Why HBAR’s Bearish Sentiment Might Be Its Trigger for a Price Rebound

HBAR price has dropped over 11% in the past month, with weak buying flows and shrinking social interest signaling bearish sentiment. The only possible support comes from heavy short positioning that could trigger a squeeze if broader market momentum turns.

Hedera (HBAR) has been up more than 40% over the past three months. However, its recent performance suggests that those gains are at risk.

In the last 24 hours, HBAR’s price dropped by over 4%, and its one-month losing streak has now extended to more than 11%. With sellers in control, HBAR is in a key zone. The only potential support comes from a very unlikely source.

Fading Interest Fuels Sellers’ Control

A look at on-chain data shows why buyers have stepped back. Hedera’s social dominance, which tracks how much discussion it generates across crypto platforms, has collapsed.

On July 13, it stood at 2.417%, but by late August, it had fallen to just 0.515% — a decline of almost 80%. This drop in attention has been mirrored by weak buying flows.

HBAR Price And Social Dominance:

HBAR Price And Social Dominance:

For example, net flows to exchanges increased sharply over the past month. On July 21, buying pressure was measured at -46.48 million tokens, while by August 25, it had only improved to -12.24 million.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Buying Weakens:

HBAR Buying Weakens:

That represents a 73% reduction in buying pressure, signalling that sellers remain ahead. The lack of buyer conviction explains why every small bounce has been sold into, keeping the HBAR price on a steady downward path.

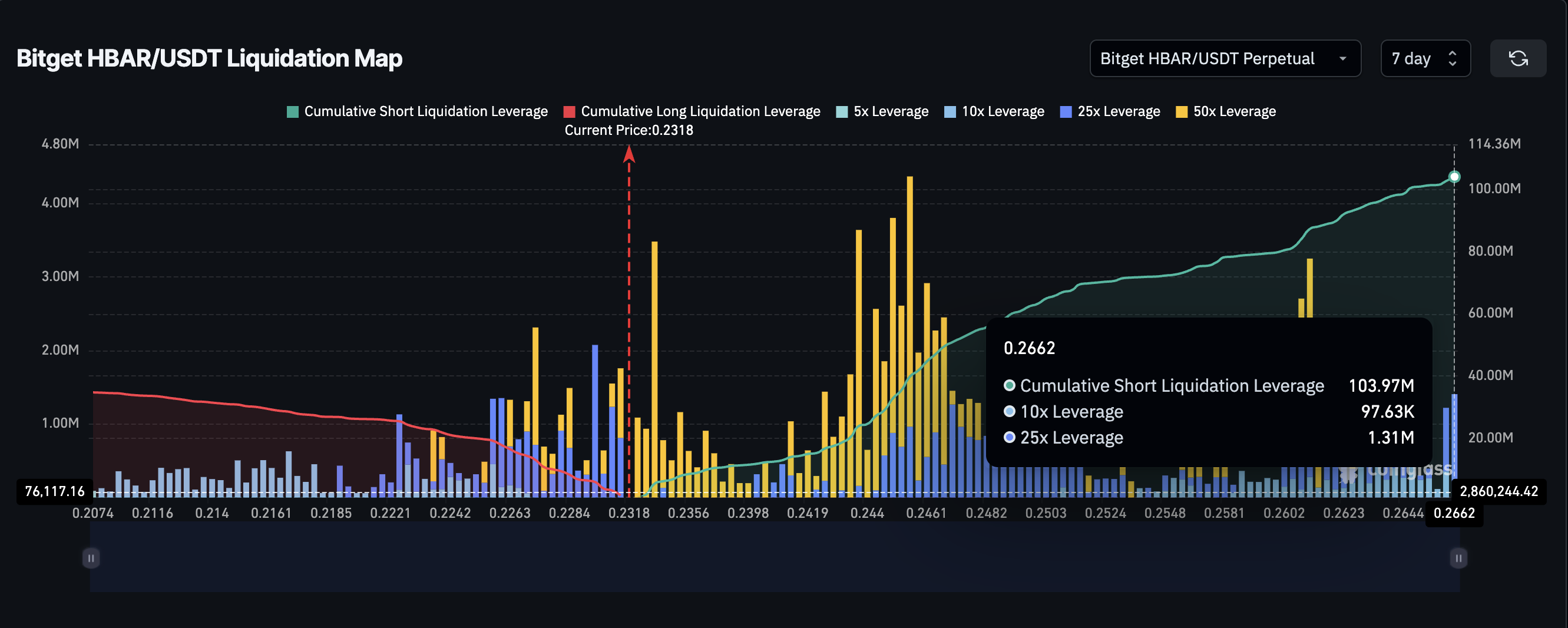

Derivatives Positioning Is Bearish, But Also the Only Ally

The weakness is not limited to spot trading. Derivatives markets tell the same story. On platforms like Bitget, open positions are heavily skewed toward shorts.

Short leverage stands at $103.97 million, compared with just $34.78 million in long positions — nearly 200% more shorts than longs.

Bitget HBAR Liquidation Map:

Bitget HBAR Liquidation Map:

This lopsided positioning is clearly bearish. However, it also creates an unlikely ally.

If the HBAR price gains upward momentum from broader market moves, the heavy concentration of shorts between $0.23 and $0.26 could be liquidated.

