Aster Price Jumps 16% in 24 Hours As Investors See Opportunity

Aster rallied 16% to $1.62 on strong investor inflows, but technicals show caution. Holding $1.58 or breaking $1.71 will decide if it advances toward its all-time high.

Aster has drawn investor attention with a sharp 16% rise in the last 24 hours, placing the altcoin at $1.62.

The sudden surge comes despite a directionless broader market, signaling that supportive buyers are stepping in to sustain momentum and potentially drive further price gains.

Aster Investors See Opportunity

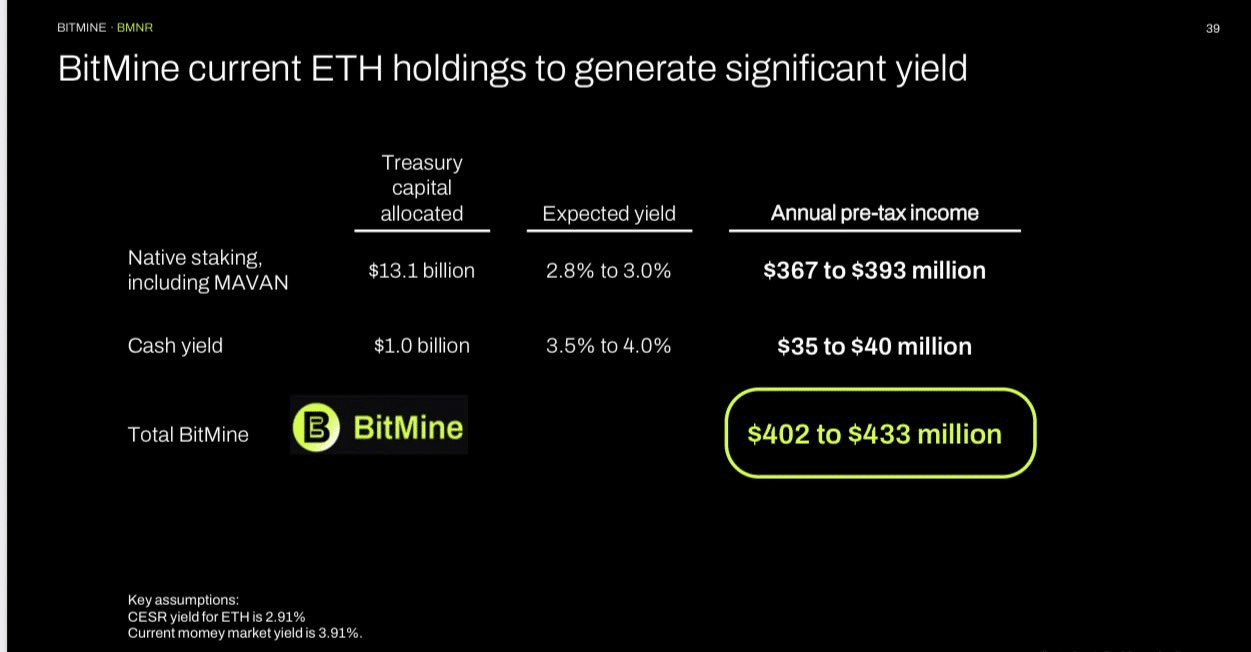

The Chaikin Money Flow (CMF) indicator highlights that Aster continues to record strong inflows even as most cryptocurrencies show declines. Sustained demand suggests that investors remain confident in the token’s potential, regardless of short-term volatility across the broader crypto market.

