While Government Stalls, the White House Plots Its Crypto Move? US Crypto News

As Washington’s shutdown drags on, the White House is reportedly moving to nominate SEC veteran Mike Selig to lead the CFTC—an appointment that could finally align U.S. crypto oversight and reshape digital asset policy.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee because as the US government grinds deeper into shutdown, whispers from the West Wing hint at a strategic crypto move that could quietly redraw the lines of power between the digital asset sector and America’s financial regulators.

Crypto News of the Day: Shutdown Deepens as White House Edges Toward Surprise Crypto Regulator Pick

The White House is reportedly nearly naming Mike Selig, Chief Counsel on the SEC’s Crypto Task Force, as its nominee to lead the CFTC (Commodity Futures Trading Commission). The move that could reshape US crypto regulation just as Washington teeters on the edge of a record-breaking government shutdown.

Two people familiar with the matter told Crypto In America that Selig remains the top contender to replace contentious and former CFTC Chair Brian Quintenz, with formal vetting underway for additional commissioner roles.

The administration aims to rebuild the five-member CFTC and unify oversight between the SEC and CFTC amid intensifying calls for a cohesive digital asset framework.

“No one is better suited than Mike Selig to harmonize the CFTC and SEC on crypto and beyond,” said Stu Alderoty, Chief Legal Officer at Ripple.

Indeed, Selig may understand both sides of the regulatory fence and, with his background spanning both agencies, could finally reduce duplicative oversight.

A former CFTC clerk for Chris Giancarlo and advisor to SEC Chair Paul Atkins, he later served in private practice at Perkins Coie and Willkie Farr & Gallagher, advising on blockchain and token regulation.

Therefore, his nomination could pass as a crypto-positive signal, bridging the deep policy rift that has paralyzed the industry’s US growth.

“Glad to see the (hopefully) newly appointed CFTC is liked by those who are working for blockchain interoperability,” one user remarked.

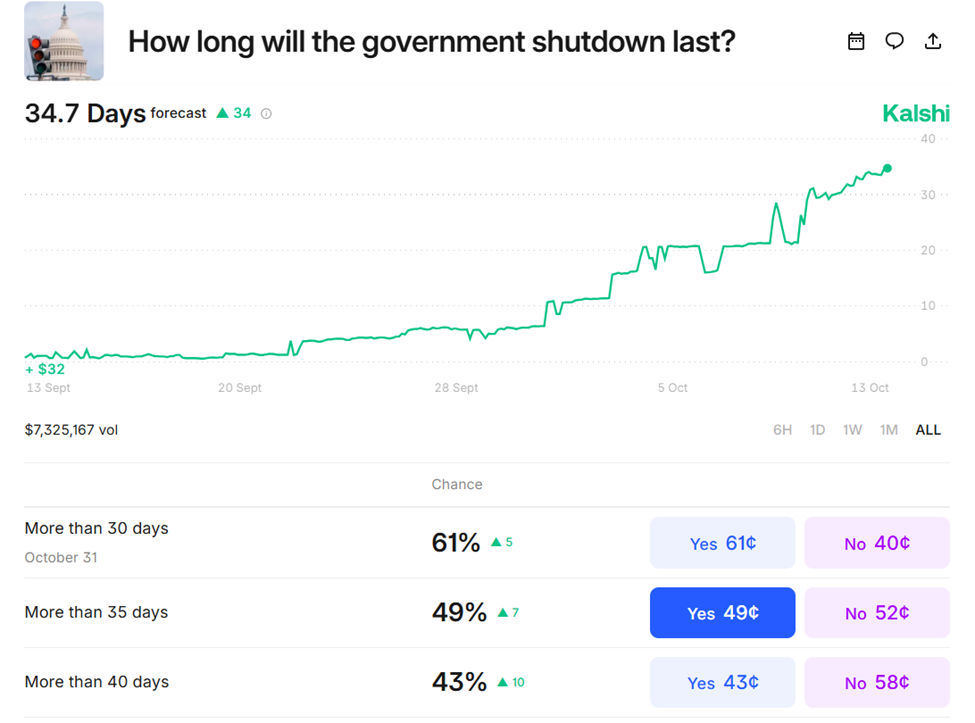

Kalshi Predicts Record-Long US Shutdown

Meanwhile, the potential nomination lands at a tense political moment. Kalshi prediction markets now price the shutdown lasting 34.7 days, signaling what could become the longest in US history.

The extended standoff has already halted policy momentum, delaying progress on key crypto and macro market updates.

Meanwhile, the third week of the shutdown has seen negotiations collapse over military pay and healthcare subsidies, and crypto markets rebounded modestly after last week’s derivatives-led selloff. Still, the longer Washington remains frozen, the greater the risk of delayed CFTC enforcement guidance, ETF reviews, and data releases critical for institutional traders.

Two forces are therefore at play. On the one hand, Congress is deadlocked on the market structure bill. On the other hand, Kalshi forecasts the shutdown extending beyond 35 days.

Against these backdrops, all eyes are on whether the administration can push Selig’s nomination through a paralyzed government, or whether crypto’s next regulatory chapter will remain on pause until Washington reopens for business.

Chart of the Day

US Government Shutdown Duration Probabilities. Source:

Kalshi

US Government Shutdown Duration Probabilities. Source:

Kalshi

According to Kalshi prediction markets, there’s a 61% chance the shutdown lasts over 30 days and a 49% likelihood it will extend beyond 35.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- 35% XRP price rally? One metric says “yes”, another says “wait”

- Coinbase–Kimchi signal just flashed again — What does it mean for Bitcoin?

- Ethereum price could rise and fall to these levels before its next rally.

- Grayscale’s move could send this altcoin to a new ATH.

- What are crypto whales betting on after Trump’s tariff-induced market crash?

- Bitcoin price nears $115,000 as spot investors defy market fear.

- Four US macro data points to watch this week after the weekend market crash.

- Top three crypto airdrops and rewards to watch in the third week of October.

- Bulls flock to BNB as a Chinese bank mulls $600 million investment in the Binance token.

Crypto Equities Pre-Market Overview

| Company | At the Close of October 10 | Pre-Market Overview |

| Strategy (MSTR) | $304.79 | $308.00 (+1.05%) |

| Coinbase (COIN) | $357.01 | $363.36 (+1.78%) |

| Galaxy Digital Holdings (GLXY) | $39.38 | $40.20 (+2.08%) |

| MARA Holdings (MARA) | $18.64 | $19.19 (+2.98%) |

| Riot Platforms (RIOT) | $21.01 | $21.58 (+2.71%) |

| Core Scientific (CORZ) | $18.52 | $18.97 (+2.43%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Borrowing short to repay long: The Bank of England and the Bank of Japan lead the shift from long-term bonds to high-frequency "interest rate gambling"

If expectations are not met, the government will face risks of uncontrollable costs and fiscal sustainability due to frequent rollovers.

How do 8 top investment banks view 2026? Gemini has summarized the key points for you

2026 will not be a year suitable for passive investing; instead, it will belong to investors who are skilled at interpreting market signals.

Valuation Soars to 11 Billions: How Is Kalshi Defying Regulatory Pressure to Surge Ahead?

While Kalshi faces lawsuits and regulatory classification as gambling in multiple states, its trading volume is surging and its valuation has soared to 11 billion dollars, revealing the structural contradictions of prediction markets rapidly growing in the legal gray areas of the United States.

How will the Federal Reserve in 2026 impact the crypto industry?

Shifting from the technocratic caution of the Powell era, the policy framework is moving towards a more explicit goal of reducing borrowing costs and serving the president's economic agenda.