Solana crypto forecasting: is SOL nearing a tactical bottom?

Summary

- Summary

- Solana crypto forecasting: Market Context and Direction

- Technical Outlook: reading the overall setup

- Intraday Perspective and SOLUSDT token Momentum

- Key Levels and Market Reactions

- Future Scenarios and Investment Outlook

Summary

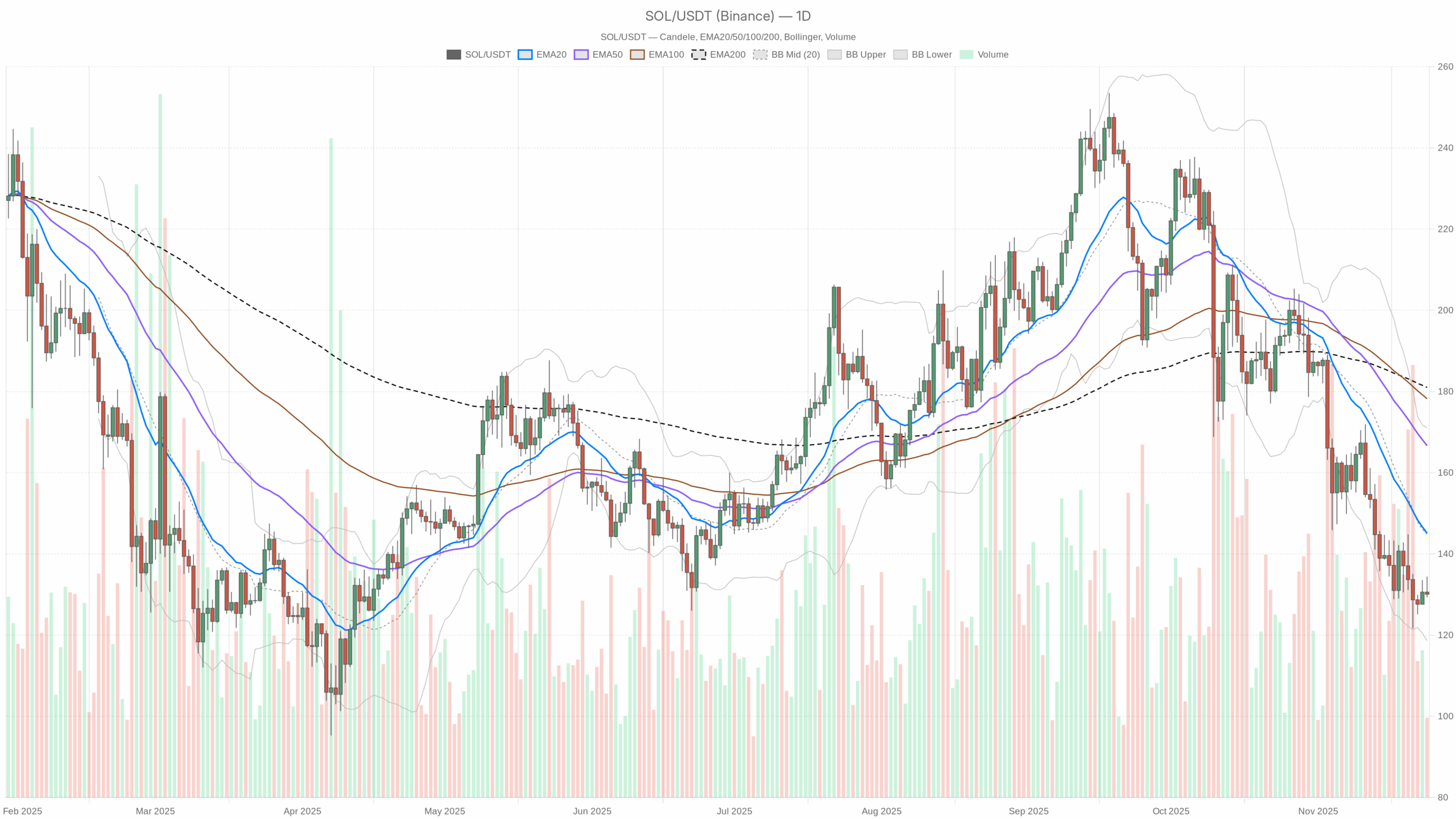

The daily chart shows a clear bearish regime, with price around 130 USDT and trading well below the 20, 50 and 200-day EMAs. Momentum is weak, as the daily RSI hovers near 33, close to oversold but not yet washed out. However, the MACD histogram has almost flatlined, suggesting downside momentum is losing strength. Bollinger Bands are wide and price sits in the lower half, pointing to elevated but decelerating volatility. Moreover, the broader crypto market is modestly positive on the day, which contrasts with the token’s underperformance. With the Fear & Greed Index at 19 (Extreme Fear), sentiment is clearly stressed, yet that has historically paved the way for sharp mean-reversion rallies.

Solana crypto forecasting: Market Context and Direction

The backdrop for this move matters. Total crypto market capitalization stands near 3.04 trillion dollars, up about 0.6% over the last 24 hours. That means the broader market is grinding higher even as this asset remains under pressure, a sign of relative weakness versus the aggregate crypto complex. Bitcoin dominance sits just under 57%, confirming that liquidity and risk appetite are still concentrated in the benchmark coin rather than in altcoins.

Moreover, the Fear & Greed Index at 19 signals Extreme Fear. Historically, such readings often coincide with late stages of a selloff, when forced sellers dominate. That said, extreme fear can persist, so it is better seen as a contrarian tailwind rather than a precise timing tool. In contrast to the gloomy sentiment, Solana ecosystem activity remains vibrant: Raydium, Orca, HumidiFi and other Solana-based DeFi venues are still generating substantial fee volumes. This combination of fearful prices and resilient usage hints at an environment where medium-term accumulation may quietly be building, even if the short-term chart looks heavy.

Technical Outlook: reading the overall setup