This investor conviction could prove pivotal for Aster. Consistent inflows often translate into price stability, and in this case, resilience against wider bearish pressures. If demand persists, the altcoin could maintain upward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

ASTER CMF. Source:

ASTER CMF. Source:

ASTER CMF. Source:

ASTER CMF. Source:

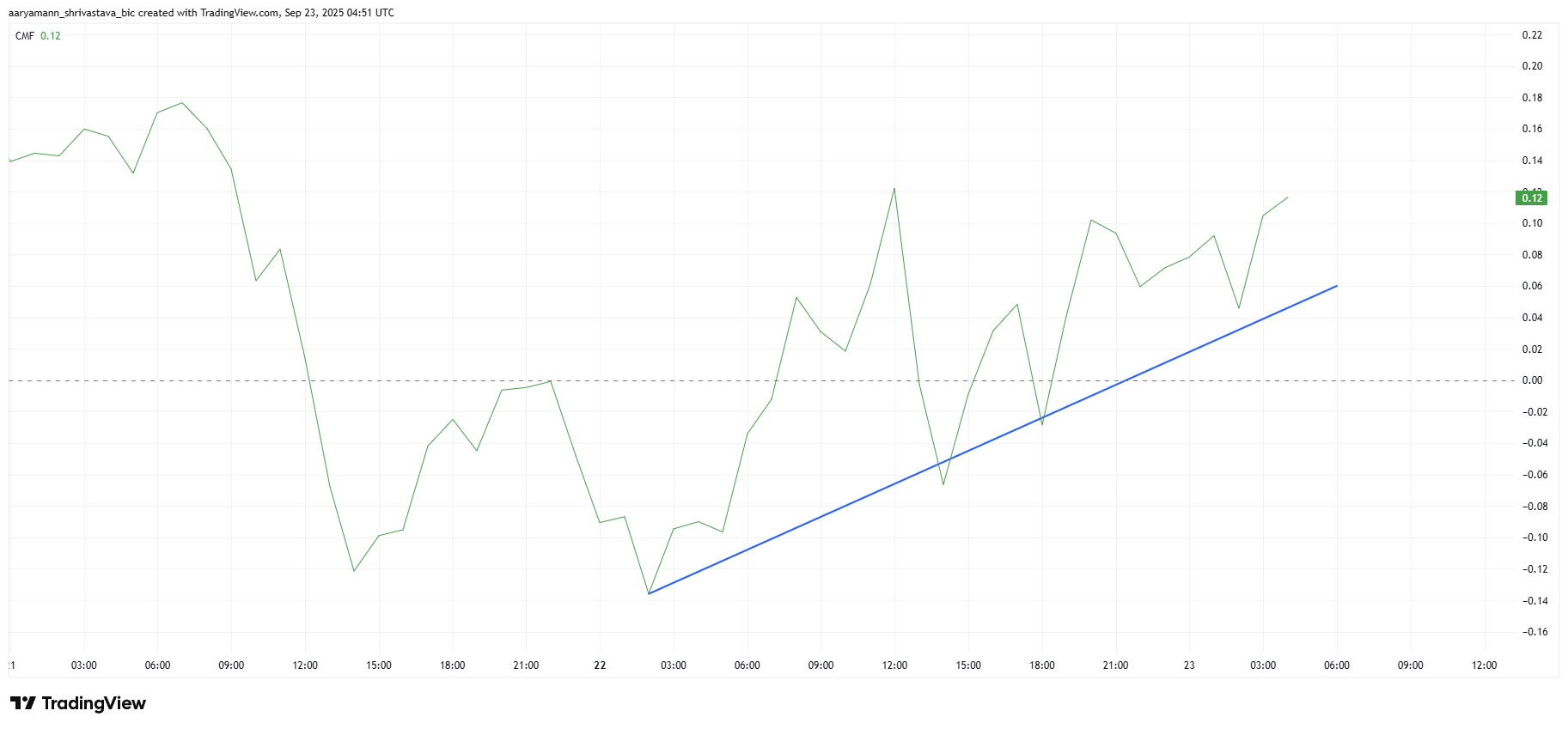

While inflows provide optimism, technical indicators like the Moving Average Convergence Divergence (MACD) paint a more cautious picture. The MACD shows limited support for a bullish continuation, with rapid shifts on the hourly chart highlighting market uncertainty.

This directionless behavior suggests that while Aster benefits from strong backing, it is still vulnerable to external conditions. Any sustained bearish market cues could offset inflows, leaving the altcoin exposed to declines.

