Trump Administration Acquires Interest in Key Mineral Company ATALCO

US Invests $150 Million to Boost Domestic Gallium Production

Photo by Alex Kraus/Bloomberg

The US government is making a significant move to strengthen its supply of critical minerals by investing $150 million in equity to establish the nation's only major gallium producer. Gallium is a vital component in technologies such as satellite communications and military radar systems.

Strategic Partnership Announced

The Department of Defense, in collaboration with a Pinnacle Asset Management affiliate, will soon unveil a new partnership with Atlantic Alumina Co. (ATALCO). Located near New Orleans, ATALCO has been converting bauxite into alumina—a key ingredient in aluminum manufacturing—since the late 1950s.

Top Stories from Bloomberg

Direct Investments in National Security

This initiative is part of a broader effort by the Trump administration to directly support companies seen as vital to US security interests. Previous actions include acquiring a stake in Intel and negotiating a special share in US Steel during its acquisition by Japan’s Nippon Steel.

Through the Pentagon’s Industrial Base Analysis and Sustainment Program, $150 million in preferred equity has been invested in ATALCO. Combined with an additional $300 million from Pinnacle, these funds will expand alumina output and create the first large-scale gallium production facility in the US. Additional government funding is anticipated within a month of the deal’s completion.

"This collaboration marks a crucial move toward reducing US dependence on foreign sources for essential minerals," stated ATALCO.

This strategy aligns with Commerce Secretary Howard Lutnick’s push to secure supplies of rare earths and other key minerals, a central issue in ongoing trade tensions with China, which currently leads the global alumina and gallium markets. In a similar move last year, the administration supported a US firm in acquiring a majority share of Kazakhstan’s largest untapped tungsten reserve.

According to ATALCO, which is owned by Concord Resources Holdings (a Pinnacle subsidiary), the company aims to eventually produce over 1 million metric tons of alumina and up to 50 metric tons of gallium annually. The investment will modernize its Gramercy, Louisiana facility, enabling it to satisfy all US gallium requirements.

Both alumina and gallium are indispensable for manufacturing aerospace, defense, semiconductor, and energy technologies. The Defense Department’s investment is intended to reinforce the nation’s industrial capabilities.

Pinnacle’s Commitment to Critical Minerals

Pinnacle, headquartered in New York, oversees assets exceeding $6 billion. Chief Investment Officer Jason Kellman emphasized that the company’s strategy over the past decade has focused on strengthening the US supply chain for vital minerals and commodities.

Managing Partner Scott Kellman added that, beyond expanding ATALCO’s core operations, this investment will enhance the site’s mineral processing and power generation, further securing the nation’s long-term material needs.

Most Popular from Bloomberg Businessweek

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trader Turns $12 into $100K with Bitcoin Bets

Bullish News for Bitcoin and Cryptocurrencies Comes from US Mortgage Giant

XRP price at risk of a crash as two risky chart patterns form

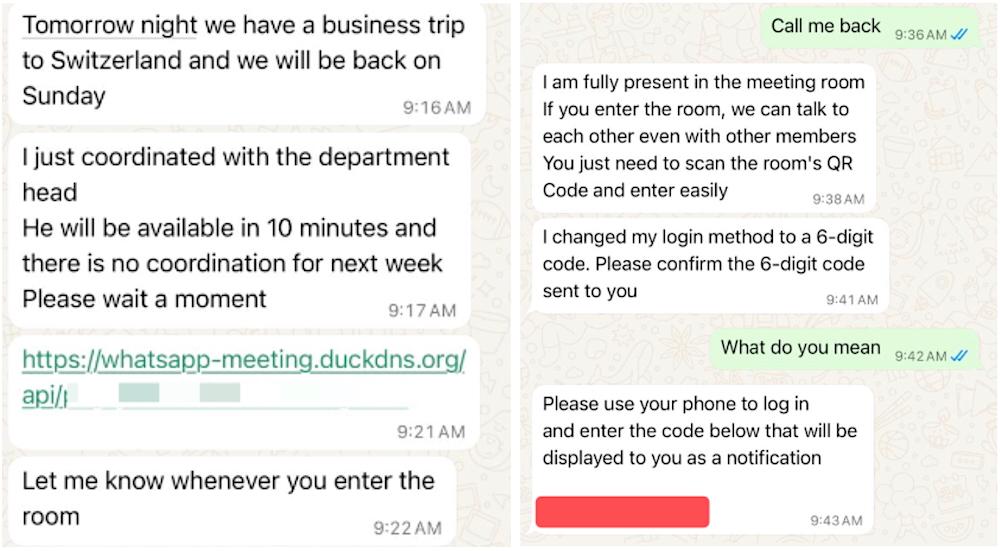

How a cyberattack operation focused on prominent Gmail and WhatsApp users throughout the Middle East