Goldman Sachs Unveils Playbook To Jumpstart US Economy, Tells Bears ‘Do Not Fight the Fed’

Banking giant Goldman Sachs believes that powerful tailwinds are gathering to propel a sluggish US economy.

In a new CNBC interview, Tony Pasquariello, the head of hedge fund client coverage at Goldman Sachs, says the US economy is one Fed cutting cycle away from coming back to life.

He also believes that the macro setup is very favorable for the stock market based on historical precedent.

“The recipe, if our economists are correct, to get back to trend growth, would be the Fed is going to ease, so you have monetary tailwind. Do not fight the Fed, particularly in the absence of recession. The history book is very clear on that.

The history book is also very favorable when the Fed cuts at or near the highs in the stock market. I think that’s only happened nine times since 1990. One year forward, you’re higher in all [9] occurrences.

So a fiscal tailwind, a monetary tailwind, distance from peak tariff uncertainty. That would be the recipe to get the US economy going again.”

Turning to monetary policy, Goldman Sachs predicts that the Federal Reserve will cut rates multiple times in the coming months, with more to come next year.

“So our view is they’re going to go three times this year: September, October, December, so sequential. Two more times next year on a quarterly pace makes five.

So when we’re sitting here next June, the funds rate is not 4.375%; it’s 3.125%.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After an 80% drop in stock price, is there a value mismatch in BitMine?

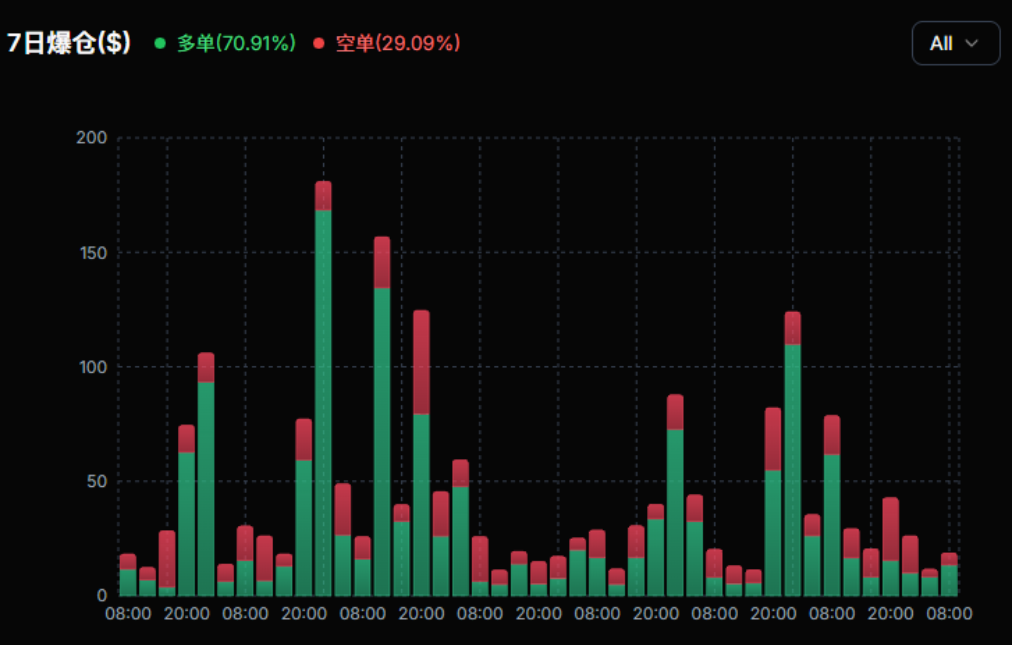

With the three main buying channels simultaneously under pressure and the staking ecosystem losing momentum, Ethereum's next stage of price support faces a structural test. Although BitMine is still buying, it is almost fighting alone. If even BitMine, the last pillar, can no longer buy, what the market stands to lose will not just be a single stock or a wave of capital, but potentially the very foundation of belief in the entire Ethereum narrative.

Bitcoin falls below the 90,000 mark, hidden opportunities emerge amid spreading panic

Major Earthquake in Digital Assets: Billion-Dollar Compensation Storm from Mt.Gox and FTX

U.S. state governments are betting on Bitcoin ahead of regulatory storms