Prenetics Boosts Bitcoin Holdings to 243.4 BTC, Ranks 78 on Corporate Bitcoin List

Prenetics $PRE is a publicly-traded medical company, which acquired 15.4 additional Bitcoin to reach a total of 243.4 BTC. Prenetics was ranked 78 on the Bitcoin 100 Ranking on September 29, 2025 according to an update announced by BitcoinTreasuries.NET. The Nasdaq billboard to welcome Prenetics was also present in the post.

JUST IN: Publicly traded healthcare company Prenetics $PRE buys 15.4 additional #Bitcoin and now holds a total of 243.4 BTC.

— BitcoinTreasuries.NET (@BTCtreasuries) September 29, 2025

🔸Bitcoin 100 Ranking: 78🪜🔸 pic.twitter.com/o0XoFRsYxC

Prenetics Company Overview

BitcoinTreasuries.NET uses corporate Bitcoin adoption. It provides news about the purchases, rankings and treasury policies. The account collects the information based on the disclosures of the population and company announcements. It educates investors and crypto fans regarding institutional Bitcoin action.

Prenetics Global Limited is a company dealing in health sciences and consumer healthcare. The company is listed on NASDAQ $PRE. It is based in Charlotte, North Carolina and operates in the global markets. Danny Yeung is the CEO and Co-Founder. Andy Cheung became a member of the board in 2025. Selling such brands as CircleDNA and IM8, Prenetics possesses.

Prenetics was the first in adopting Bitcoin treasuries in healthcare. It initially purchased 187.42 BTC in June of 2025 at approximately $20 million. The recent 15.4 BTC acquisition is an addition to its plan. The company now holds 243.4 BTC. Prenetics will involve the use of Bitcoin in payment, management of treasury, and solutions of data through blockchain. The treasury will be valued at about 15.8-17 million BTC at mid-2025 (between 65K and 70K).

Financial and Operational Context

On the financial front, Prenetics increased revenues in the first quarter of 2025 by 336.5 percent to $14.4 million without ACT Genomics. The company estimates a full year investment of between $80 and 100 million. It has recorded a loss of $20 million on revenue of 30 million but it is accruing Bitcoin. Adjusted EBITDA and non-IFRS indicators are indicative of its health of operations.

Bitcoin uptake in corporations is increasing. Prenetics is a company that competes with other companies such as MicroStrategy and Metaplanet. BitcoinTreasuries.NET has a list of more than 80 companies with a total of over 20,000 BTC. The move of Prenetics indicates entrance of healthcare and tech industries to crypto adoption. It is an indication of trust in Bitcoin as a long-term investment and store of value.

There was a mixed response in the community. Others exalted the astute hoarding. Others were concerned with timely matters and economic well-being. On the whole, Prenetics is a leader among the healthcare companies that have adopted Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP ETF Investments See $4 Billion Influx Amid Price Drop: Market Adjusts After Recent Surge

- Ripple's XRP ETFs see $128M inflows and regulatory approvals, but prices drop amid market correction. - XRPI and XRPR ETFs fall 8%, while XRPC ETF generates $58.5M in first-day trading, surpassing Solana's debut. - SEC approvals confirm XRP's commodity status, boosting institutional confidence as nine new XRP ETFs target $4B–$8B inflows. - Technical analysis shows XRP-USD above $2.00, with analysts projecting $2.50 by late 2025 if ETF AUM exceeds $8B.

San Francisco Hotel Promotions and Autonomous Taxis Indicate Economic Recovery

- San Francisco's hotel market shows recovery as Newbond and Conversant buy two iconic hotels for $408M, signaling investor confidence amid rising convention bookings. - Tech innovation accelerates with Amazon's Zoox launching free robotaxi trials, competing with Waymo and Tesla in autonomous vehicle testing. - Deutsche Bank raises capital via a 7.125% AT1 bond and revises ESG targets to include 900B€ in transition finance by 2030, reflecting industry decarbonization trends.

