Date: Thu, Oct 09, 2025 | 12:10 PM GMT

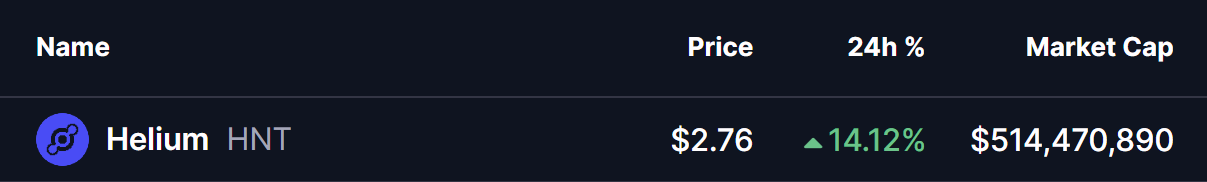

The cryptocurrency market is witnessing volatility today after an impressive rally that sent Bitcoin (BTC) to a new all-time high of $126,000 before correcting to around $123K. Ethereum (ETH) also slipped over 2%, adding mild pressure across major altcoins — except for the IoT-focused token Helium (HNT).

HNT has surged by an impressive 14% today, but more importantly, its latest technical structure is showing a potential bullish setup that could drive the price much higher in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Bullish “Adam and Eve” Pattern in Play

On the daily chart, HNT has formed a textbook bullish Adam and Eve double bottom pattern — a classic reversal setup often seen before major trend shifts from bearish to bullish.

This pattern began taking shape after HNT was rejected from the $4.23 resistance zone in late May 2025. The first sharp decline formed the V-shaped Adam bottom near $2.15, while the second decline was slower and more rounded — creating the Eve bottom around the same price range.

Helium (HNT) Daily Chart/Coinsprobe (Source: Tradingview)

Helium (HNT) Daily Chart/Coinsprobe (Source: Tradingview)

Since then, HNT has been steadily recovering, carving out the right side of the cup formation. Currently, the price has reached around $2.7621 and has reclaimed its 100-day moving average (MA) at $2.7395, which now acts as a strong support level for the next sessions.

What’s Next for HNT?

If this pattern continues to unfold and buyers manage to defend the 100-day MA, the next key target will be the 200-day MA at $3.0159.

A decisive move above this level could confirm the bullish momentum, paving the way for HNT to test its neckline resistance at $4.23 — a potential breakout zone that represents a 53% upside from the current price.

Such a breakout would officially validate the Adam and Eve reversal pattern and could mark the beginning of a stronger uptrend heading into Q4 2025.