1inch launches Aqua: The First Shared Liquidity Protocol, Now Available for Developers

1inch, the leading DeFi ecosystem, announces the developer release of Aqua, a revolutionary liquidity layer built to transform how capital and yield strategies operate in DeFi. Aqua marks the beginning of a new era of shared liquidity and unlimited capital efficiency. It creates a multiplier effect for liquidity by allowing multiple strategies to access a

1inch, the leading DeFi ecosystem, announces the developer release of Aqua, a revolutionary liquidity layer built to transform how capital and yield strategies operate in DeFi. Aqua marks the beginning of a new era of shared liquidity and unlimited capital efficiency. It creates a multiplier effect for liquidity by allowing multiple strategies to access a user’s balance simultaneously, without requiring funds to be removed from users wallets and locked in smart contracts.

Start building for the next era in DeFi

Aqua’s frontend is set to be released in Q1 2026. But 1inch is opening access to Web3 devs on GitHub now, so they can:

- Explore, optimize, verify. With the Aqua SDK, libraries and full documentation, implementation is easy – so builders can focus on exploring the potential of this new approach.

- Build from scratch or plug-and-play. Aqua is ready for developers to build and test new approaches from scratch – or they can use the SwapVM partner protocol to assemble strategies from our library of instructions.

- Help shape the product. 1inch is offering contribution and bug discovery bounties of up to $100,000

Unlock DeFi liquidity

Funds locked in old-style pools are restricted to single strategies. Liquidity providers face tough decisions on where to commit, facing opportunity cost and inefficiency whatever choice they make. So until now, strategies and protocols have been forced to compete for TVL.

Aqua changes that, turning each wallet into a self-custodial AMM that applies multiple strategies to the same assets. Each strategy accesses liquidity based on its own rules and conditions, and anyone can interact with it to execute an atomic swap according to those rules. The result: the same capital can power multiple strategies at once.

These are the main benefits Aqua is offering users:

- Shared liquidity, not competition for it. Different strategies can access the same tokens. Liquidity providers no longer need to split or lock funds across pools.

- Deeper liquidity across the ecosystem. Shared liquidity means better availability for all networks, meaning that even smaller projects will be able to reliably support larger and more efficient transactions.

- Unlimited capital efficiency. Multiple strategies can run off a single asset. Capital no longer fragments. Instead, it compounds efficiency and boosts returns.

- True self-custody. Your assets always stay under your control. Strategies pull and return assets instantly. Custodial setups are possible, but self-custody remains Aqua’s core advantage.

- Developer simplicity. No more deposit, withdrawal, or pooling logic. Developers simply query Aqua for balances and build products on top, rather than managing funds directly.

The developer release: build on Aqua early

The Aqua developer release invites builders to experiment, integrate and push the limits of what’s possible. They can create their own products on Aqua, test performance, submit improvements and help shape the next generation of DeFi liquidity. Simultaneously, 1inch is launching a bounty program for contributors who help to optimize the Aqua protocols.

“Aqua solves liquidity fragmentation for market makers by multiplying effective capital. From now on, the only limit to your capital efficiency is your strategy.” said Anton Bukov, 1inch co-founder. “Building AMM strategies for Aqua is the hottest opportunity in DeFi today. It’s time to help liquidity providers unleash their potential.”

“Aqua is not just another protocol. It’s the foundation for scalable, capital-efficient DeFi,” said Sergej Kunz, 1inch co-founder. “Just as we did in 2019 with our aggregation protocol, Aqua is set to revolutionize DeFi. With Aqua, 1inch is once again giving users back the power, empowering them to manage and optimize liquidity on their own terms.”

