Key Market Information Discrepancy on October 21st, A Must-See! | Alpha Morning Post

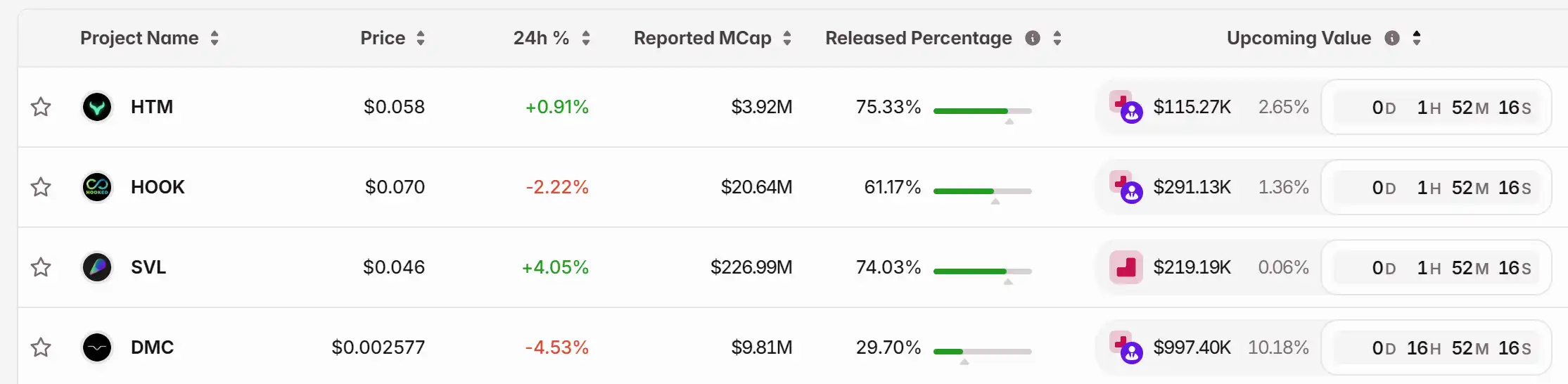

1. Top News: Meme Coin "Base Life" on the Rise on Base Protocol, Market Cap Surpasses $9 Million, Spiking 300% in 1 Hour 2. Token Unlock: $HTM, $HOOK, $SVL, $DMC

Top News

1. Base's Meme Coin "Base Life" Market Cap Surges Past $9 Million, Up 300% in 1 Hour

2. Chinese Meme Coins on BSC Continue Bullish Trend, "Binance Life" Surges Over 150% in 24 Hours

3. US Stock Crypto Concept Stocks See Green at Open, MSTR Up 3.78%, BMNR Up 5.74%

4. US Stock Market Closes with All Three Major Indexes Up Over 1%

5. Blockchain.com Seeks SPAC Listing, Hires Financial Advisor

Articles & Threads

1. "When a Foreigner Starts Learning Chinese to Trade Cryptocurrency"

"Binance Life" has finally become the first Chinese coin to be listed on Binance perpetual contracts. If you are a Chinese cryptocurrency enthusiast, you could not have missed this word in the past two weeks. Since the birth of this 'ticker,' it has been both a joke and a vision. CZ himself said he didn't expect that just a simple reply would lead to this series of events."

2. "Six Major AIs Enter Crypto Trading Competition: Who Will Make the Most Money?"

In the world of cryptocurrency, human traders are often plagued by emotions and information asymmetry. But what would happen if AI models were in charge? Currently, the competition is still ongoing. Whether Deepseek can maintain its top position in unrealized gains or if Gemini can stage a comeback remains to be seen. Nof1 founder Jay stated that the next season of the competition will introduce live traders and internally developed models.

Market Data

Daily Market-wide Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Investor’s $33M ETH Wager Withstands $1.1B Liquidation Surge While Crypto Markets Approach Bearish Levels

- A top crypto trader liquidated $7. 3M before re-entering with a $33M ETH long amid $1.1B market-wide liquidations on Nov 14, 2025. - Long positions suffered 973M losses vs 131M short liquidations, with a $44.29M BTC-USDT position marking extreme leverage use. - Bitcoin's RSI hit "massively oversold" levels and fell below its 3-year volatility band, echoing 2022 FTX-era market stress. - The crisis reignited debates over leveraged trading risks, with 246,000 traders forced to exit positions during the shar

Tokenizing Development: Trump’s Hotel Sets a New Standard for Luxury Real Estate Investment

- Trump Organization partners with Dar Global to launch world's first tokenized hotel in the Maldives, blending luxury real estate with blockchain technology. - The project tokenizes construction-phase investments, offering fractional ownership in 80 ultra-luxury villas before completion, unlike traditional post-construction models. - Eric Trump highlights the venture as a "benchmark" for redefining real estate investment, aligning with the Trump family's expanding crypto-friendly business strategy. - Mark

Fed Weighs Job Growth Against Inflation Concerns in 2026 Interest Rate Decisions

- The Fed plans two 2026 rate cuts amid weak labor markets and stubborn inflation, balancing job support with inflation risks. - Internal FOMC divisions persist, with Vice Chair Jefferson advocating caution and Governor Waller pushing for aggressive cuts, while Trump’s appointee Miran amplifies easing pressure. - Incomplete data from a government shutdown complicates decisions, and market expectations for a December cut dropped to 42.9% amid inflation concerns. - J.P. Morgan urges diversification to hedge

Bitcoin News Update: The Cryptocurrency Market's Ongoing Struggle: Careful Hopefulness Against Persistent Threats

- Crypto market shows stabilization as funding rates on major exchanges return to neutrality after overselling, per Coinglass data. - Bitcoin's 14-day RSI dipped below 30 (oversold level) on Nov 18, suggesting potential short-term rebound despite analysts' caution. - Institutional interest grows with Ark Invest adding $10.2M in Bullish shares, while Hyperliquid (HYPE) shows on-chain resilience. - Macroeconomic risks persist, including U.S. government shutdown impacts and stalled ETF inflows, keeping $95,00