Earnings Preview | GameStop's "crypto speculation" + transformation + resource integration may lead to continued profitability in Q2

Summary: GameStop will release its Q2 financial report after the market closes on September 9. With investments in bitcoin, a focus on the "trading card" business, and large-scale store closures, whether GameStop's series of moves can bring positive results and whether its stock price will experience another round of "madness" are key points to watch.

Q1 Performance Review

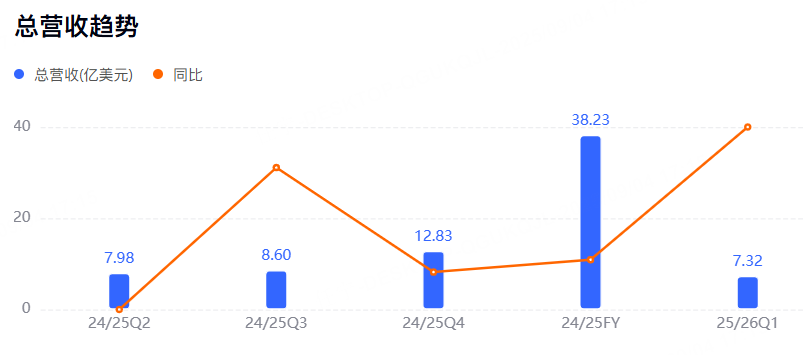

GameStop's Q1 revenue fell 17% year-on-year, dropping from $881.8 million in the same period last year to $732.4 million, below analysts' expectations of $750 million. During the reporting period, revenue from the hardware and accessories segment, which includes sales of new and used video games, fell by about 32%.

Through cost-cutting measures, the company achieved a net profit of $44.8 million (9 cents per share) in the first quarter, compared to a net loss of $32.3 million (11 cents per share) in the same period last year, marking the fourth consecutive quarter of profitability. Adjusted earnings per share reached 17 cents, exceeding the expected 8 cents.

Q2 Outlook

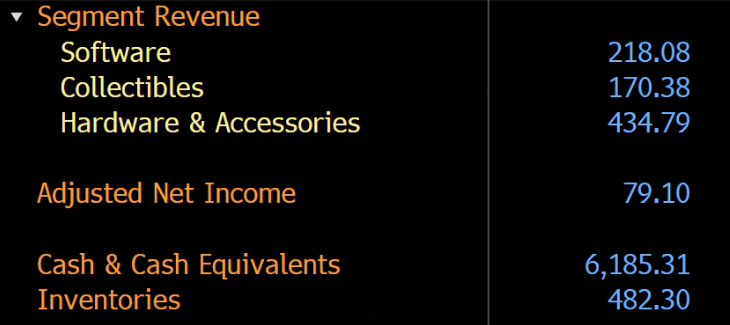

According to Bloomberg data, analysts currently expect GameStop's Q2 revenue to be $823 million, with adjusted earnings per share of $0.16 and adjusted net profit of $79.1 million.

Main Focus Points

How much profit has bitcoin investment brought?

This year, GameStop followed the example of Strategy and included bitcoin as a reserve asset, making this move a focal point. Investors should pay close attention to the impact of bitcoin on the company's quarterly earnings, as well as management's outlook on future cryptocurrency investments. The volatility of cryptocurrencies has become a key factor affecting GameStop's stock performance.

Focusing on the "trading card" business—how effective is it?

At the annual shareholders' meeting held on June 12, GameStop CEO Ryan Cohen made it clear that the company will focus on the "trading card" business in the future. Cohen pointed out that the Pokémon card and sports trading card businesses are closely linked to the company's traditional business, not only fitting the buyback and resale model and attracting the core customer base, but also being deeply tied to physical retail. As consumers increasingly purchase video games online, GameStop plans to vigorously expand its collectibles business, with trading cards becoming a key component.

It is clear that GameStop is leveraging the trading card business to transform and open up new growth paths. How effective this move is remains to be seen in the financial report.

Can "store closures" provide a boost?

After closing nearly 600 U.S. stores in 2024, the company announced that it will close a "large number" of stores this year as well, indicating that its retail business remains sluggish. In addition, GameStop's exit from the European market and optimization of domestic stores are critical moves. The company is concentrating resources in markets with greater profit potential, and the effectiveness of these measures remains to be seen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Holds the $84,000 Support Like a Champion: Oversold Rebound Targets $94,000 This Week

Bitcoin has successfully held the $84,000 support level and may rebound to $94,000 this week. If it falls below $80,000, it could further drop to $75,000. Although market sentiment is extremely bearish, a short-term oversold condition may trigger a rebound. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still being updated iteratively.

What will happen to the price of DOGE after the listing of Grayscale's GDOG ETF?

Dogecoin's price is being suppressed by resistance at $0.1495, with short-term support at $0.144. Grayscale's DOGE ETF debut failed to boost the price, and continued whale sell-offs are exerting further pressure. Technical analysis indicates a neutral-to-bearish trend, lacking clear reversal signals. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still undergoing iterative updates.

BitMine spends heavily again to buy 70,000 ETH! Holdings surpass 3% of total circulating supply; Tom Lee: Ethereum's worst-case scenario is a drop to $2,500

BitMine Immersion Technologies increased its holdings by 69,822 ETH, bringing its total holdings to 3.62 million ETH, which accounts for 3% of the circulating supply, with total assets of $11.2 billions. Tom Lee believes that ETH's risk/reward is asymmetric, with limited downside potential. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

Trending news

MoreBitget Daily Digest (Nov 25) | Grayscale XRP ETF and Franklin XRP ETF go live; Public companies bought a net $13.4M BTC last week; U.S. September PCE rescheduled to December 5, and Q3 GDP advance report canceled

Bitcoin Holds the $84,000 Support Like a Champion: Oversold Rebound Targets $94,000 This Week