News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

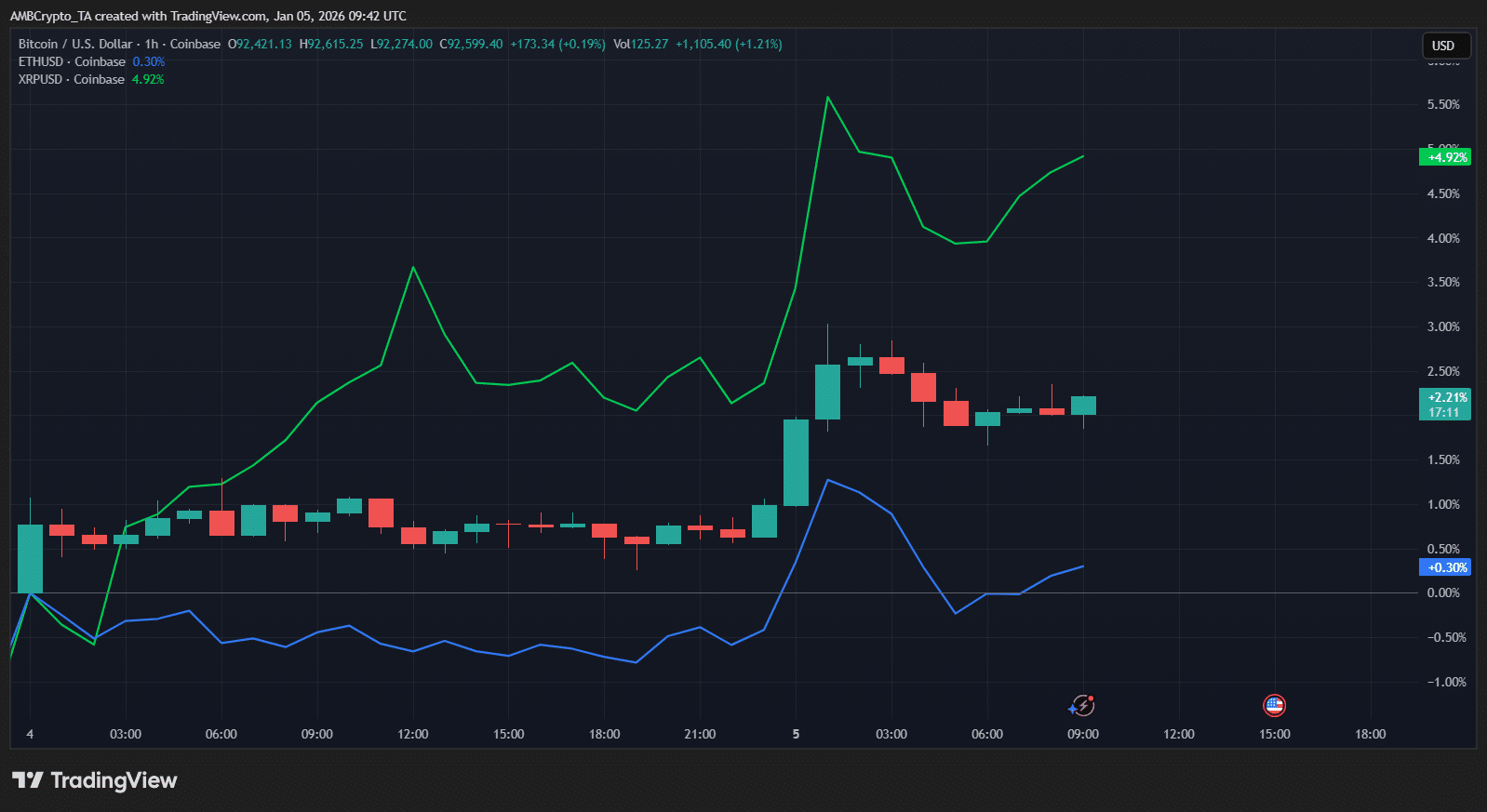

Why is crypto up today? XRP rallies as Bitcoin stabilizes

AMBCrypto·2026/01/05 19:03

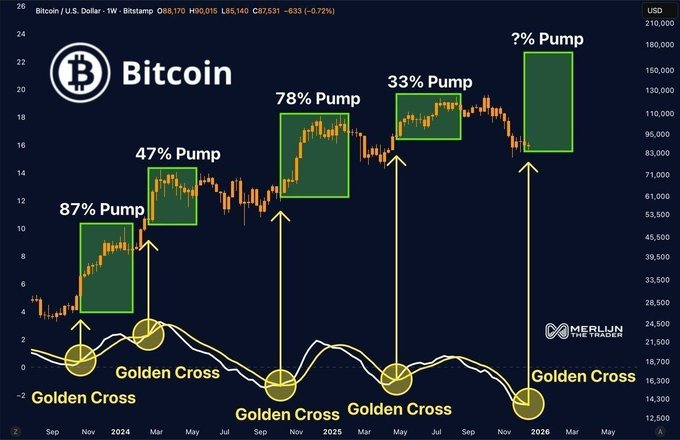

Bitcoin Hits New Heights: What Experts Are Predicting

Cointurk·2026/01/05 18:51

SHIB Breaks Year-Long Downtrend as Volume Explodes Entering 2026

CoinEdition·2026/01/05 18:06

As SHIB and SOL Lose Momentum, BlockDAG Presale Approaches January 26 Deadline With 3.5B Coins Left

BlockchainReporter·2026/01/05 18:00

Crypto Wallet Maker Ledger Confirms Data Breach on Global-e Platform

Decrypt·2026/01/05 17:53

Best Crypto to Buy Now: Why AlphaPepe Could Outperform Bitcoin and Ethereum This Cycle

BlockchainReporter·2026/01/05 17:30

Infinex Announces Token Sales Changes in TGE Failure; Insider Trading Concerns

Coinspeaker·2026/01/05 17:27

Bank of America Says Own Bitcoin, Markets Respond With Silence

CoinEdition·2026/01/05 17:12

Fund Flows Near Record US$47.2B in 2025 as Ethereum, XRP and Solana Surge

BlockchainReporter·2026/01/05 17:12

Market Overview: Dogecoin, Uniswap, and Zero Knowledge Proof

Crypto Ninjas·2026/01/05 17:06

Flash

07:15

Data: If ETH falls below $2,986, the cumulative long liquidation intensity on major CEXs will reach $947 millions.ChainCatcher News, according to Coinglass data, if ETH falls below $2,986, the cumulative long liquidation intensity on major CEXs will reach $947 millions. Conversely, if ETH breaks above $3,287, the cumulative short liquidation intensity on major CEXs will reach $735 millions.

07:15

A swing whale enters the market to short ETH, with an average entry price of $3,142.76, having previously made a profit of $21.84 million.According to Odaily, on-chain data shows that swing trader pension-usdt.eth deposited 29,999,699 USDC into its contract account and opened a new 3x leveraged ETH short position. Currently, the size of its ETH short position has increased to 762.3 ETH (approximately $2.397 million). This address has completed about 70 transactions in total, with total profits reaching $21.84 million.

07:15

Swing whale "pension-usdt.eth" opened a short position on ETH at an average entry price of $3,142.76On January 4, the swing whale "pension-usdt.eth" shorted 247.78 ETH (approximately $778,000) with 3x leverage within 5 minutes, with an average entry price of $3,142.76. According to Hyperinsight monitoring, this address has completed about 70 transactions in total, with cumulative profits reaching $21.84 million.

News