Ethereum Surges to All-Time High, Gas Prices Concerns Raised

- Ethereum surpasses $4,878 amid market and macroeconomic factors.

- Institutional investments drive ETH’s recent peak.

- Regulatory statements enhance market confidence.

Ethereum reached a record high of $4,878 on August 22, 2025, following remarks from Jerome Powell that spurred institutional interest and market momentum.

The event underscores growing institutional interest and regulatory clarity, with potential long-term impacts on Ethereum and broader crypto markets, fostering an environment ripe for continued growth.

Ethereum reached a historic peak, breaking past $4,878 on August 22, 2025, largely influenced by macroeconomic changes and substantial institutional interest. Analysts and on-chain metrics support this significant surge .

Vitalik Buterin, Ethereum co-founder, has not publicly commented on this rise. Federal Reserve Chair Jerome Powell’s remarks on potential interest rate adjustments have notably enhanced market optimism, fueling Ethereum’s price increase. In his own words, Jerome Powell, Chair, Federal Reserve, stated: “The baseline outlook and the shifting balance of risks may warrant adjusting our policy stance.” ( Source )

The rise in Ethereum’s value has generated considerable interest, affecting various industries reliant on blockchain technologies. Increased institutional investment is pronounced, with major participants accumulating Ethereum .

Macroeconomic factors, including possible Federal Reserve rate cuts, have bolstered investor risk appetite. Experts note that regulatory clarity from figures like SEC Chair Paul Atkins plays a pivotal role.

An analysis of historical data indicates a shift towards institutional participation compared to previous retail-driven rallies. This trend suggests a more stable market outlook and a pathway for future growth.

Insights suggest the introduced regulations may drive stronger technological advancements and facilitate further financial integration. Analysts, including Arthur Hayes, forecast possible future price points, enhancing crypto market dynamics. Arthur Hayes, Co-founder, BitMEX, predicted: “I expect the crypto to go as high as $20,000 this cycle.” ( Source )

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Metaplanet Acquires 775 BTC, Expands Holdings to 18,888

Ethereum Hits New All-Time High Above $4868 Fueled by Powells Dovish Remarks

Bitcoin price breakout to $117K liquidates bears, opening door to fresh all-time highs

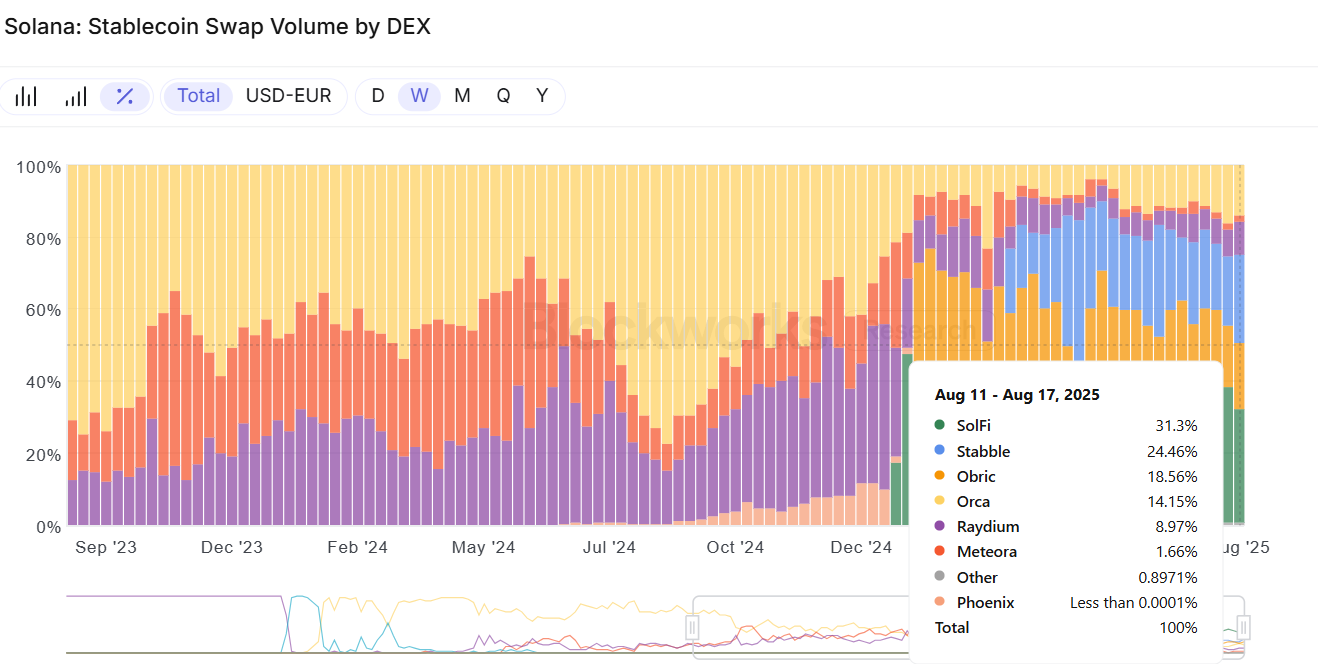

Solana’s proprietary AMMs are reshaping liquid asset markets for users

Prop AMMs like SolFi, HumidFi and Obric are taking over liquid capital markets