Bitcoin News Update: Fed's Balancing Act: Crypto Crash Highlights Market Vulnerability

- Bitcoin fell to $82,605, its worst monthly decline since 2022, driven by Fed policy uncertainty, institutional outflows, and macroeconomic pressures. - Record $3.79B ETF outflows and $120B in crypto liquidations highlight waning confidence, with leveraged positions collapsing amid weak U.S. employment data. - Deutsche Bank and BofA's Hartnett warn of a "liquidity event," comparing the crisis to 2018, as stalled regulations and thinning liquidity expose market fragility. - Analysts debate a potential rebo

Bitcoin recently tumbled to $82,605, experiencing its steepest monthly drop since 2022 and prompting swift assessments from financial experts and institutions.

Fluctuations in the Federal Reserve’s interest rate policy have played a major role in driving crypto market swings.

Bitcoin’s price slide has been made worse by a cascade of forced liquidations.

Wider economic conditions,

Ongoing regulatory ambiguity has also weighed on sentiment.

Despite ongoing turbulence, experts remain split on bitcoin’s outlook.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Tether’s $5.7 Million Investment Shows Support for Rumble’s Shift Toward Crypto-Based Cloud Services

- Tether boosted its Rumble stake by $5.7M, buying 1.06M shares to signal confidence in the firm's cloud-crypto integration strategy. - The investment follows Rumble's Northern Data AG acquisition, expanding its GPU capacity and data centers for crypto infrastructure growth. - Tether agreed to $250M in GPU purchases and advertising, while Rumble's Bitcoin tipping features and $18.5M BTC reserves reinforce crypto alignment. - Rumble's stock surged 13% amid market optimism, though analysts maintain a "Hold"

Undisclosed Repayment Provision Sets Brevan Howard in Opposition to Berachain

- Brevan Howard secured a $25M refund clause in Berachain's $142M Series B, allowing recovery if BERA token underperforms within a year. - The SAFT-linked mechanism requires $5M deposit post-TGE, creating liquidity risks if Berachain must repay $25M by 2026. - BERA's 67% price drop to $1 raises doubts about clause viability, while legal experts call such terms "extremely rare" in token financing. - The undisclosed clause highlights tensions in crypto VC structures, potentially setting precedents for prefer

XRP News Today: The 2017 Surge of XRP Faces Off Against Today’s Market Conditions

- Analyst Steph Is Crypto notes XRP's 2017-like price patterns, including Gaussian channel breakouts and 42-day corrections, suggesting potential for a "massive" upward move. - Whale accumulation of $7.7B XRP and new ETFs (e.g., Franklin Templeton's XRPZ) signal institutional confidence despite recent price dips below $2.00. - Technical indicators show bullish RSI divergence and critical support at $1.90-$2.06, but liquidation risks and whale sell-offs ($480M in 48 hours) highlight volatility. - Regulatory

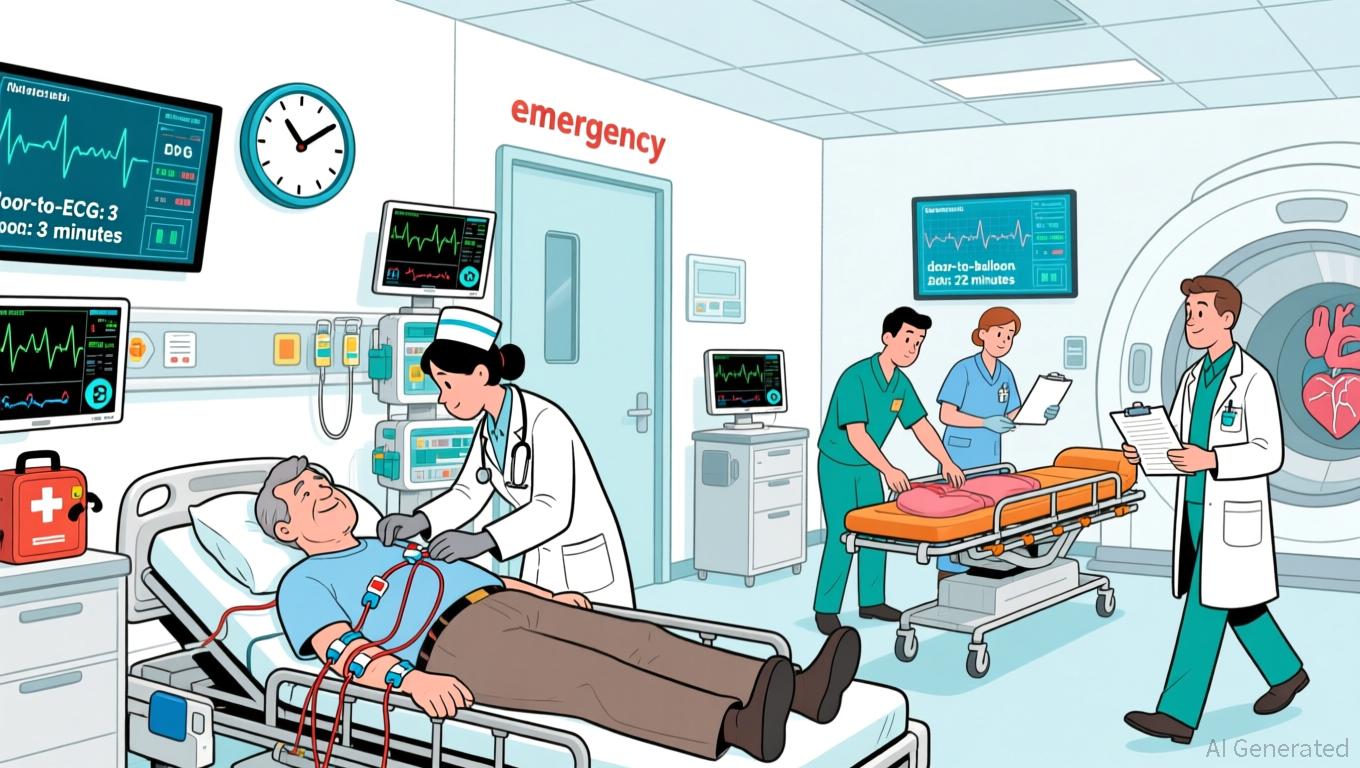

Accelerated Pathways Help Close the Gap Between ACS Guidelines and Actual Clinical Practice

- A Hunan hospital study found fast-track pathways for ACS patients reduced treatment delays and MACE without increased bleeding risk. - The protocol cut median door-to-ECG time by 50% and door-to-balloon time for STEMI patients to 68 minutes, improving guideline adherence. - In-hospital MACE rates dropped from 11.6% to 6.6%, with 30-day composite outcomes improving from 13.9% to 8.7% under fast-track care. - Researchers emphasized the pathway's applicability across all ACS subtypes and potential system ef