On the daily timeframe, the token closes near 130.06 USDT. The 20-day EMA around 145.08, the 50-day near 166.65 and the 200-day at 181.01 are all clearly above spot and stacked bearishly (short below long). This configuration confirms a well-established downside trend where rallies so far have been sold rather than bought.

The daily RSI at 32.91 paints a picture of weak momentum but not yet classic capitulation. It implies that sellers remain in control, yet each additional leg lower provides diminishing incremental energy. Meanwhile, the MACD line at -13.57 is slightly above its signal at -13.62, with a marginally positive histogram of 0.05. That tiny cross hints at momentum exhaustion rather than fresh aggressive selling, consistent with a maturing downtrend rather than its early phase.

Bollinger Bands on the daily chart, centered near 144.85 with the lower band around 118.64 and the upper near 171.07, are still relatively wide. Price is trading closer to the lower band, which usually reflects pressure within a volatility expansion following a prior decline. However, the fact that candles are no longer hugging the extreme of the band suggests the move may be shifting from acceleration to consolidation. The ATR at 10.86 confirms that dollar swings remain large; yet when ATR stops rising after a strong drop, it often marks a transition toward a quieter, range-bound environment.

Intraday Perspective and SOLUSDT token Momentum

On the 1-hour chart, the picture is less bearish. Price around 129.97 USDT sits just below the 20-period EMA at 131.34, roughly in line with the 50-period at 130.7, and slightly under the 200-period at 134.91. This clustering of moving averages, combined with a neutral regime tag, suggests short-term consolidation after the previous selloff. As a result, intraday traders are seeing a more balanced tug-of-war between buyers and sellers.

The hourly RSI at 45.25 is neutral, implying that neither side has a clear edge over the very short term. Meanwhile, the hourly MACD line (0.3) is below its signal (0.65) and the histogram is modestly negative, pointing to a mild downside bias rather than a strong push. On the 15-minute chart, RSI dips to about 39.5 and MACD is negative, indicating that fast money remains slightly tilted to the sell side. Nevertheless, both intraday regimes are labeled neutral, reinforcing the idea that the dominant trend is on the daily timeframe, while shorter horizons are trying to stabilize after the fall.

