Why ANI Pharmaceuticals (ANIP) Shares Are Rising Today

Recent Developments at ANI Pharmaceuticals

ANI Pharmaceuticals (NASDAQ:ANIP), a company specializing in pharmaceuticals, saw its stock surge by 13.6% during the afternoon after releasing optimistic financial projections for 2026 that exceeded Wall Street’s expectations.

The company anticipates its net revenue for 2026 will range from $1.055 billion to $1.115 billion, significantly outpacing the FactSet consensus of $955.1 million. A major contributor to this anticipated growth is Cortrophin Gel, ANI’s treatment for rare diseases, which is expected to bring in between $540 million and $575 million—a 55% to 65% increase over 2025 estimates. Preliminary results for 2025 also look promising, with Cortrophin Gel’s net revenue climbing 76% year-over-year to $347.8 million. To build on this momentum, ANI plans to grow its rare disease team by approximately 90 new hires.

By the end of the trading day, ANI’s stock closed at $84.43, marking a 10.7% rise from the previous session.

Market Reaction and Performance Insights

Historically, ANI Pharmaceuticals’ stock has shown limited volatility, with only eight instances of price swings greater than 5% over the past year. This recent surge is unusual and highlights the significant impact of the latest announcement on investor sentiment.

The most notable price movement in the last year occurred five months ago, when the stock jumped 18.4% following the release of second-quarter results that beat analyst forecasts and an upward revision of full-year guidance. At that time, ANI reported quarterly net revenue of $211.4 million—a 53.1% increase from the previous year and well above the expected $191.5 million. Adjusted earnings per share reached $1.80, surpassing the consensus estimate of $1.42. The company also raised its 2025 outlook, projecting annual revenue between $818 million and $843 million and adjusted earnings per share between $6.98 and $7.35, both higher than previous estimates.

Since the start of the year, ANI Pharmaceuticals’ stock has gained 7.7%. Despite closing at $84.43, the share price remains 14.6% below its 52-week peak of $98.81, reached in September 2025. An investment of $1,000 in ANI Pharmaceuticals five years ago would now be valued at $2,642.

Many industry giants—such as Microsoft, Alphabet, Coca-Cola, and Monster Beverage—began as lesser-known growth stories that capitalized on major trends. We believe we’ve found the next big opportunity: a profitable AI semiconductor company that’s still flying under Wall Street’s radar。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

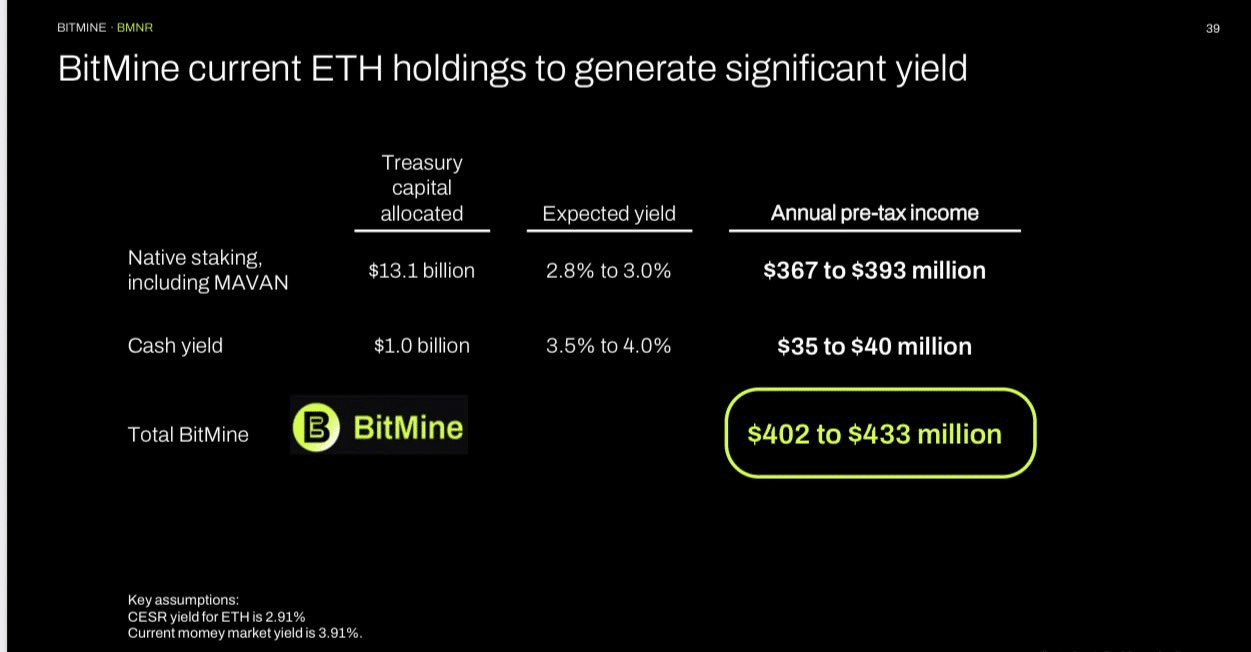

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense