Institutions grab 1.03m Ethereum worth $4.17b, ETH price breaks $4,000

More than 1.035 million Ethereum worth $4.167 billion have been accumulated by unknown whales and institutions over the past month.

- Whales, institutions amass 1.035 million Ethereum worth $4.17 billion in one month.

- Average ETH buy price $3,546 as price surges from $2,600 to $4,170.

- Analysts warn of overextension, advise ETH ecosystem plays instead.

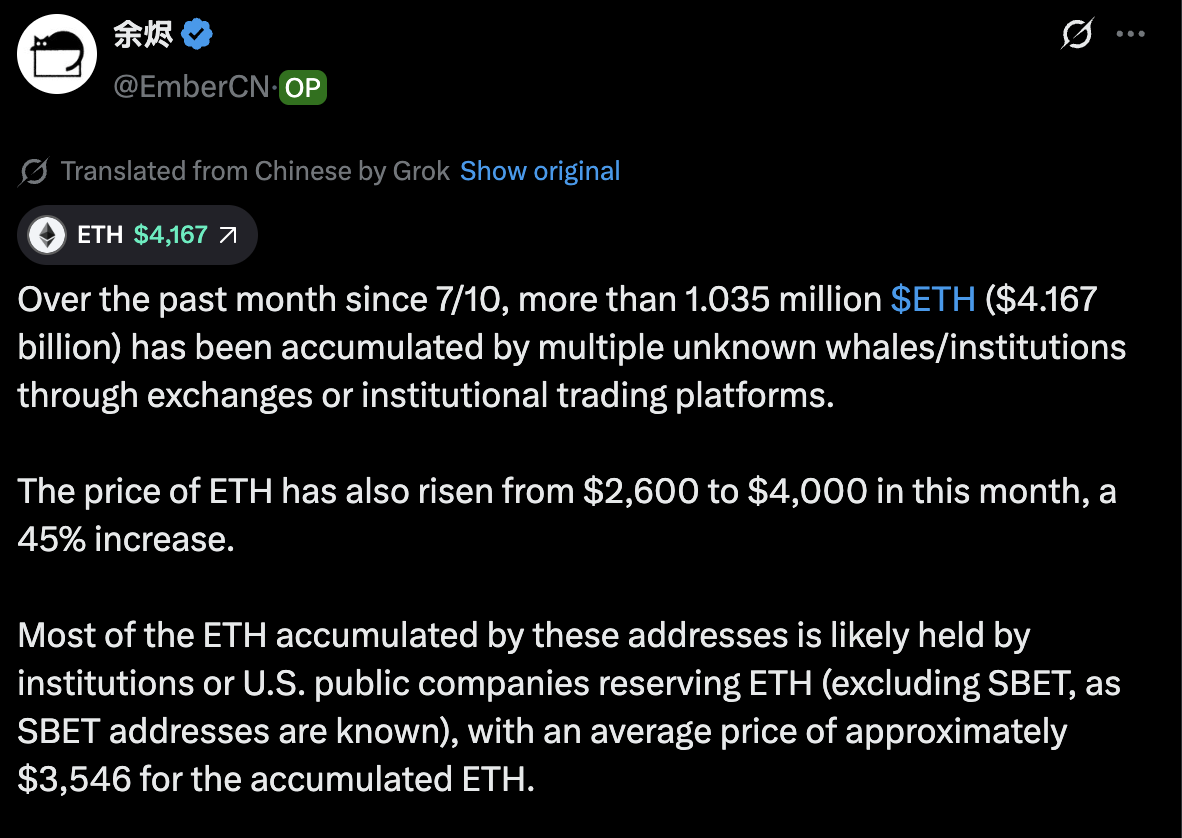

According to analyst Ember CN, the massive buying spree coincided with ETH’s price surge from $2,600 to over $4,000, which is a 45% gain since July 10 and a 19.6% gain over the last seven days.

The institutional accumulation occurred through exchanges and institutional trading platforms and buyers paidan average price of approximately $3,546 per Ethereum ( ETH ).

Ember CN suggested most addresses belong to institutions or U.S. public companies building Ethereum reserves, excluding known addresses like SBET.

X post by analyst EmberCN

X post by analyst EmberCN

Binance moves ETH as price breaks $4,000

Arkham Intelligence data shows Binance hot wallets transferred thousands of ETH to market maker Wintermute within hours of the price surge.

The transactions began with flows of 250 to 500 ETH per transfer before escalating to larger movements including single transactions exceeding 1,800 ETH.

The Wintermute transfers suggest institutional demand need better execution to avoid market impact. Market makers handle large orders by breaking them into smaller transactions or providing liquidity during volatile periods.

Ethereum 24-H price chart: CoinGecko

Ethereum 24-H price chart: CoinGecko

Ethereum’s 24-hour gain of 6.6% pushed the price to $4,170, approaching the previous all-time high near $4,800. The 30-day performance of nearly 50% shows sustained institutional buying pressure across multiple time frames.

Technical analysts warn of overextension

Analyst Michaël van de Poppe cautioned against buying ETH at current levels. He also described the move as “wild” and noting that prices have “swept the high.”

Poppe suggested the setup could lead to “a big breakout towards ATHs” but recommended allocating funds within the Ethereum ecosystem instead.

“It’s a little too risky to be buying $ETH at these highs,” van de Poppe posted. “I think it’s wiser to allocate funds within the $ETH ecosystem as it should yield a higher return.”

The analyst’s recommendation shows a common strategy of buying ecosystem tokens that may outperform ETH during rallies while maintaining exposure to Ethereum’s growth.

The $4.17 billion accumulation period coincides with increased institutional cryptocurrency adoption.

U.S. public companies have increasingly adopted cryptocurrency treasury strategies, with Ethereum becoming a secondary choice after Bitcoin for corporate holdings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Understanding Vitalik's Long Essay: Why Should Smart People Stick to "Dumb Rules"?

Those "galaxy brain" theories that seem to explain everything are often the most dangerous universal excuses. On the contrary, those rigid and dogmatic "high-resistance" rules are actually our last line of defense against self-deception.

Bitcoin’s Sharpe ratio is nearly at zero, a rare risk-reward signal

XRP price ‘looking very bullish’ after 25% weekly gain: How high can it go?

HIP-3 projects are transforming the Hyperliquid ecosystem

US stocks, Pokémon cards, CS skins, pre-IPO companies—a diversified, all-weather liquid capital market.