TWT's Revamped Tokenomics: Redefining Value for Holders and Ensuring Long-Term Project Viability

- TWT rebranded as Toncoin in 2025, shifting to gamified utility via Trust Premium, emphasizing user engagement and gas discounts. - A 2020 token burn reduced supply by 40%, but liquidity risks persist due to pre-burn circulation and centralized utility dependencies. - Lessons from TNSR's collapse highlight the need for decentralized use cases, as TWT's value relies on recurring incentives and cross-chain liquidity. - Analysts project TWT could reach $15 by 2030, contingent on sustained adoption and addres

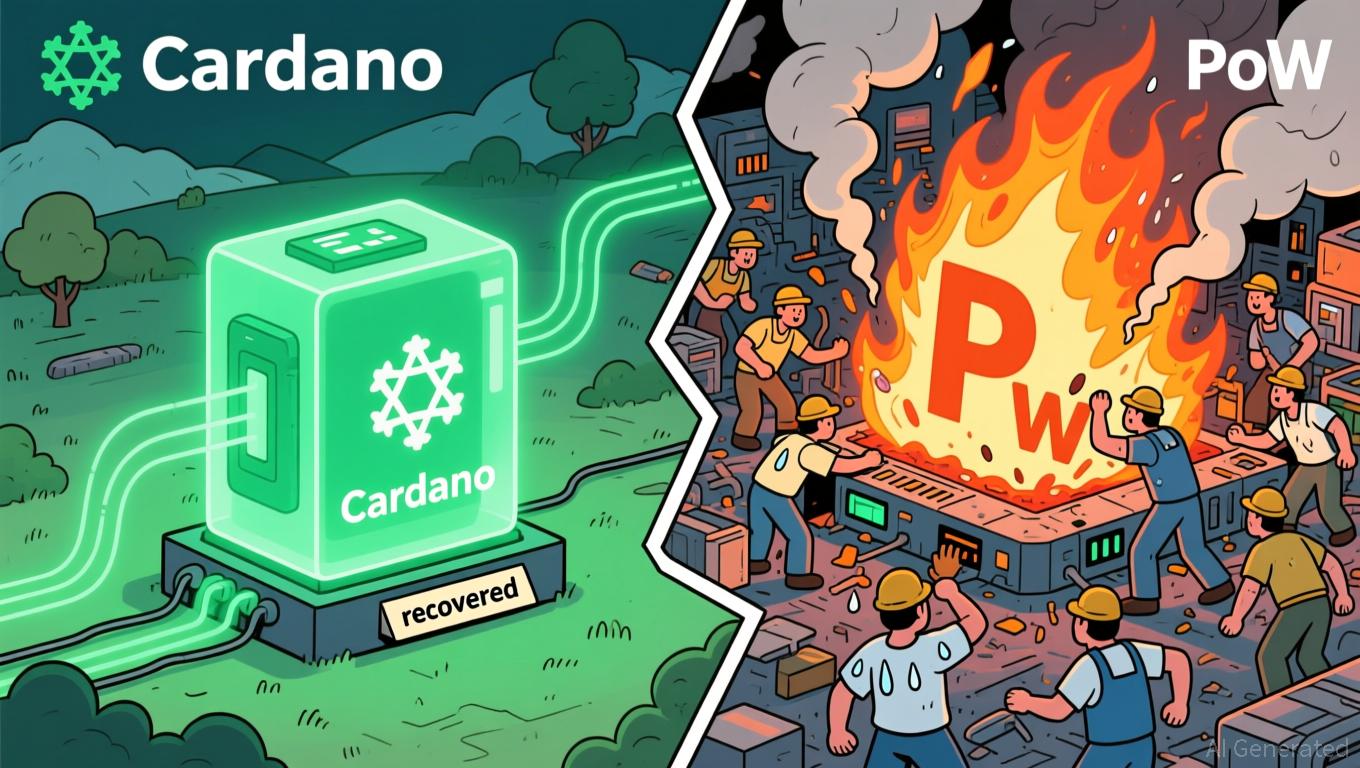

Cardano News Today: Blockchain Dispute: Should Those Responsible for Chain Splits Face Legal Action or Should Open-Source Creativity Be Safeguarded?

- Solana co-founder Anatoly Yakovenko praised Cardano's swift recovery from a November 2025 chain split, calling its resilience "pretty cool" despite a malicious transaction exploiting a deserialization bug. - Cardano's Ouroboros consensus model enabled rapid convergence without hard forks, preserving transaction throughput and avoiding fund losses through emergency node upgrades. - A public debate emerged between Yakovenko and Cardano founder Charles Hoskinson over legal accountability, with Hoskinson adv