Research Report | Detailed Explanation & Market Value Analysis of the Boundless (ZKC) Project

Bitget2025/09/15 10:04

By:Bitget

1. Project Introduction

Boundless is a decentralized computing marketplace and smart contract settlement protocol that leverages zero-knowledge (ZK) technology to expand verifiable computing capabilities, meeting the computational demands of various blockchains. The core concept of the project is to financialize computing resources and establish an open market environment, enabling hardware compute providers (provers), such as GPU operators, to efficiently match with demanders (requestors) in either spot markets or service agreements.

Key innovations include:

-

Introduction of the Proof of Verifiable Work mechanism to fairly measure computational complexity and incentivize compute providers;

-

Multi-chain deployment support, inheriting the security properties of each chain to enable high-activity compute resource circulation;

-

Use of Reverse Dutch Auction for price discovery, ensuring users can access distributed computing services at low cost while maintaining market decentralization.

The $ZKC token has a limited supply and is primarily used for payments, governance, and incentivizing compute contributors. Newly minted tokens are distributed based on Proof of Verifiable Work, and market fees are returned to holders via a “Vault” mechanism. Boundless is currently in development, with its code and technical documentation publicly available, demonstrating promising real-world applications of ZK technology.

2. Project Highlights

-

Pioneer in Decentralized ZK Computing Market Boundless builds a decentralized marketplace for verifiable computation, treating computing resources as tradeable assets to address on-chain compute scarcity and trust bottlenecks. Through market mechanisms, users and protocols can obtain high-confidence computation proofs at low cost, laying a solid foundation for large-scale blockchain application deployment.

-

Low Entry Barrier and Scalability The technical architecture allows ordinary consumer-grade hardware to participate in ZK computation, requiring no specialized equipment to contribute compute power. The system’s computational capacity scales linearly with the number of hardware nodes, providing flexible and sustainable compute support for diverse applications.

-

Economic Incentives and Fair Mechanism Innovation By binding Proof of Verifiable Work to native tokens, compute providers are fairly rewarded according to actual contributions. Price discovery uses mechanisms such as Reverse Dutch Auction to optimize market efficiency and protect user interests. Decentralized governance supports long-term ecosystem stability.

-

Cross-chain Compatibility and Infrastructure Potential Boundless supports independent multi-chain deployment with high cross-chain compatibility and modular integration. Developers can freely build service agreements to meet diverse on-chain computing needs, positioning Boundless as a key infrastructure layer in the Web3 ecosystem, providing a reliable verifiable computation trust layer for various applications.

