Ethereum Inflows Spike as ETF Optimism Builds Momentum

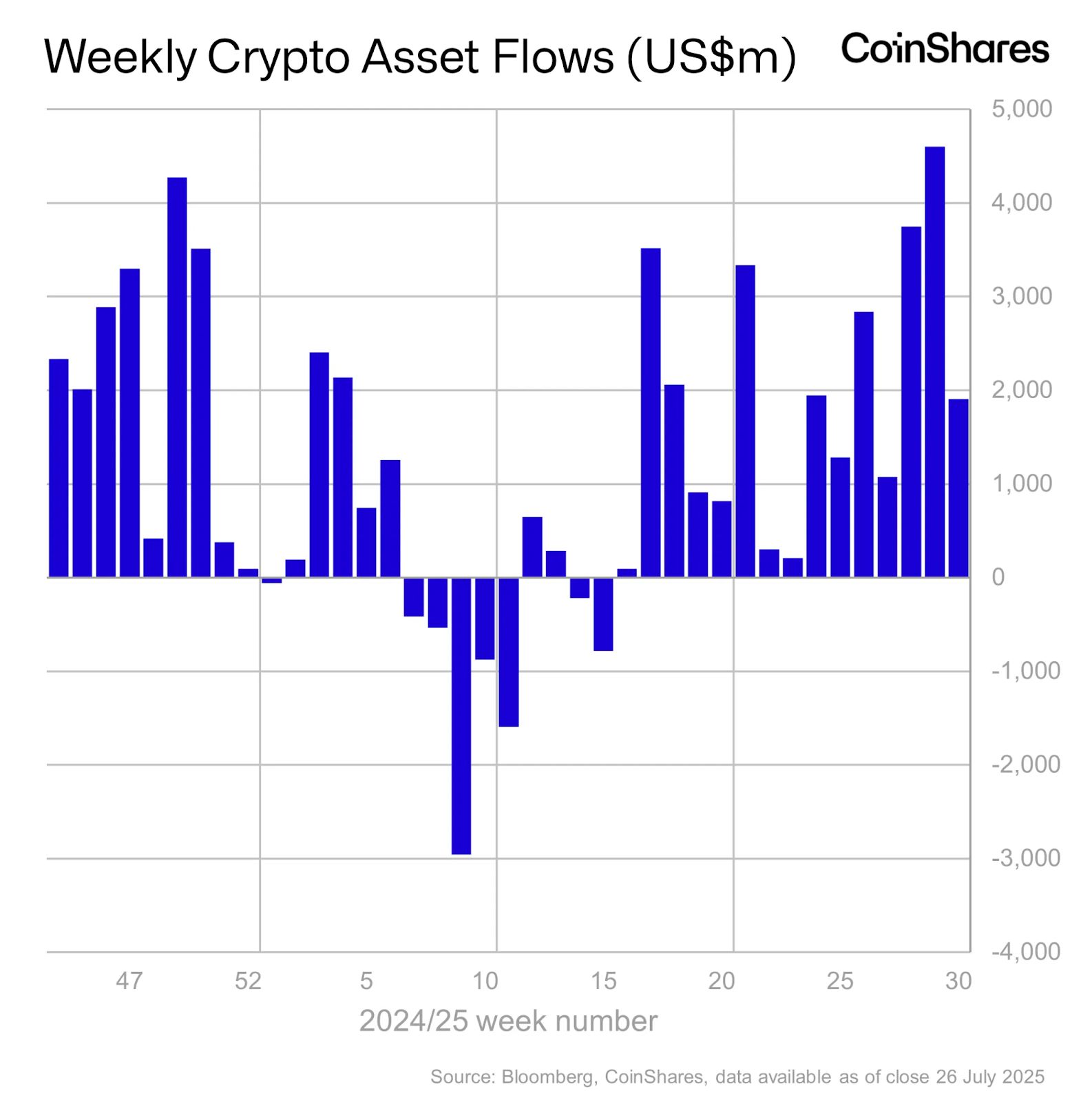

Digital asset investment products saw $1.9 billion in inflows this week, a 15-week run of positive sentiment, as reported by CoinShares. So far in July, inflows have hit $11.2 billion, outpacing the $7.6 billion recorded back in December 2024 after the U.S. election. The United States led the charge with $2 billion, while Germany contributed an additional $70 million. On the flip side, outflows from Hong Kong, Canada, and Brazil totaled $160 million, $84.3 million, and $23.2 million, which somewhat balanced out the demand from the U.S.

In Brief

- Ethereum pulled in $1.59B last week as ETF hopes grow, signaling strong investor interest and rotation from Bitcoin into altcoins.

- Over $11.2B flowed into digital assets this month alone, led by Ethereum, Solana, and XRP, driven by ETF optimism and U.S. demand.

- Confidence in a Ripple ETF hit 98% while ETF launches surged in June, showing investors are betting big on crypto-backed products.

Ethereum Leads as Bitcoin Faces Outflows

Ethereum had its second-strongest weekly performance , with inflows of $1.59 billion. This year, Ethereum inflows have already surpassed all of last year , totaling $7.79 billion. In comparison, Bitcoin had outflows of $175 million during this increase.

Besides Ethereum, large-cap altcoins attracted targeted demand. Solana gained $311 million, while XRP followed with $189 million. SUI added $8 million in inflows. However, inflows tapered beyond these names, with Litecoin and Bitcoin Cash seeing small outflows of $1.2 million and $660,000. Hence, analysts warned that the current momentum does not yet qualify as a broad altcoin season.

ETF Launches Drive Market Sentiment

James Butterfill, Coinshares’ head of research, said investors appear to be tactically positioning ahead of potential U.S. ETF approvals. He noted that flows remain concentrated in a few assets and regions. Moreover, Bloomberg analyst Eric Balchunas revealed that ETFs attracted nearly $100 billion in the last month, potentially breaking last year’s record.

June recorded 108 ETF launches, the highest monthly figure ever, and 50% higher than last year’s pace. Nearly a quarter of the 450 ETFs launched in 2025 are leveraged products, 2.5 times the old record. However, Balchunas warned that many of these ETFs may fail to attract assets. Approximately 40% of existing ETFs remain unprofitable with less than $40 million in assets.

Historical data further highlights 2025’s volatility. Monthly launches hit major peaks in January, March, and June, with June’s 108 launches standing out. The trend continues to outperform the five-year historical average of 35–60 monthly launches.

XRP ETF Confidence Surges

Additionally, there was a surge in momentum toward ETFs. According to data released by Amonyx on X, Polymarket indicates a 98% chance of the XRP ETF being approved by December 31, 2025. Compared to 80% earlier in June, this sudden rise in market sentiment may have been brought on by recent regulatory changes.

Consequently, speculation that more large-cap cryptocurrencies may receive inflows is being fueled by anticipation for an XRP ETF . This reinforces the pattern of investors shifting their money from Bitcoin to Ethereum and a few other altcoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Price predictions 11/28: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, HYPE, BCH, LINK

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?