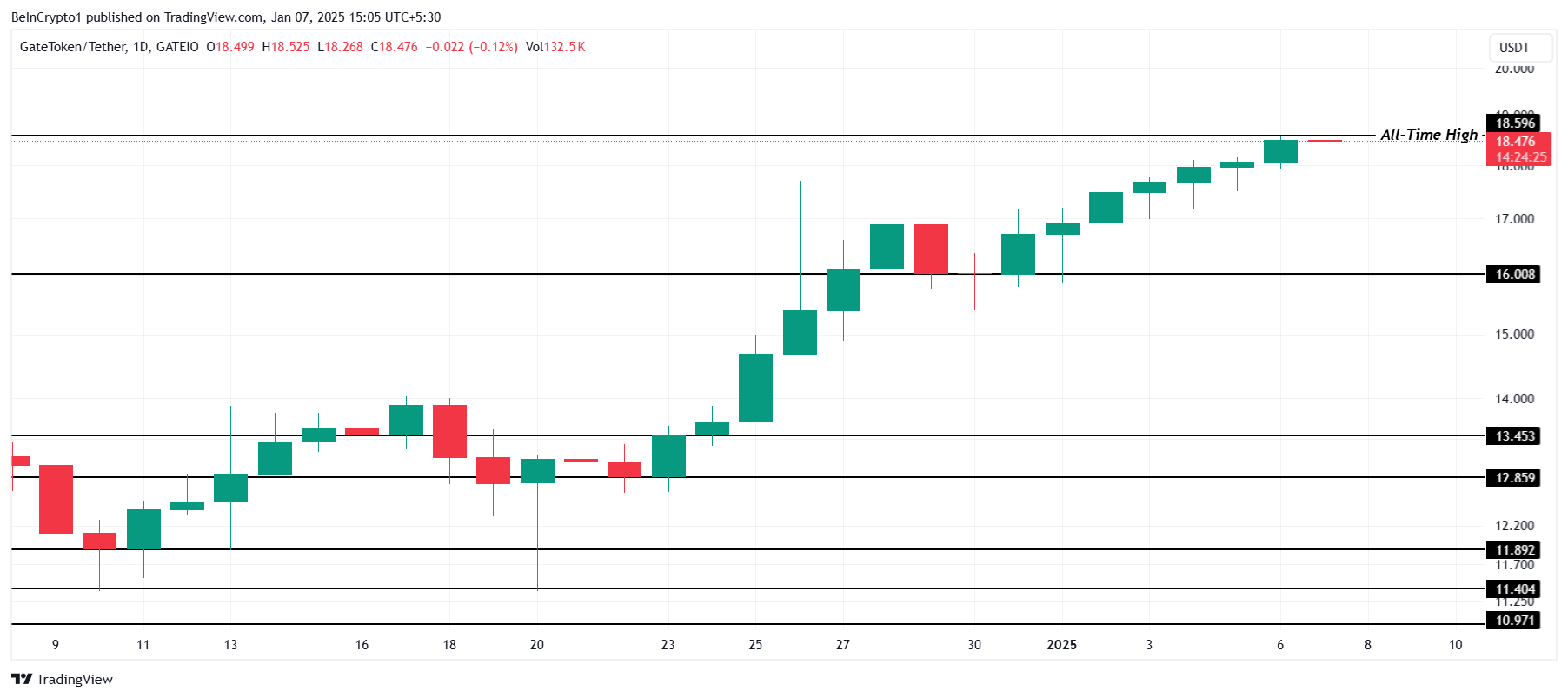

Another crypto token, GT’s price achieved a new all-time high of $18.59 today, continuing its impressive streak. The steady upward trend has helped the altcoin avoid significant volatility, reflecting stability in its growth trajectory.

The next milestone for GT is reaching $20.00, a psychological and technical target. This move, however, requires the current bullish momentum to remain strong, supported by consistent investor interest and favorable market conditions.

GT Price Analysis. Source:

TradingView

GT Price Analysis. Source:

TradingView

If a drawdown occurs, GT could face a decline, potentially falling to test the support at $16.00. A breach of this critical level would invalidate the bullish outlook, signaling a potential reversal in the altcoin’s upward trend.

WhiteBIT Token (WBT)

WBT price surged by 6.5% over the last 24 hours, forming a new all-time high of $27.25. This marks the second ATH in just two days, reflecting strong investor optimism and market momentum.

Escaping the consolidation range between $25.13 and $24.25, WBT has maintained a strong uptrend. If this momentum persists, the altcoin could achieve even higher levels, bolstered by increased trading activity.

WBT Price Analysis. Source:

TradingView

WBT Price Analysis. Source:

TradingView

However, if the upward momentum falters, WBT might drop to test the support at $26.00. A failure to hold this level could lead to further declines, potentially invalidating the current bullish outlook entirely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Sahara to Tradoor: A Review of Recent “Fancy Drop” Tactics Among Altcoins

The End of Ethereum’s Island: How EIL Reconstructs Fragmented L2s into a “Supercomputer”?

XRP's price beginning to show promise above $2.15: Here’s why