ASTER MACD. Source:

ASTER MACD. Source:

ASTER MACD. Source:

ASTER MACD. Source:

ASTER Price May Bounce Back

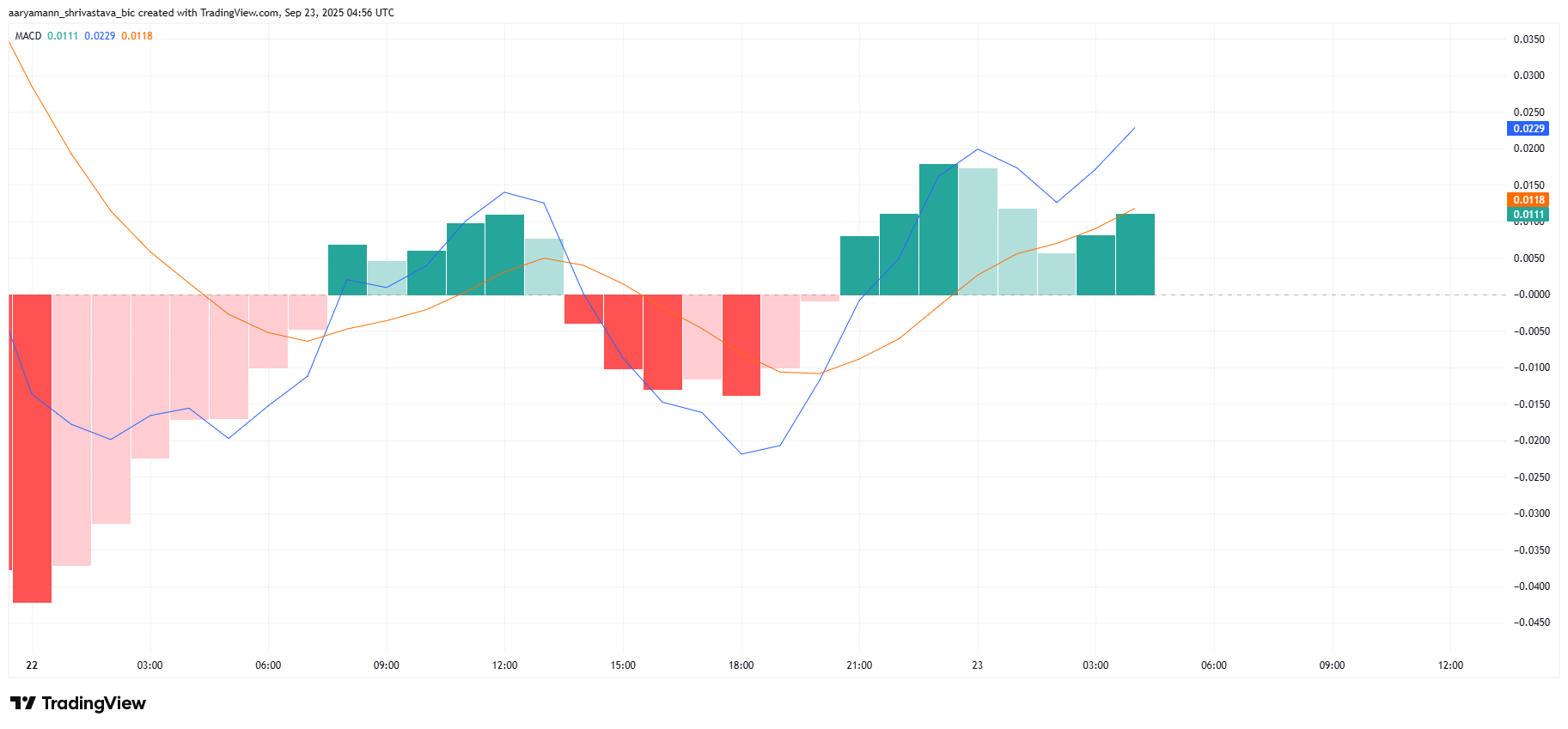

At the time of writing, Aster is priced at $1.62, holding firm above its $1.58 support. For now, the altcoin is likely to remain rangebound between $1.58 and $1.71 as it consolidates recent gains.

