Accelerated Pathways Help Close the Gap Between ACS Guidelines and Actual Clinical Practice

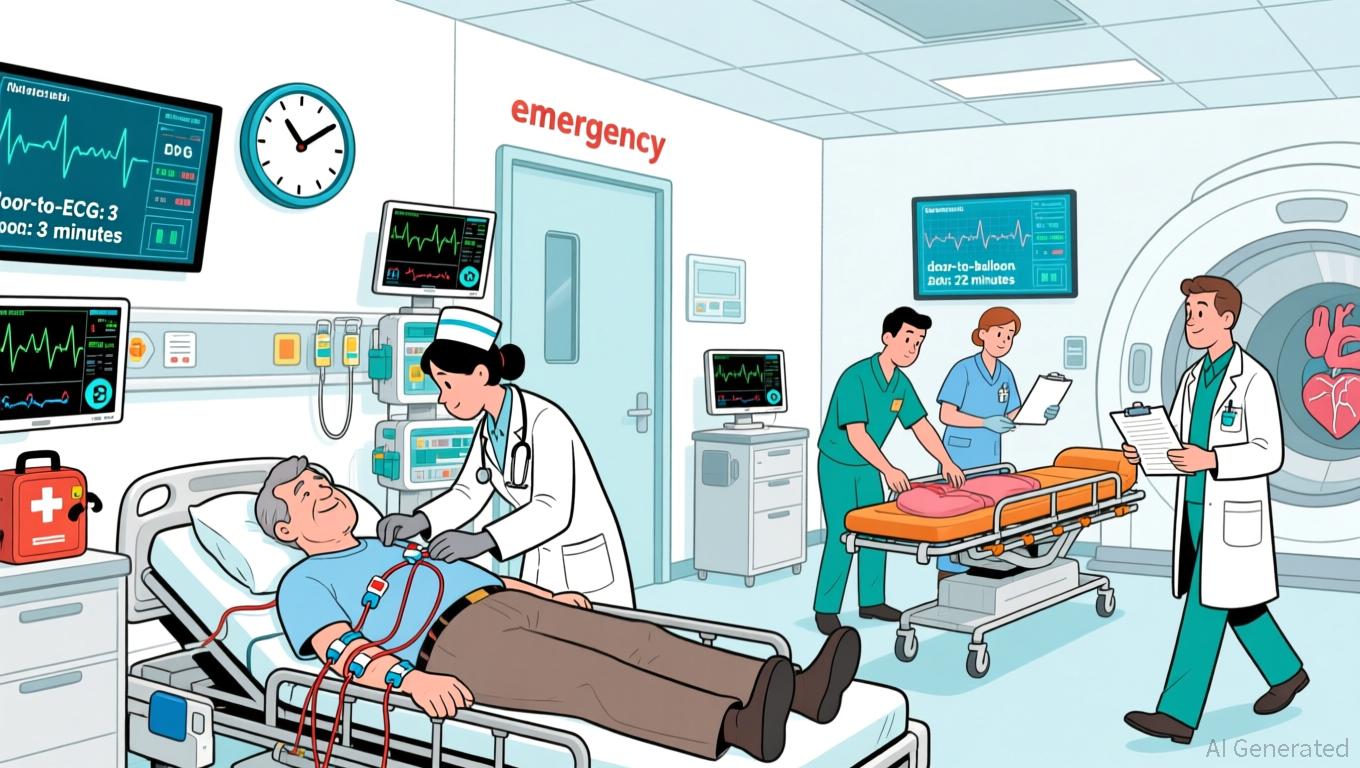

- A Hunan hospital study found fast-track pathways for ACS patients reduced treatment delays and MACE without increased bleeding risk. - The protocol cut median door-to-ECG time by 50% and door-to-balloon time for STEMI patients to 68 minutes, improving guideline adherence. - In-hospital MACE rates dropped from 11.6% to 6.6%, with 30-day composite outcomes improving from 13.9% to 8.7% under fast-track care. - Researchers emphasized the pathway's applicability across all ACS subtypes and potential system ef

