PancakeSwap (CAKE) Soars 21% as Inflows Hit Monthly High, Surpassing $3 Million

CAKE's 21% price rally is driven by a surge in spot inflows and rising demand on PancakeSwap, outpacing its rivals. The token shows strong bullish momentum, potentially reaching $2.90.

PancakeSwap’s CAKE token is the market’s top performer today, surging 21% in the past 24 hours. At press time, the altcoin trades at $2.56.

This rally comes as CAKE records its highest daily spot inflow in a month amid strong demand and renewed investor interest in the token.

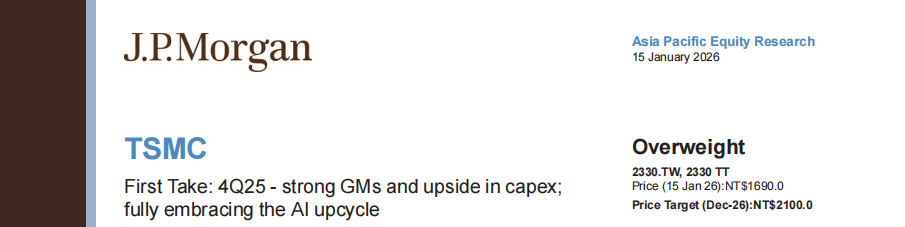

CAKE Rockets Higher with $3.37 Million Inflows—Is More Upside Ahead?

CAKE’s price rally is primarily driven by the sharp increase in trading activity on the PancakeSwap decentralized exchange (DEX). Over the past few days, the platform has seen a significant uptick in daily trading volume, outperforming Ethereum’s Uniswap and Solana’s Raydium.

The trend has triggered a surge in demand for the DEX’s native token, CAKE, causing its value to soar by double digits. The uptick in buying pressure is reflected by the token’s spot inflows, currently at $3.37 million, its single-day highest figure in the past month.

CAKE Spot Inflow/Outflow. Source:

Coinglass

CAKE Spot Inflow/Outflow. Source:

Coinglass

When an asset records spot inflows, the number of tokens purchased and moved into spot markets has increased, indicating rising demand. CAKE’s high spot inflows suggest that investors are actively accumulating the asset. If this buying pressure continues, it can drive further price appreciation.

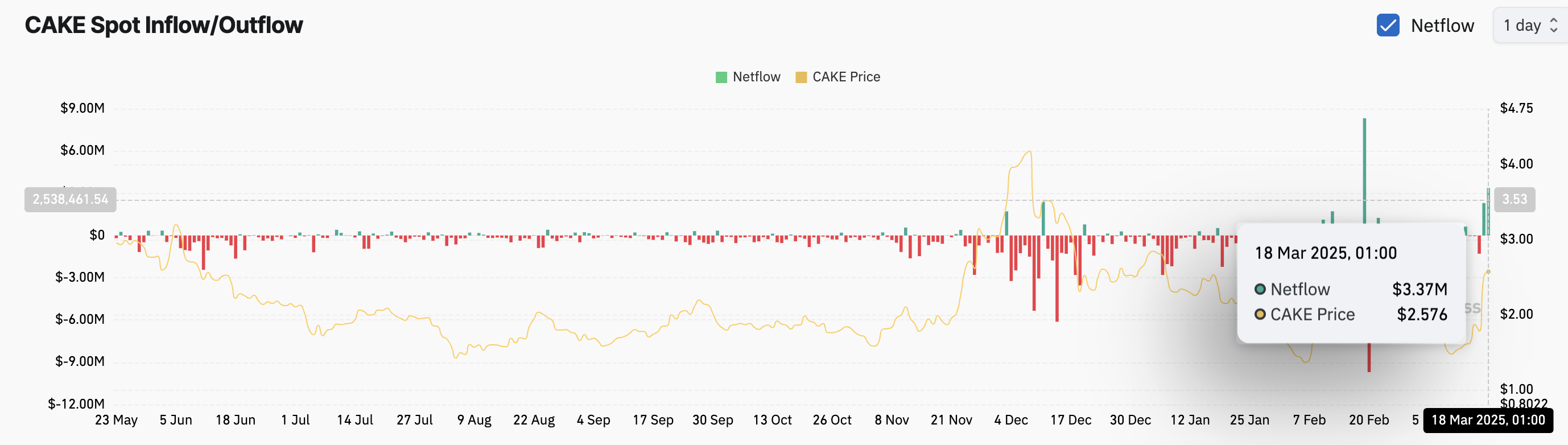

This is a bullish signal, especially as it is accompanied by positive market sentiment, as shown by the token’s funding rate, which is 0.0021% as of this writing.

CAKE Funding Rate. Source:

Coinglass

CAKE Funding Rate. Source:

Coinglass

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot market. A positive funding rate means long traders are paying short traders, indicating strong demand and bullish market sentiment for CAKE.

With rising inflows and growing demand, CAKE’s price performance suggests that traders are positioning for further upside. If demand continues at this pace, the token could extend its gains, drawing even more liquidity into PancakeSwap’s ecosystem.

CAKE Holds Strong Above 20-Day EMA—Bullish Momentum Builds

CAKE’s rally has pushed it significantly above its 20-day exponential moving average (EMA) which now forms dynamic support below its price at $1.93.

This moving average measures an asset’s average price over the past 20 trading days. It gives more weight to recent price data, making it more responsive to price movements than a simple moving average.

When an asset’s price climbs above the 20-day EMA, it signals bullish momentum, suggesting that buyers are in control and the asset may continue its upward trend.

If this trend persists, CAKE could extend its uptrend to $2.90.

CAKE Price Analysis. Source:

TradingView

CAKE Price Analysis. Source:

TradingView

On the other hand, a resurgence in profit-taking activity could prevent this from happening. If CAKE demand stalls and it sheds its recent gains, its value could plunge to $2.41. If that support level fails to hold, the token’s price could drop to $2.01.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Status SNT Pre-Deposit Campaign Enters Thrilling Final Stage with 35 Million Token Rewards

Taiwan seeks to become a key AI collaborator with the US through the tariff agreement

Why are institutions continuing to raise their holdings of TSMC at this level?