3. Market Cap Expectations

4. Economic Model

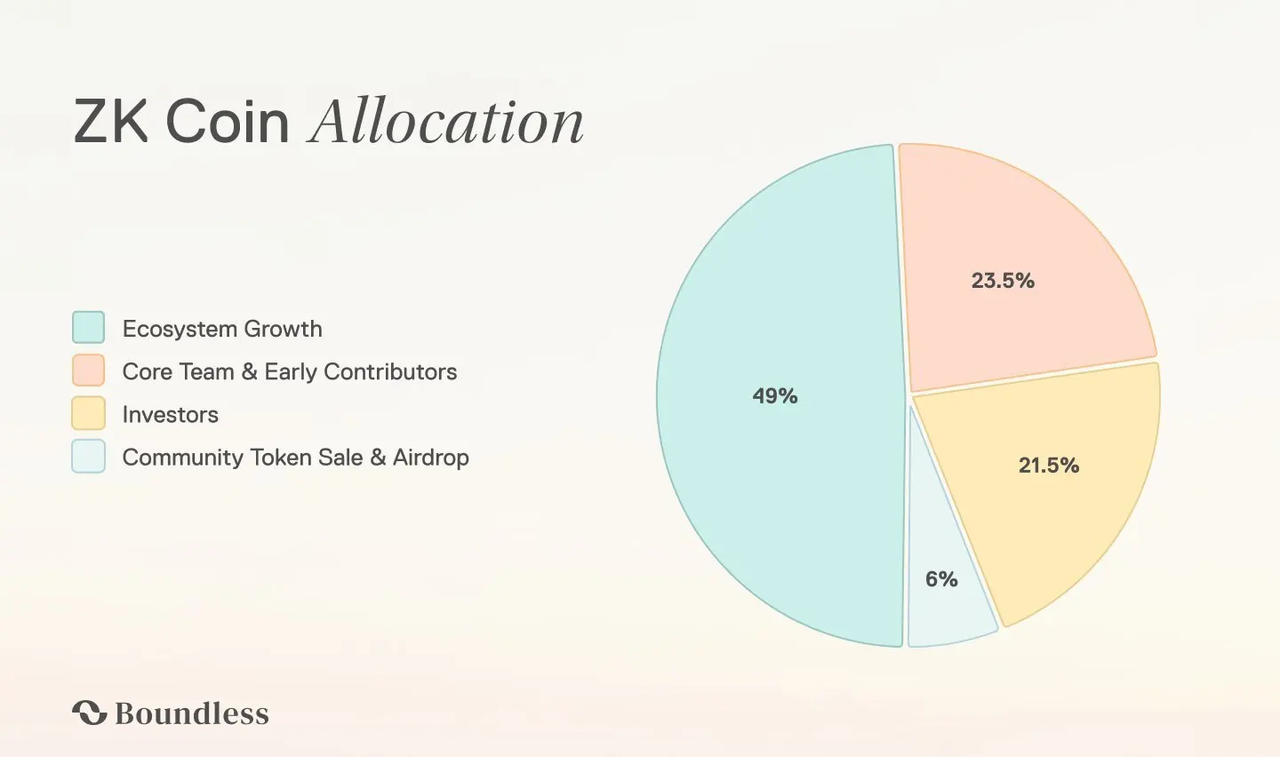

The initial supply of ZKC is 1 billion tokens, with the following allocation:

-

49% for Ecosystem Development: Of this, 31% will be held by the Boundless Foundation as an ecosystem fund. One-quarter of these tokens will be locked for one year, while the remaining three-quarters will be gradually unlocked on a monthly basis over the following 24 months, until the end of the third year.

-

18% for Strategic Growth Fund: Allocated for enterprise integration, business development, and onboarding of institutional-level validators. These tokens will be unlocked gradually over 12 months.

-

23.5% for Core Team and Early Contributors: 20% of the tokens are distributed to the core development team and early contributors who advanced Boundless from concept to mainnet. The remaining 3.5% are allocated to RISC Zero, the company that initially incubated Boundless. The unlocking rules for this portion follow the same schedule as the ecosystem fund.

-

~6% for Community Token Sales and Airdrops: Used to reward early contributors, including witnesses and Kaito Yappers. 50% of community sale tokens will unlock at TGE, with the remaining 50% unlocking six months later. 100% of airdropped tokens will unlock at TGE.

-

21.5% for Investors: This portion follows the same unlocking schedule as the core team.

Token Utility

-

Validator Incentives: Rewards provers for providing ZKP computing resources to the Boundless Marketplace. Rewards are proportional to contributions based on market fees or proof cycles.

-

Market Fee Distribution: Holders can lock $ZKC in the Vault to earn points, which can be used to claim a share of market fees, forming a “staking + earnings” mechanism.

-

Staking and Service Agreements: Supports locking for spot market requests and staking for service periods under agreements, enhancing the credibility of market participants.

-

Decentralized Governance: Holders can participate in on-chain governance, adjusting minting rates and reward frequencies, influencing tokenomics parameters and market incentive strategies.

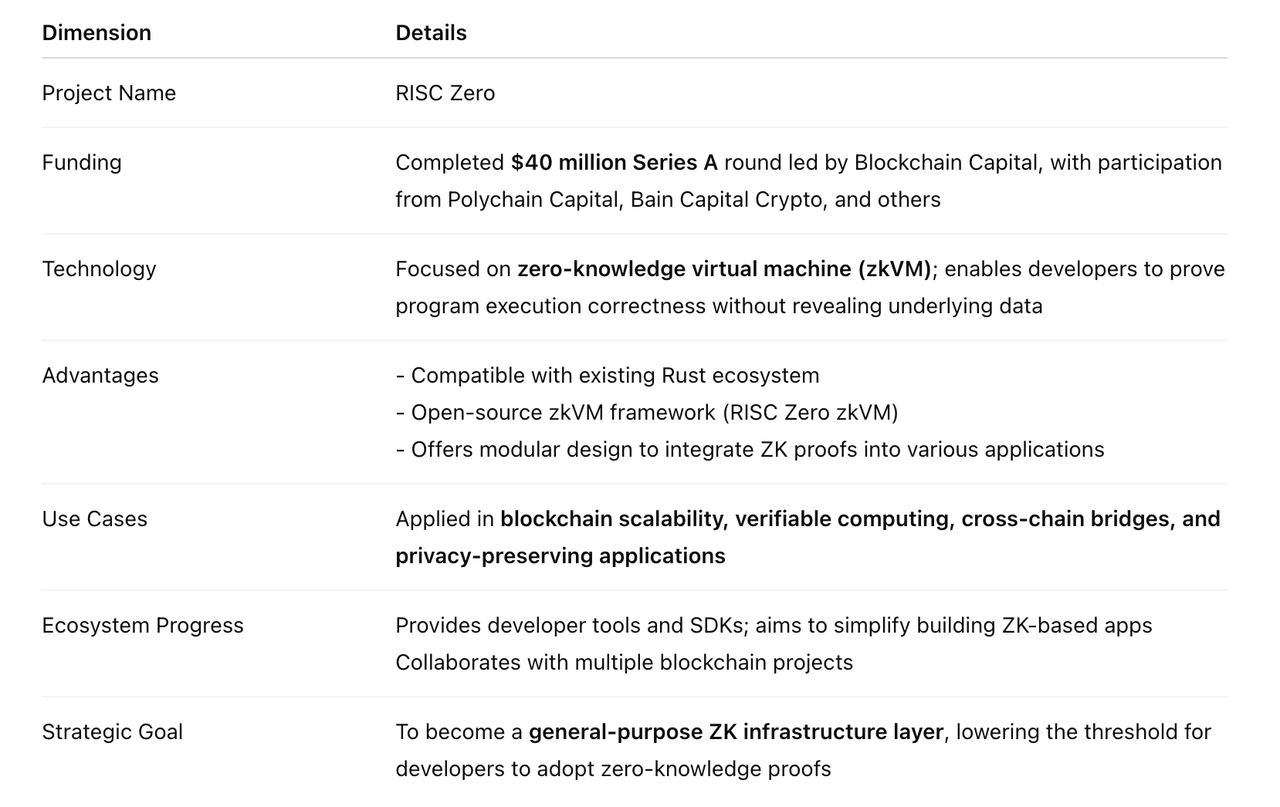

5. Team and Funding Information

-

Team The Boundless protocol was initiated by the RISC Zero team, which has a strong background in zero-knowledge proofs and previously launched zkVM and Zeth, advancing ZK technology in the industry. Founder Jeremy Bruestle and the team have long been engaged in research on zero-knowledge proofs and mathematical theories such as the PCP theorem.

-

Funding To date, no disclosed funding information has been found for Boundless itself, including seed rounds, private placements, ICOs, or venture investments. The project is still at an early stage, and it is recommended to follow official channels for updates on future funding.

-

Series A Funding: RISC Zero raised $40 million in a Series A round, with investors including Blockchain Capital, Bain Capital Crypto, Galaxy, and others. Public records indicate that RISC Zero has raised a total of $54 million.

-

Token Sale: The token sale accounts for 3% of the total supply, with expected proceeds of $4 million. However, the actual sale amount has not been officially disclosed.

