Leveraged Solana, XRP ETFs Attract Major Capital Inflows

- Introduction of leveraged Solana and XRP ETFs boosts institutional interest.

- ProShares and Volatility Shares lead ETF launches.

- SEC’s new leadership influences regulatory clarity on digital assets.

ProShares and Volatility Shares have jointly launched leveraged ETFs focused on Solana and XRP, stirring significant market interest with a combined capital inflow of over $3 billion.

The launch underscores rising institutional participation and could influence SEC rulings, reflecting broader market shifts towards regulated digital asset investments.

Leveraged Solana and XRP ETFs have significantly affected the crypto market, highlighting major investment flows exceeding $1 billion. These ETFs, spearheaded by ProShares and Volatility Shares, are amid increasing regulatory clarity from the SEC under new leadership.

ProShares and Volatility Shares are central to these developments. Their ETFs aim to provide 2x daily exposure to Solana and XRP futures. Significant players like BlackRock are reportedly considering the launch of spot XRP ETFs. Nate Geraci, President of The ETF Store, remarked, “Futures-based Solana and XRP ETFs have attracted over $1 billion in capital since launch.”

The introduction of these products has led to increased institutional engagement and inflows into Solana and XRP. High-profile custodians, including Galaxy Digital, hold substantial XRP, buoyed by recent regulatory developments, and Ripple’s legal resolution contributes to growing confidence.

Financial implications include a surge in trading volumes and enhanced liquidity for Solana and XRP. The market anticipates further regulatory clarity, possibly enabling spot ETF listings and increased retail and institutional participation in these digital assets.

The SEC’s decision on spot ETFs might further open avenues for digital asset products. As seen historically, futures ETFs have set precedents enhancing the possibility of spot ETF approvals, thus bolstering the crypto landscape significantly.

Potential monetary and technological advancements are likely to emerge from these shifts, supported by past trends. Tokens like Ethereum and Bitcoin may also experience indirect enhancements due to ETF-induced capital flows, suggesting a broader impact on the cryptocurrency ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto Presale Projects: Cold Wallet, HYPER, T6900 & SUBBD

Ethereum whales scoop sales by traders in ‘disbelief’ of rally: Santiment

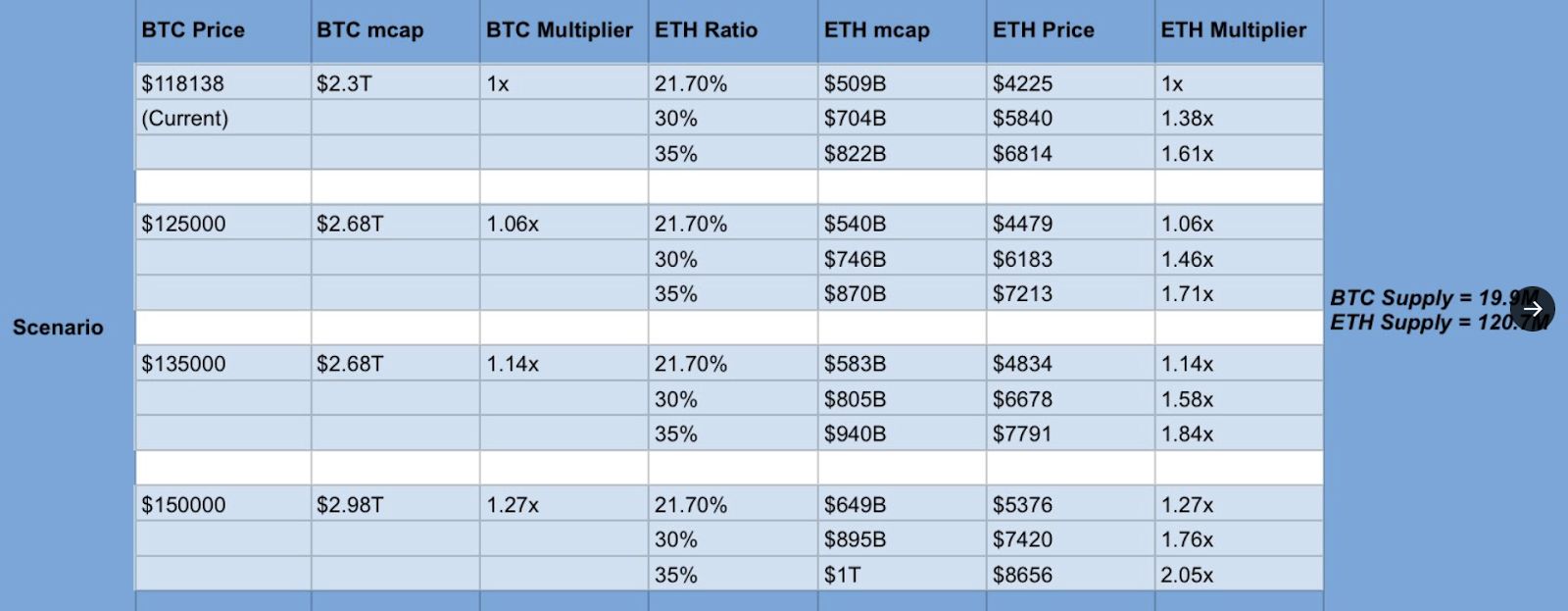

Ethereum could reach $8.5K if Bitcoin taps $150K, trader says

Ether May Approach $8,656 If Bitcoin Reaches $150,000, Analysts Suggest