In simple terms, traders betting against HBAR might be forced to buy back their positions quickly, pushing the price higher in a short squeeze. While the core sentiment remains negative, this imbalance provides the only visible catalyst for a rebound.

However, if the price corrects further, the small yet significant long positions could also face liquidation risks, pushing the HBAR price lower.

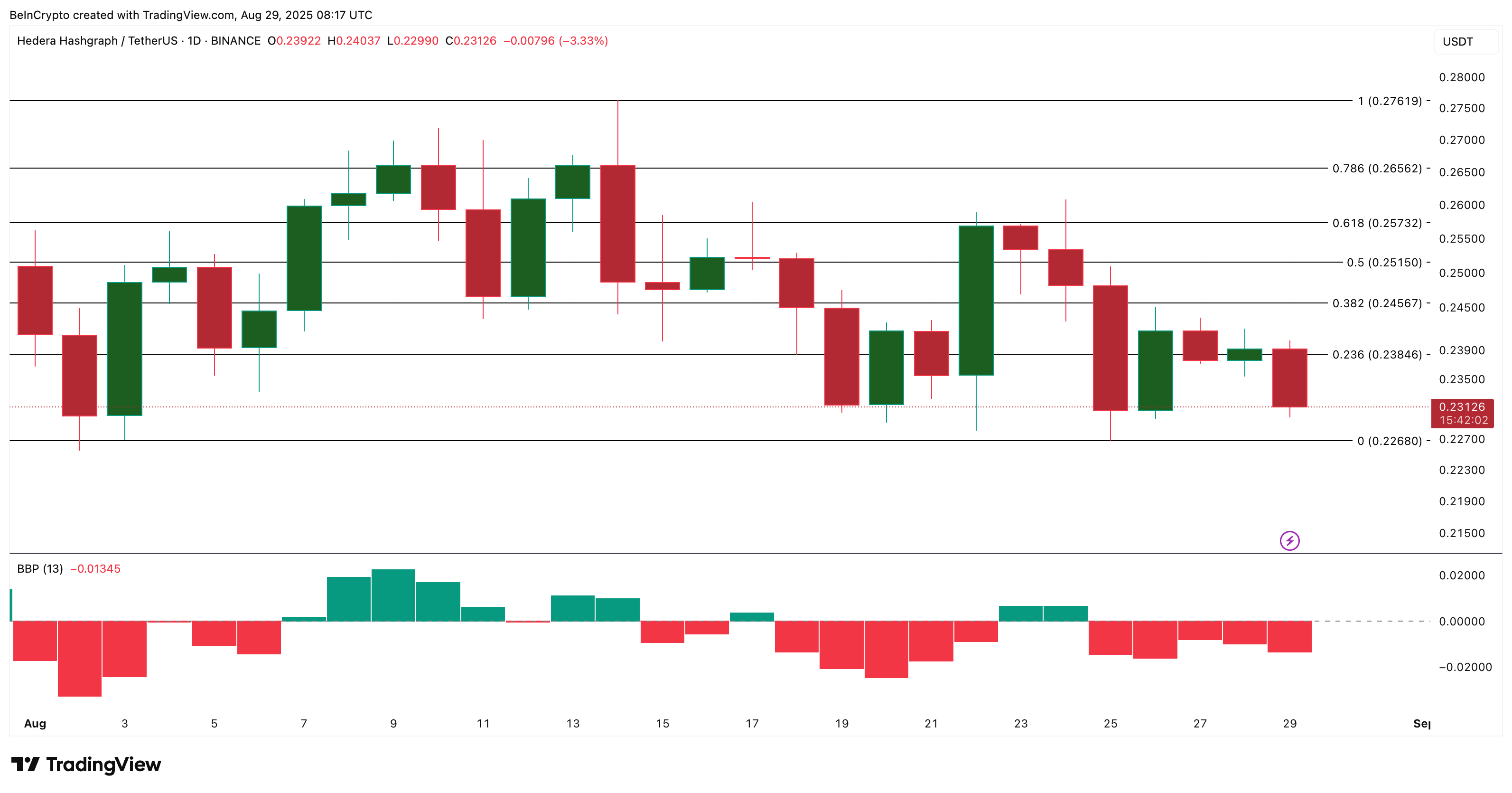

Hedera (HBAR) Price Hangs by a Thread

At press time, HBAR price trades around $0.231. Lose $0.23, and the next slide toward $0.22 becomes likely, more so with the Bull-Bear Power (BBP) indicator flipping strongly into the negative zone.

The Bull-Bear Power indicator measures the balance between buyers and sellers. It compares the highest price a token reaches in a given period with its average price. If the value is positive, it suggests buyers are pushing prices higher. If it is negative, it shows sellers have more control.

HBAR Price Analysis:

HBAR Price Analysis:

If $0.226 breaks, new local lows could await the HBAR price. Yet, if a squeeze starts, the first rebound zone is just above $0.26. Clearing that area would open room to build a larger move, but until then, sellers remain in control.

Without help from a short squeeze, HBAR price risks printing new local lows despite its solid three-month gain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing short to repay long: The Bank of England and the Bank of Japan lead the shift from long-term bonds to high-frequency "interest rate gambling"

If expectations are not met, the government will face risks of uncontrollable costs and fiscal sustainability due to frequent rollovers.

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.