6. Potential Risk Warnings

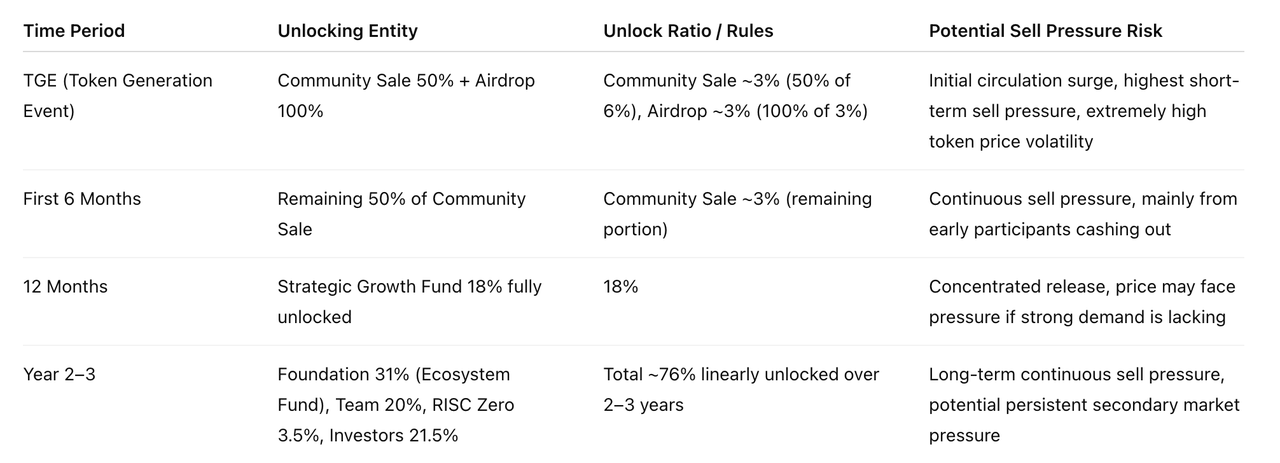

Token Distribution and Governance Uncertainty The minting rate and reward frequency of $ZKC are determined by community governance. If governance is imbalanced or lacks transparency, it may lead to inflationary pressure or ineffective incentive mechanisms, impacting the healthy development of the ecosystem. Additionally, identifying market entry points and profitable models remains a challenge for ZK-based projects in the current market.

Selling Pressure Risk There is a potential risk of selling pressure due to token unlocks or market dynamics, which may affect token price stability.

-

Short-term risk (0–6 months): Heavy sell pressure from airdrops and community sale tokens. Price volatility risk is highest during this phase.

-

Mid-term risk (6–12 months): Strategic Growth Fund unlock (18%) poses a concentrated supply shock.

-

Long-term risk (1–3 years): Large allocations to the foundation, team, and investors unlock gradually, creating a long-lasting sell pressure band that could weigh on market performance unless offset by strong demand growth.

7. Official Links

-

Twitter: https://x.com/boundless_xyz

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Ethereum : Buterin reveals major upcoming reforms

Cointribune•2026/01/18 10:30

Samsung set to hand out record bonuses as AI boom translates into profits

Cointelegraph•2026/01/18 10:21

Bitcoin Gains Traction As ETF Demand Surges

Cointribune•2026/01/18 10:15

Bank of England raises concerns as hedge fund positions in gilts reach £100 billion

101 finance•2026/01/18 10:06

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,091.8

-0.09%

Ethereum

ETH

$3,319.52

+0.71%

Tether USDt

USDT

$0.9996

+0.01%

BNB

BNB

$944.31

+0.27%

XRP

XRP

$2.05

-0.52%

Solana

SOL

$142.19

-1.52%

USDC

USDC

$0.9998

+0.01%

TRON

TRX

$0.3168

+1.66%

Dogecoin

DOGE

$0.1372

-0.31%

Cardano

ADA

$0.3933

-0.82%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now