Key Levels and Market Reactions

Daily pivot levels help frame where the next battle could take place. The main pivot point on the daily chart sits around 131.26 USDT, just above current prices. A sustained recovery above that zone would indicate buyers slowly regaining control and might open the door toward the nearby resistance area around 133.2. Conversely, failure to reclaim the pivot and a slip back through the 128 region, aligned with the first daily support, would confirm that sellers still dominate reactions to every bounce.

Bollinger support near 118.64 marks a critical downside reference. A decisive break and daily close below that band would signal a fresh downside breakout with renewed volatility, potentially triggering stop cascades. On the upside, the 20-day EMA near 145 USDT is the first real structural hurdle; if price were to reclaim and hold above that moving average, it would be the earliest sign that the current bearish regime is giving way to a more constructive phase.

Future Scenarios and Investment Outlook

Overall, the base case remains a bearish but aging downtrend on the daily chart, set against a crypto market that is still broadly resilient. Extreme fear, weakening downside momentum on MACD, and neutral intraday structures all argue for a growing probability of a relief rally in the coming sessions. However, as long as price trades beneath the 20-day EMA and fails to establish higher highs above short-term resistance zones, any bounce should be treated as a counter-trend move within a still-fragile structure.

For active traders, that means focusing on reaction areas: keeping an eye on how price behaves around the daily pivot near 131, the support band down toward 118, and the resistance cluster around 145. For longer-term participants, the combination of extreme sentiment and solid underlying network activity suggests that gradual accumulation with strict risk management may offer a balanced approach, acknowledging both the downside risk of a deeper correction and the upside potential if the broader market rotation eventually favors high-beta layer-1 assets again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Accelerated Pathways Help Close the Gap Between ACS Guidelines and Actual Clinical Practice

- A Hunan hospital study found fast-track pathways for ACS patients reduced treatment delays and MACE without increased bleeding risk. - The protocol cut median door-to-ECG time by 50% and door-to-balloon time for STEMI patients to 68 minutes, improving guideline adherence. - In-hospital MACE rates dropped from 11.6% to 6.6%, with 30-day composite outcomes improving from 13.9% to 8.7% under fast-track care. - Researchers emphasized the pathway's applicability across all ACS subtypes and potential system ef

Crypto Supporters Rally Ahead of 2026 Midterm Elections to Influence a Congress Favoring Innovation

- Stand With Crypto, backed by Coinbase , launched a 2026 midterm campaign to evaluate candidates' digital asset policies, focusing on innovation, de-banking, and regulation. - The group aims to influence Congress to prioritize pro-crypto policies, leveraging prior success in mobilizing voters and tracking 274 "pro-crypto" elected officials in 2024. - SEC's 2026 regulatory shift to information security and delayed digital asset legislation create uncertainty, while Trump's political strategies intersect wi

Ethereum News Update: While Ethereum Declines, DeFi's Mutuum Rises Amid Presale Boom

- Ethereum (ETH) fell below $2,800 on Nov 24, 2025, amid crypto market turmoil driven by rising Japanese bond yields and algorithmic sell-offs. - DeFi project Mutuum Finance (MUTM) raised $18.9M in its presale, with Phase 6 nearing 90% sales at $0.035 per token before a 20% price increase. - Mutuum's dual-lending model and automated interest systems differentiate it, while Ethereum ETFs saw $465M outflows despite institutional Bitcoin/Ethereum deposits. - The project's presale growth remains resilient amid

XRP News Update: Franklin XRP ETF: $1.69 Trillion Titan Signals Crypto Market Evolution

- Franklin Templeton launches XRPZ ETF, first regulated XRP fund on NYSE Arca, reflecting institutional crypto adoption. - SEC's 2025 Ripple settlement cleared XRP's regulatory status, enabling $125M-payout-driven investment products like XRPZ. - XRPZ joins competitive ETF landscape (Bitwise, Grayscale) amid mixed market signals: $2.11 price rebound vs. 200M XRP whale sales. - Franklin's $1.69T AUM entry underscores crypto market maturation, with XRP positioned as foundational asset for cross-border paymen