Ethereum ETFs Record $422M Single-Day Outflows

- Massive outflow from Ethereum ETFs following institutional sell-offs.

- BlackRock and Fidelity initiated notable fund withdrawals.

- Market adjusts amid macroeconomic uncertainties and institutional stances.

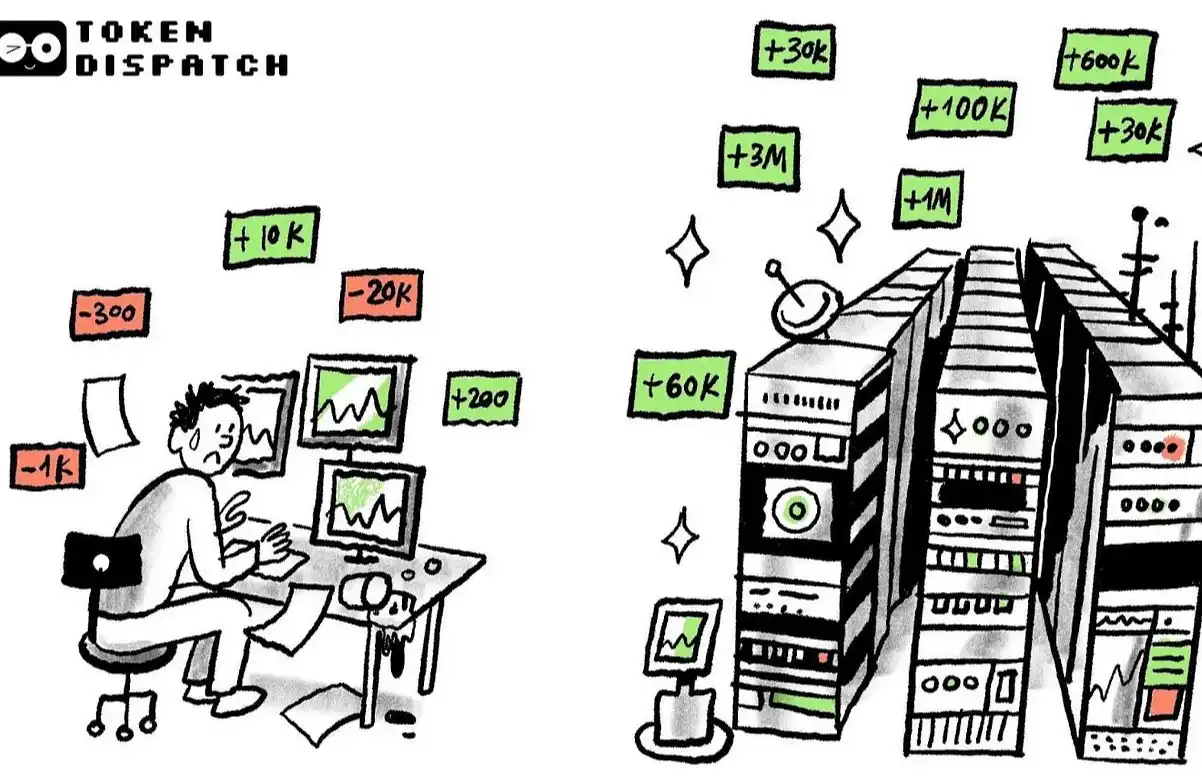

Ethereum spot ETFs experienced a massive $422 million net outflow on August 19, 2025, marking the second-largest in history. BlackRock and Fidelity drove the withdrawals, reflecting institutional reactions to macroeconomic conditions and anticipated interest rate shifts.

Ethereum spot ETFs experienced significant net outflows amounting to $422 million on August 19, 2025. This occurrence marks the second largest single-day withdrawal in the history of Ethereum ETFs , highlighting impactful shifts within the market.

Led by institutions like BlackRock and Fidelity, the withdrawals underscore strategic moves within the Ethereum ETF landscape. Significant outflows present responses to macroeconomic conditions that contribute to broader market fluctuations.

Institutional Influence on Ethereum ETFs

Institutional entities, including BlackRock and Fidelity, conducted substantial Ethereum ETF redemptions, with BlackRock selling 19,500 ETH and Fidelity selling 36,250 ETH. The response to external financial pressures reveals institutional decisions’ influence on Ethereum’s market dynamics.

Larry Fink, CEO of BlackRock, stated, “The recent outflows reflect significant market shifts as institutional investors navigate macroeconomic uncertainties.”source

The withdrawal has prompted Ethereum’s price to drop to approximately $4,282, showing a 1% daily fall. The action aligns with broader market reactions in the context of tighter monetary policies and potential long-term economic impacts.

Market Adjustments and Future Projections

Despite the outflows, core technology and protocol developments remain unaffected; however, broader market trends and risk sentiments continue to be shaped by such institutional movements. The current environment points toward further profit-taking amidst prevailing macroeconomic conditions.

Although the outflow poses challenges, experts will closely monitor Ethereum and associated assets for future stability and regulatory shifts, considering potential technological advancements and economic forecasts. Future moves and data will reveal broader market impacts, providing insight into ongoing cryptocurrency evolution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto treasury stocks plunging in August after massive run-up

Share link:In this post: Crypto treasury stocks fell sharply in August after major summer gains. Ethzilla led the sector with a 114% rise, while others like Strategy dropped 16%. Companies backed by Tom Lee and Peter Thiel held up better than others.

OpenAI mulls new revenue from AI infrastructure

Share link:In this post: OpenAI is considering leasing out its AI-ready data centers and infrastructure in the future. The plan mirrors Amazon Web Services, which turned excess computing into a trillion-dollar business. OpenAI is exploring new financial instruments beyond debt to fund large-scale projects.

Interpreting Galaxy Q2 Financial Report: Hundred Billion Revenue but Unprofitable, Transforming into AI "Gold Mining"

Galaxy's cryptocurrency trading business generated $8.7 billion in revenue, but only brought in $13 million in profit (a profit margin of only 0.15%).

ETH futures data reflects traders’ fear, while onchain data points to a price recovery