If the broader market turns favorable, Aster could breach $1.71 and move toward $1.87. Such momentum would bring the altcoin closer to retesting its all-time high of $1.99, a milestone last seen during peak bullish phases.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, downside risks remain. A break below $1.58 would signal weakening demand, potentially driving Aster down to $1.48. This scenario would invalidate the current bullish outlook, highlighting the importance of strong market support

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

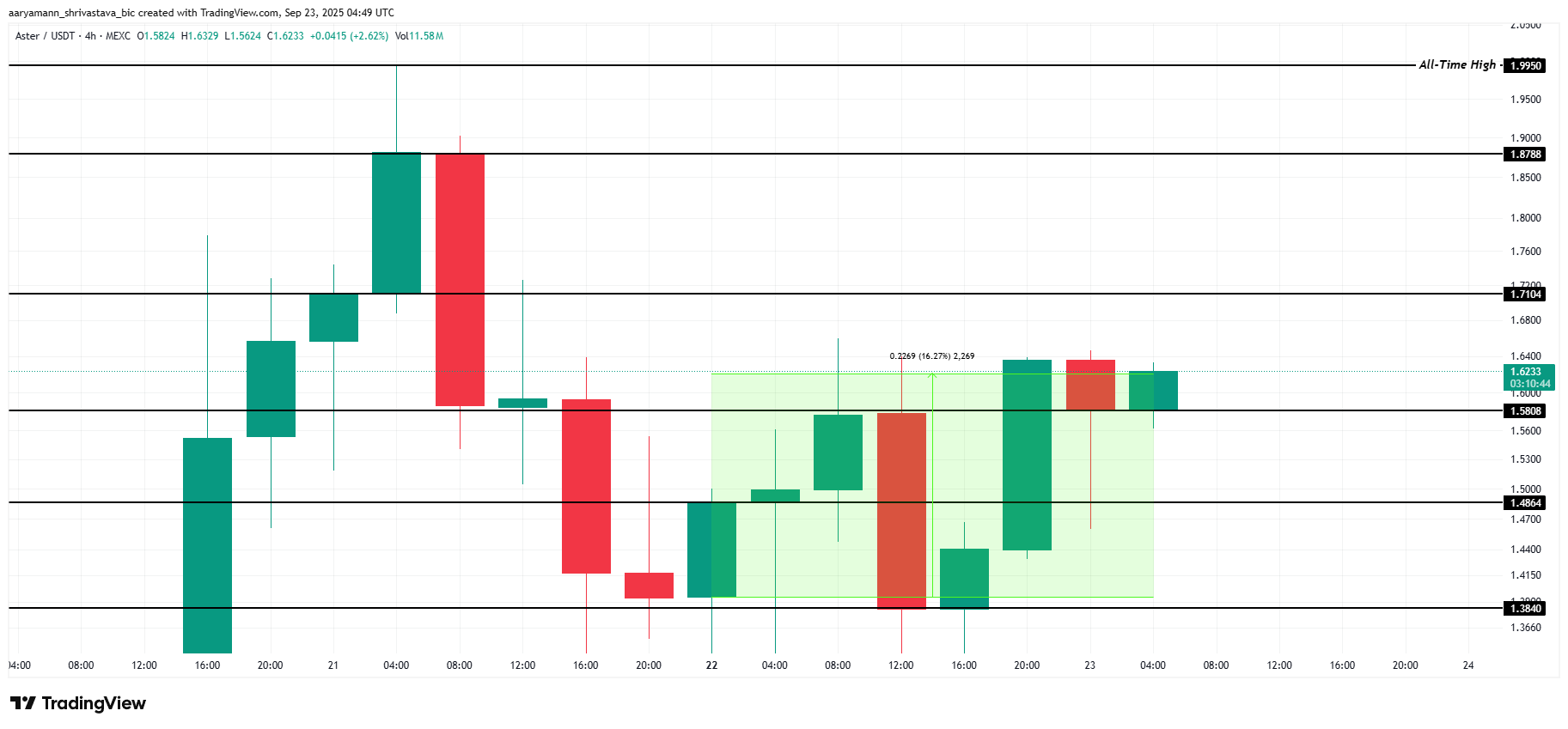

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense