Tanker Shipping Cost Drop Temporarily Lifts U.S. Oil Prices

U.S. Crude Prices Benefit from Lower Tanker Rates, But Outlook Remains Uncertain

This month, a drop in shipping costs for oil tankers has provided a boost to U.S. crude prices, suggesting an uptick in demand. However, this positive trend may be short-lived, as most industry projections indicate that freight rates will remain well above 2025 levels throughout the year.

According to an analyst at TP ICAP, “Shipping lanes are opening up, and freight costs from the U.S. and U.K. to Asia are falling,” as reported by Bloomberg this week. This decline in rates is fueling greater demand for American crude oil.

Consequently, U.S. benchmark oil prices have seen a recovery. However, high-sulfur crude varieties continue to face downward pressure after President Trump announced plans for the U.S. to import millions of barrels of Venezuelan oil.

Despite the recent dip, overall freight rates remain elevated. Increased oil output from both OPEC+ and the U.S. has tightened the tanker market. Last year, this led to several new Very Large Crude Carriers (VLCCs) embarking on their first voyages without cargo—an unusual move—so they could pick up crude shipments and capitalize on soaring daily rates.

By the end of last year, tanker rates on major shipping routes had surged by 467% year-to-date, according to Bloomberg’s December estimates based on data from the Baltic Exchange and Spark Commodities.

Related: Mexico’s Crude Exports Slide as Refining Finally Reawakens

In December, Lloyd’s List reported a dramatic 20% drop in VLCC rates on the Baltic Exchange between December 19 and 22. Even after this plunge, rates remained at $83,882 per day—the highest since the spring 2020 floating storage surge. Smaller tanker rates also stayed robust, according to Lloyd’s List.

The spike in tanker rates was partly driven by U.S. sanctions on Russian oil giants Rosneft and Lukoil, which took effect in late November. Anticipation of a reduced Russian fleet pushed rates higher. This week, tanker rates received further support after the U.S. pursued and seized the Russian-flagged vessel Bella 1 in the North Atlantic, highlighting rising geopolitical tensions. With fewer tankers available and ongoing global uncertainties, freight rates are likely to remain high.

Supertanker Utilization and Sanctions to Keep Rates Elevated

Looking ahead, supertanker utilization is projected to reach 92% in 2026—the highest in seven years—up from 89.5% last year, according to a Jefferies analyst. Utilization measures the proportion of tankers in active service compared to the total fleet.

Sanctions are another key factor pushing rates higher. As the U.S. sanctions more vessels, the pool of available tankers shrinks, Reuters highlighted in a mid-December report. Last month, a combination of sanctions and increased OPEC+ demand drove daily freight rates up to $130,000. Although rates have since eased, they remain above last year’s levels. The aging tanker fleet is also a concern: stricter safety standards mean oil companies often retire vessels after 15 years. Nearly 44% of the global tanker fleet is at least 15 years old, and 18% of those are under sanctions, according to Frontline. With so many vessels sidelined, rates are expected to stay high unless a sharp drop in oil demand occurs, which would likely require a significant price spike.

By Irina Slav for Oilprice.com

More Top Reads from Oilprice.com

- Oil Prices Could Slip to $50 a Barrel by June

- European Energy Giants Chase $6 Billion Debt from Venezuela

- Saudi Arabia Slashes Oil Prices to Asia for Third Straight Month

Oilprice Intelligence delivers market insights before they make headlines. This expert analysis is trusted by seasoned traders and policy advisors. Subscribe for free and receive updates twice a week, giving you an edge on market movements.

