Amazon’s $50 Billion Investment in AI: Strengthening America’s Position in the Worldwide Technology Competition

- Amazon invests $50B to boost AWS AI/supercomputing for U.S. government agencies, adding 1.3GW capacity by 2026. - Tech giants like Microsoft and Meta also ramp up AI spending, with global capex projected to hit $611B by 2026. - AWS dominates government cloud computing, serving 11,000+ agencies with secure, classified workloads since 2011. - Competitors like AMD and Oracle join AI expansion, while economic analysts warn of overbuilding risks and GDP concentration. - The GAIN AI Act supports domestic AI ch

Amazon.com Inc. (NASDAQ:AMZN) has revealed plans to invest $50 billion to enhance artificial intelligence (AI) and supercomputing resources for U.S. government agencies via its

This investment reflects a broader surge in AI-driven capital spending among major technology companies. Corporations such as

This development further cements AWS’s leadership in the government cloud sector, a space it has dominated since the launch of AWS GovCloud (US-West) in 2011

Rivals and collaborators are also ramping up their AI commitments. AMD (NASDAQ:AMD) recently achieved $45 billion in design wins across sectors like aerospace, defense, and data centers, while Microsoft and Sony (TOKYO:6758) have increased chip production for the holiday gaming market

Economic experts warn that heavy AI spending by large cloud providers could obscure underlying economic challenges. Projections indicate U.S. AI-related capital expenditures will make up 1.2% of GDP in 2025, and growth rates may exaggerate economic strength if investments remain concentrated among a few major players

This initiative also intersects with international policy considerations. The GAIN AI Act, designed to prioritize domestic AI chip sales over exports to China, has received backing from Amazon and Microsoft but faces resistance from lawmakers concerned about trade relations with Beijing

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

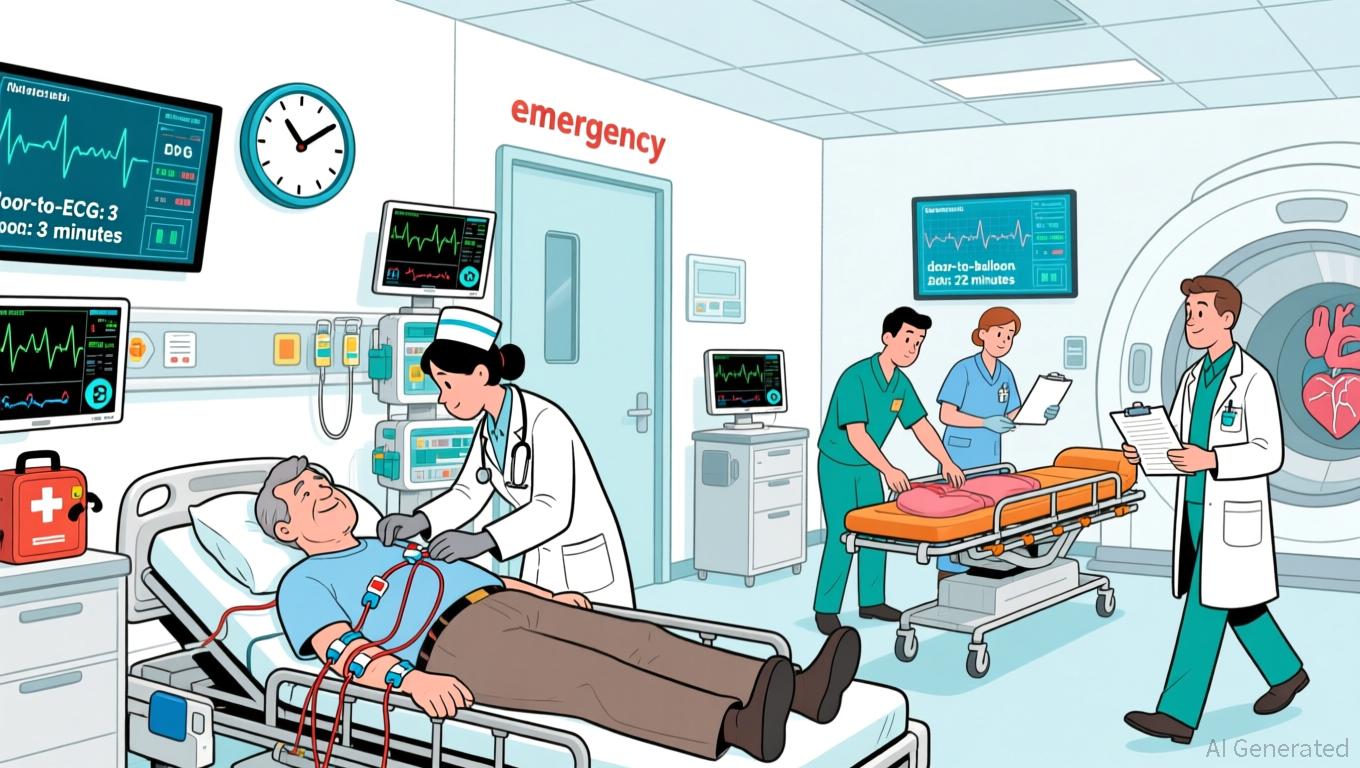

Accelerated Pathways Help Close the Gap Between ACS Guidelines and Actual Clinical Practice

- A Hunan hospital study found fast-track pathways for ACS patients reduced treatment delays and MACE without increased bleeding risk. - The protocol cut median door-to-ECG time by 50% and door-to-balloon time for STEMI patients to 68 minutes, improving guideline adherence. - In-hospital MACE rates dropped from 11.6% to 6.6%, with 30-day composite outcomes improving from 13.9% to 8.7% under fast-track care. - Researchers emphasized the pathway's applicability across all ACS subtypes and potential system ef

Crypto Supporters Rally Ahead of 2026 Midterm Elections to Influence a Congress Favoring Innovation

- Stand With Crypto, backed by Coinbase , launched a 2026 midterm campaign to evaluate candidates' digital asset policies, focusing on innovation, de-banking, and regulation. - The group aims to influence Congress to prioritize pro-crypto policies, leveraging prior success in mobilizing voters and tracking 274 "pro-crypto" elected officials in 2024. - SEC's 2026 regulatory shift to information security and delayed digital asset legislation create uncertainty, while Trump's political strategies intersect wi

Ethereum News Update: While Ethereum Declines, DeFi's Mutuum Rises Amid Presale Boom

- Ethereum (ETH) fell below $2,800 on Nov 24, 2025, amid crypto market turmoil driven by rising Japanese bond yields and algorithmic sell-offs. - DeFi project Mutuum Finance (MUTM) raised $18.9M in its presale, with Phase 6 nearing 90% sales at $0.035 per token before a 20% price increase. - Mutuum's dual-lending model and automated interest systems differentiate it, while Ethereum ETFs saw $465M outflows despite institutional Bitcoin/Ethereum deposits. - The project's presale growth remains resilient amid

XRP News Update: Franklin XRP ETF: $1.69 Trillion Titan Signals Crypto Market Evolution

- Franklin Templeton launches XRPZ ETF, first regulated XRP fund on NYSE Arca, reflecting institutional crypto adoption. - SEC's 2025 Ripple settlement cleared XRP's regulatory status, enabling $125M-payout-driven investment products like XRPZ. - XRPZ joins competitive ETF landscape (Bitwise, Grayscale) amid mixed market signals: $2.11 price rebound vs. 200M XRP whale sales. - Franklin's $1.69T AUM entry underscores crypto market maturation, with XRP positioned as foundational asset for cross-border paymen