Analyst Forecasts Major Solana Breakout in 2026, Updates Outlook on Bitcoin, Ethereum and BONK

A widely followed trader believes Solana ( SOL ) may be gearing up for massive rallies after retesting the $120 level.

The pseudonymous analyst Inmortal tells his 235,200 followers on X that Solana may experience a parabolic rally similar to what Ethereum ( ETH ) did earlier this year.

“Different structure, similar vibes.”

Source: Inmortal/X

Source: Inmortal/X

ETH went from about $1,550 in April to about $4,900 in September, a more than 216% gain.

The analyst also says that Solana’s $120 level has consistently acted as a support level during market corrections.

“This level has provided support for more than 600 days.”

Source: Inmorta/X

Source: Inmorta/X

Solana is trading for $138 at time of writing, up 1.2% on the day.

Next up, the trader says that Bitcoin ( BTC ) may chop around for months before having an explosive move to new all-time highs around $150,000.

“Imagine.”

Source: Inmortal/X

Source: Inmortal/X

Bitcoin is trading for $88,679 at time of writing, up 1.3% in the last 24 hours.

The trader also says that the meme token Bonk ( BONK ) may be forming a local bottom at a key level around $0.00000900, indicating a potential bullish reversal.

“You only see this type of charts one to two times per year.”

Source: Inmortal/X

Source: Inmortal/X

BONK is trading for $0.000009555 at time of writing, down 1.9% in the last 24 hours.

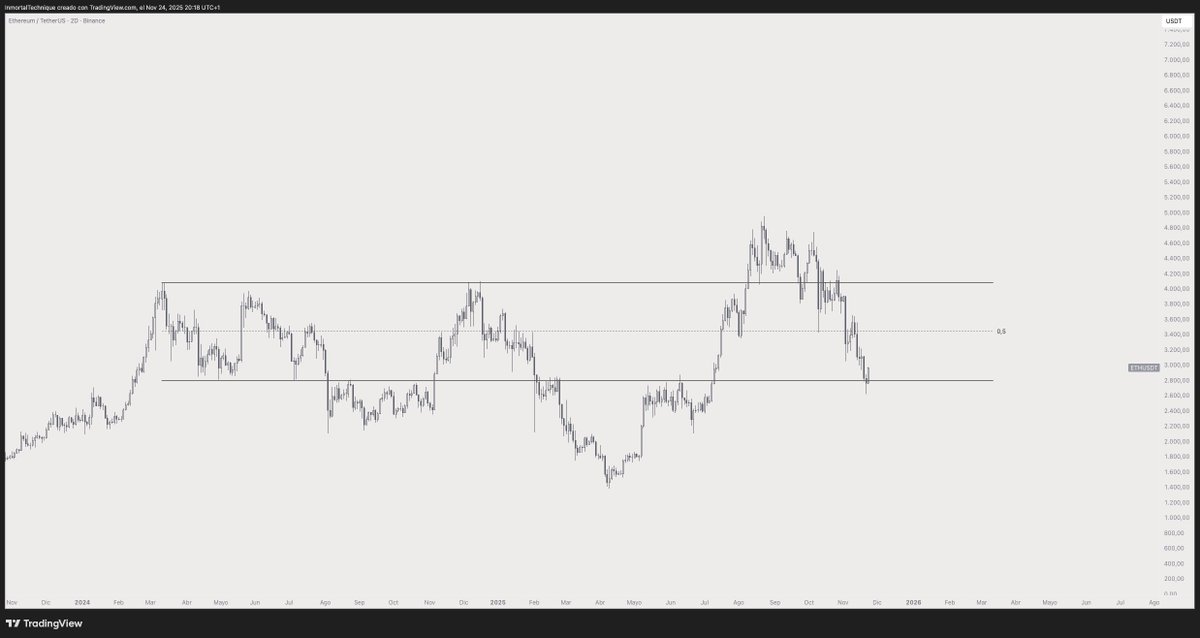

Lastly, the trader predicts that Ethereum ( ETH ) will soon surge more than 18% from its current value, after bouncing off the lower bound of a trading range at around $2,800.

“$3,500: ETH.”

Source: Inmortal/X

Source: Inmortal/X

ETH is trading at $2,963 at time of writing, up about 1% on the day.

Featured Image: Shutterstock/Vink Fan/Natalia Siiatovskaia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve's Change in Policy and Its Unexpected Effect on Solana's Rise

- Federal Reserve's 2025 rate cut and QT end injected $72.35B liquidity, briefly boosting Solana by 3.01%. - October 2025's $19B liquidation and government shutdown exposed crypto liquidity fragility, eroding investor confidence. - Solana's 6.1% price drop and 4.7% TVL decline in November 2025 highlighted macroeconomic policy's volatile impact on crypto markets. - Upcoming December FOMC meeting (87% rate cut chance) could reignite risk appetite or trigger corrections, mirroring October's 20% price drop. -

Solana’s Latest Price Fluctuations and Institutional Involvement: Insights for Long-Term Investors

- Solana (SOL) faced 2025 price swings from $155 to $294, driven by macroeconomic pressures, on-chain weakness, and institutional adoption dynamics. - Institutional ETFs like Bitwise's BSOL attracted $2B AUM by mid-2025, with major holders staking SOL to deepen ecosystem integration despite short-term volatility. - Risks include network centralization, competition from Ethereum 2.0, and reliability concerns after the 2024 cluster outage amid Fed rate uncertainty. - Ecosystem resilience with 500+ dApps and

Timeless Strategies for Investing Amid Market Volatility

- In 2025, R.W. McNeel's 1927 value investing principles and Warren Buffett's strategies remain critical amid market volatility driven by tech disruption and geopolitical risks. - Both emphasize intrinsic value, emotional discipline, and long-term thinking to counter crypto and stock market swings fueled by speculation and social media hype. - Buffett's $340B cash reserves and focus on undervalued sectors like healthcare contrast with crypto's intangible promises, reinforcing tangible asset preferences. -

Saylor Strikes Again: Strategy Makes Its Biggest BTC Buy Since July