Gain access to exclusive geopolitical analysis, inventory data, and insider market trends that influence billions in trade. Plus, receive $389 worth of premium energy intelligence at no cost when you subscribe. Join over 400,000 readers—sign up now for immediate access.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK official held talks with Paramount CEO Ellison in London on Thursday, according to a source

Indian Rupee approaches unprecedented lows as RBI's ongoing efforts prove ineffective

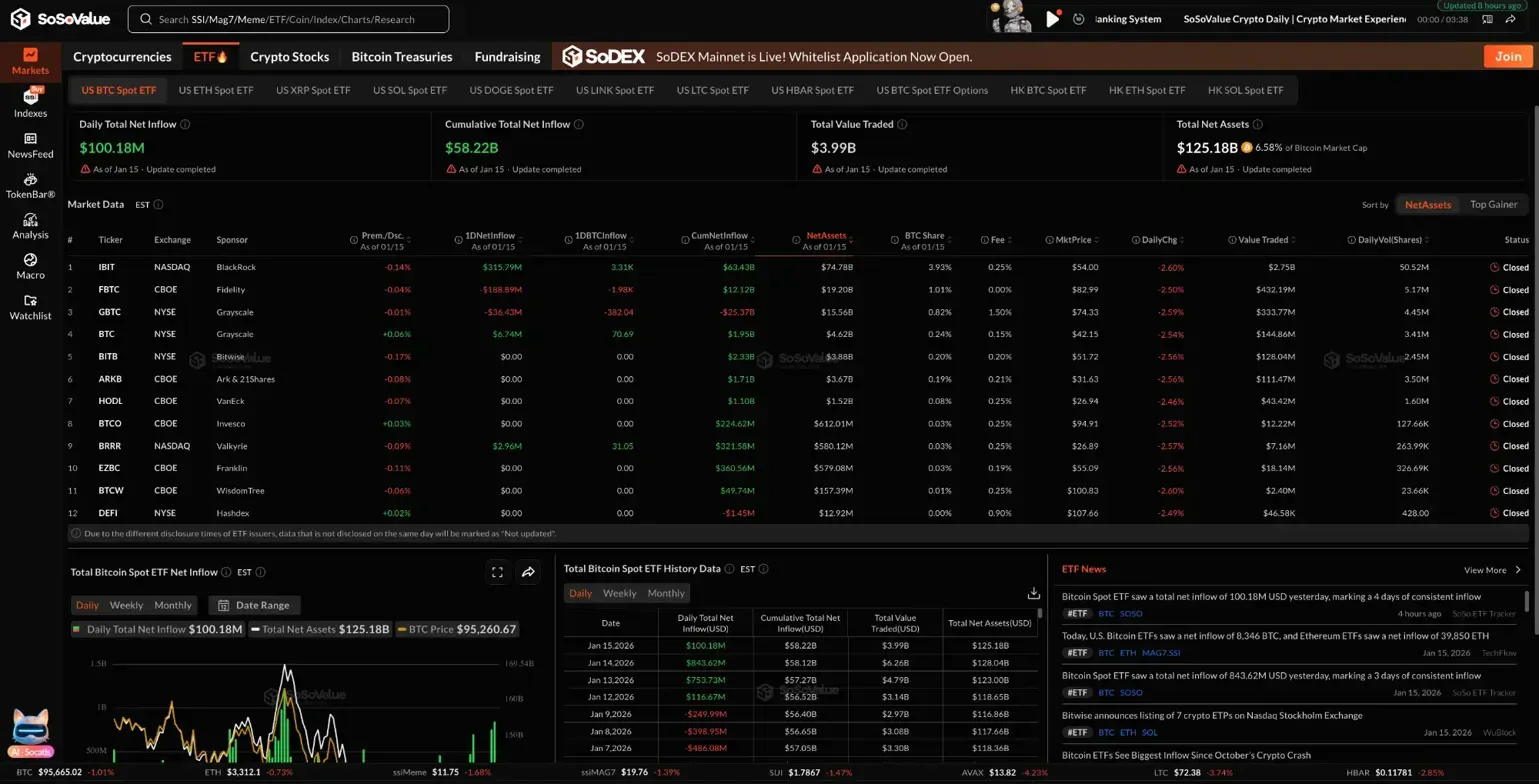

Bitcoin Price Prediction: ETF Inflows Clash With Spot Outflows As Price Stalls Below 100 EMA

Sela Network Unveils Revolutionary Solution to X API Restrictions Crisis