About 1inch

1inch accelerates decentralized finance with a seamless crypto trading experience for 26M users. Beyond being the top platform for low-cost, efficient token swaps with $500M+ in daily trades, 1inch offers a range of innovative tools, including a secure self-custodial wallet, a portfolio tracker for managing digital assets, a dedicated business portal giving access to its cutting-edge technology, and even a debit card for easy crypto spending. By continuously innovating, 1inch is simplifying DeFi for everyone. Website | 1inch Business

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Following Bitcoin’s Underperformance, ARK Invest Releases New BTC Price Forecast

AUD/JPY Price Forecast: Constructive outlook prevails, first upside barrier emerges near 106.50

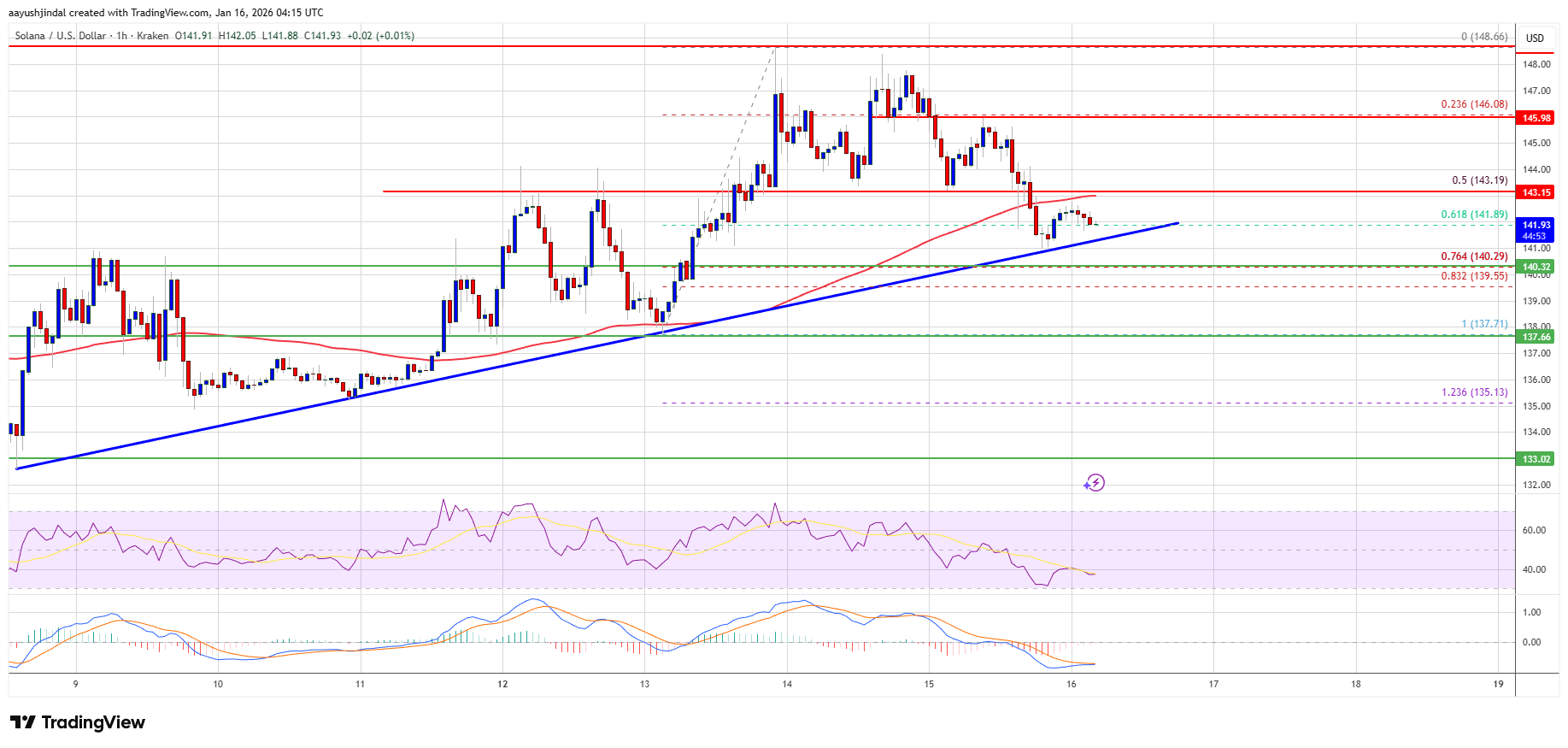

Solana (SOL) Slips Back to Support, Setting Up a High-Tension Test

Ethereum Staking Hits Record Levels As Buterin Urges Builders To Deliver Real Apps