Key Notes

- The protocol could repurchase up to 5% of total supply annually at current prices, creating sustained buying pressure.

- Historical DeFi buyback announcements show tokens outperform by 13.9% on average following such decisions.

- MegaVault's negative 16.7% returns prompted the reallocation, with 59.38% community approval backing the strategic shift.

The DYDX community has passed a governance vote to redirect most protocol revenue toward buying back DYDX tokens. Starting on Nov. 13, 2025, 75% of fees will fund open-market repurchases, up from the 25% set earlier in 2025.

Based on a report from Nethermind Research posted on the dYdX governance forum, the move aims to create buying pressure and address token price weakness. Nethermind, which received a grant from dYdX to analyze incentives, pointed to MegaVault’s poor performance—delivering negative 16.7% annualized returns without incentives—as a reason to reallocate funds.

“At present prices, the protocol could repurchase up to 5% of total supply annually. Historical analysis of DeFi protocols buyback announcements shows market-positive reception, with tokens outperforming 13.9% on average post-announcement,” Nethermind Research argued. “Tripling buyback allocation from 25% to 75% would strengthen tokenomics while signaling confidence to the market.”

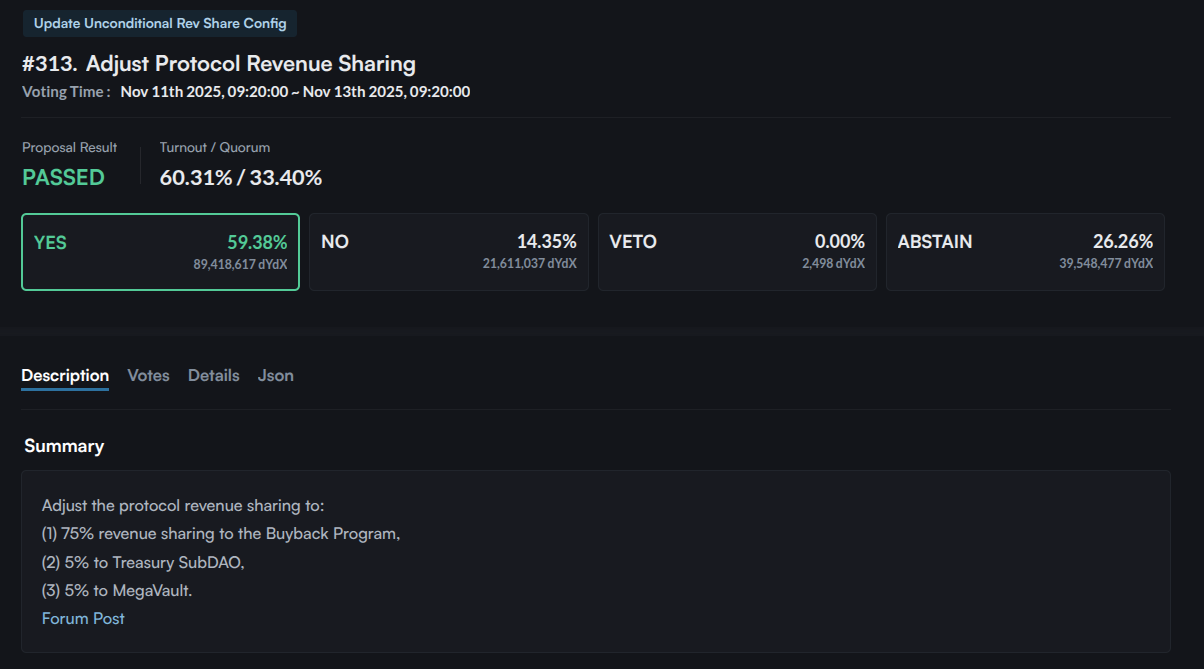

The vote, detailed on Mintscan , saw 59.38% approval with over 89 million DYDX tokens in favor and lasted from Nov. 11 to Nov. 13.

DYDX proposal #313: Adjust protocol revenue sharing | Source: mintscan.io

Full proposal discussions occurred on the dYdX forum since Oct. 30, where Nethermind outlined how tripling buybacks could lead to positive market reactions, drawing from historical DeFi examples that averaged 13.9% token gains post-announcement.

One question, however, remains unanswered: will the buyback tokens be burned or kept in some treasury account?

will you burn it after buybacks ???

— Ar$ (@universgroup13) November 13, 2025

DYDX Experimental Buybacks and Uniswap’s Fee Switch

This approval follows dYdX’s three-month experimental buyback plan announced on Oct. 29, reported by Coinspeaker , which aimed to test treasury-funded repurchases to support token value.

Other DeFi projects have pursued similar strategies, like ether.fi’s $50 million community buyback proposal and Aave’s ongoing $1 million weekly program launched on April 18.

All these activities echo recent shifts in the sector, such as Uniswap UNIfication proposal sparking a 30% UNI UNI $7.50 24h volatility: 1.3% Market cap: $4.72 B Vol. 24h: $998.57 M rally, also covered by Coinspeaker earlier in November, which activates a fee switch for holder rewards.

Today, I’m incredibly excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @nkennethk

This proposal turns on protocol fees and aligns incentives across the Uniswap ecosystem

Uniswap has been my passion and singular focus for… pic.twitter.com/Ee9bKDric5

— Hayden Adams 🦄 (@haydenzadams) November 10, 2025

As of this writing, DYDX DYDX $0.29 24h volatility: 6.1% Market cap: $231.34 M Vol. 24h: $23.49 M trades at $0.32, down 75% year-over-year but up 4% in the last 24 hours, according to CoinMarketCap data.

DYDX price | Source: CoinMarketCap

Analysts note the buyback could ease the supply pressure from the token’s inflation if protocol revenue holds around $20 million annually, which could contribute to a comeback and token recovery in the following months.

next