A recent prospective cohort investigation has found that implementing emergency fast-track protocols for acute coronary syndrome (ACS) patients leads to notably better clinical results, including shorter treatment times and fewer major adverse cardiovascular events (MACE), all without raising the risk of bleeding. The research, carried out at The Second People's Hospital of Hunan Province, assessed 870 individuals with ACS between January 2022 and December 2023. Of these, 438 were treated using a dedicated fast-track system, while 432 received standard care. The main outcomes showed that the fast-track model

The research,

The authors emphasized the study’s strong methodology, which used propensity score–based inverse probability of treatment weighting to address confounding factors. They also noted the protocol’s broad scope, as it covers all ACS types—including STEMI, NSTEMI, and unstable angina—rather than focusing solely on STEMI. This inclusive design enhances its relevance for emergency departments treating varied patient groups. Furthermore, the median length of hospital stay was

Although the findings strongly support the use of fast-track pathways, the study’s limitations include its single-center nature and insufficient sample size to detect small differences in mortality. The researchers recommend larger, multicenter studies to confirm these results and longer-term monitoring to evaluate sustained benefits. Still, the evidence offers practical guidance for healthcare leaders and providers, especially in Asia where cardiovascular disease rates are climbing. The authors suggest that structured fast-track protocols should become part of emergency care systems to help close the gap between clinical recommendations and everyday practice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Tether’s $5.7 Million Investment Shows Support for Rumble’s Shift Toward Crypto-Based Cloud Services

- Tether boosted its Rumble stake by $5.7M, buying 1.06M shares to signal confidence in the firm's cloud-crypto integration strategy. - The investment follows Rumble's Northern Data AG acquisition, expanding its GPU capacity and data centers for crypto infrastructure growth. - Tether agreed to $250M in GPU purchases and advertising, while Rumble's Bitcoin tipping features and $18.5M BTC reserves reinforce crypto alignment. - Rumble's stock surged 13% amid market optimism, though analysts maintain a "Hold"

Bitcoin News Update: Fed's Balancing Act: Crypto Crash Highlights Market Vulnerability

- Bitcoin fell to $82,605, its worst monthly decline since 2022, driven by Fed policy uncertainty, institutional outflows, and macroeconomic pressures. - Record $3.79B ETF outflows and $120B in crypto liquidations highlight waning confidence, with leveraged positions collapsing amid weak U.S. employment data. - Deutsche Bank and BofA's Hartnett warn of a "liquidity event," comparing the crisis to 2018, as stalled regulations and thinning liquidity expose market fragility. - Analysts debate a potential rebo

Undisclosed Repayment Provision Sets Brevan Howard in Opposition to Berachain

- Brevan Howard secured a $25M refund clause in Berachain's $142M Series B, allowing recovery if BERA token underperforms within a year. - The SAFT-linked mechanism requires $5M deposit post-TGE, creating liquidity risks if Berachain must repay $25M by 2026. - BERA's 67% price drop to $1 raises doubts about clause viability, while legal experts call such terms "extremely rare" in token financing. - The undisclosed clause highlights tensions in crypto VC structures, potentially setting precedents for prefer

XRP News Today: The 2017 Surge of XRP Faces Off Against Today’s Market Conditions

- Analyst Steph Is Crypto notes XRP's 2017-like price patterns, including Gaussian channel breakouts and 42-day corrections, suggesting potential for a "massive" upward move. - Whale accumulation of $7.7B XRP and new ETFs (e.g., Franklin Templeton's XRPZ) signal institutional confidence despite recent price dips below $2.00. - Technical indicators show bullish RSI divergence and critical support at $1.90-$2.06, but liquidation risks and whale sell-offs ($480M in 48 hours) highlight volatility. - Regulatory