Reeves encouraged to expand pub support following £4bn bond surge

Calls Grow for Broader Business Rates Relief Amid Falling UK Borrowing Costs

With UK government borrowing costs hitting their lowest point in over a year, financial analysts report that Chancellor Rachel Reeves now has greater flexibility in managing the nation's finances. This shift has prompted renewed appeals for her to extend business rates support, currently available to pubs, to also cover hotels and restaurants.

Industry leaders argue that the recent reduction in government debt interest payments—estimated to provide nearly £4 billion in additional fiscal space—should be used to help the hospitality sector, which is facing steep increases in tax liabilities.

According to Capital Economics, the drop in borrowing costs has boosted the Chancellor’s budgetary headroom from £21.7 billion to £25.4 billion. This improvement could allow for the expansion of business rates relief beyond pubs to other hospitality venues.

Trade associations warn that, without immediate intervention from the Treasury, as many as five hotels, restaurants, and cafes could be forced to close each day due to rising business rates.

Kate Nicholls, chair of UKHospitality, emphasized that any financial windfall should be invested in supporting the sector. She stated, “If there’s positive economic news that allows for increased support, hospitality is an ideal recipient, as it delivers significant returns through job creation, growth, investment, and tax revenue.”

Alan Morgan, CEO of Big Table Group (which owns Bella Italia), highlighted the risk to thousands of jobs, noting that relief for the broader hospitality industry could be crucial in preventing layoffs. He added that many businesses have already had to cut staff and are struggling to survive due to previous government policies.

As pandemic-era business rates relief is withdrawn and properties are revalued, many businesses are finding it increasingly difficult to meet higher tax bills. Hotels, in particular, are feeling the strain, with major operators urging the Chancellor to reconsider the current approach.

Hilton’s European president, Simon Vincent, warned that the current tax policy could stifle economic growth and employment, and called for hotels to be included in any sector-wide solution. Sir Rocco Forte, a prominent hotelier, revealed that his properties face an average business rates increase of 115% over the next three years, and argued that focusing relief solely on pubs is insufficient, as they account for only a small fraction of the total business rates burden.

Government Response and Industry Reactions

Rachel Reeves has announced plans to roll back proposed business rates hikes for pubs, but has so far resisted calls for broader support for the hospitality sector. Speaking in Leeds, she confirmed that additional measures are forthcoming, but stressed that tight public finances limit her ability to offer widespread tax reductions.

She explained, “We are developing further support for businesses, but any new funding must be balanced by savings elsewhere.” Reeves also declined to reconsider the planned 3.66% increase in alcohol duty, which is set to rise in line with the retail price index—a measure of inflation currently outpacing the consumer price index targeted by the government.

Will Beckett, CEO of Hawksmoor steakhouse, urged the Chancellor to maintain some pandemic-era business rates relief indefinitely, arguing that hospitality is vital to communities and employment across the UK. He noted that many businesses have become unsustainable under current policies, and called for a reversal to prevent further closures.

Economic Confidence and Outlook

These debates come as a recent Iwoca survey reveals declining confidence among small businesses in the UK, with only 38% expressing optimism about the future, down from 51% a year earlier. Nearly half of respondents cited rising operating costs as a major concern, and 34% specifically identified business rates as a significant challenge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trader Turns $12 into $100K with Bitcoin Bets

Bullish News for Bitcoin and Cryptocurrencies Comes from US Mortgage Giant

XRP price at risk of a crash as two risky chart patterns form

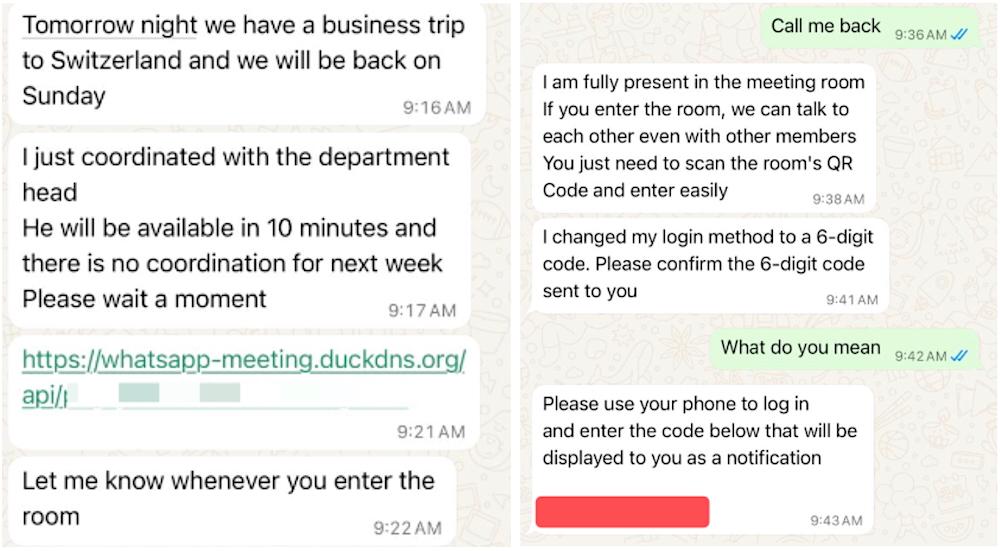

How a cyberattack operation focused on prominent Gmail and WhatsApp users throughout the Middle East