News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.9)|Zcash team mass resignations trigger ZEC oversold conditions; approx. $2.22B worth of BTC and ETH options expire today; U.S. initial jobless claims for the week ending Jan 3 came in at 208K2Bitget UEX Daily | Non-Farm Eve Market Split; Trump Picks Fed Chair; CME Hikes Precious Metals Margins (Jan 08, 2026)3Hyperliquid: How whale transfers have stressed HYPE’s fragile price structure

Events This Week That Could Make or Break Bitcoin, Ethereum, and XRP Prices

Coinpedia·2026/01/05 20:30

Crypto Educator Reveals How Bitcoin Can Actually Make You Rich

Coinpedia·2026/01/05 20:30

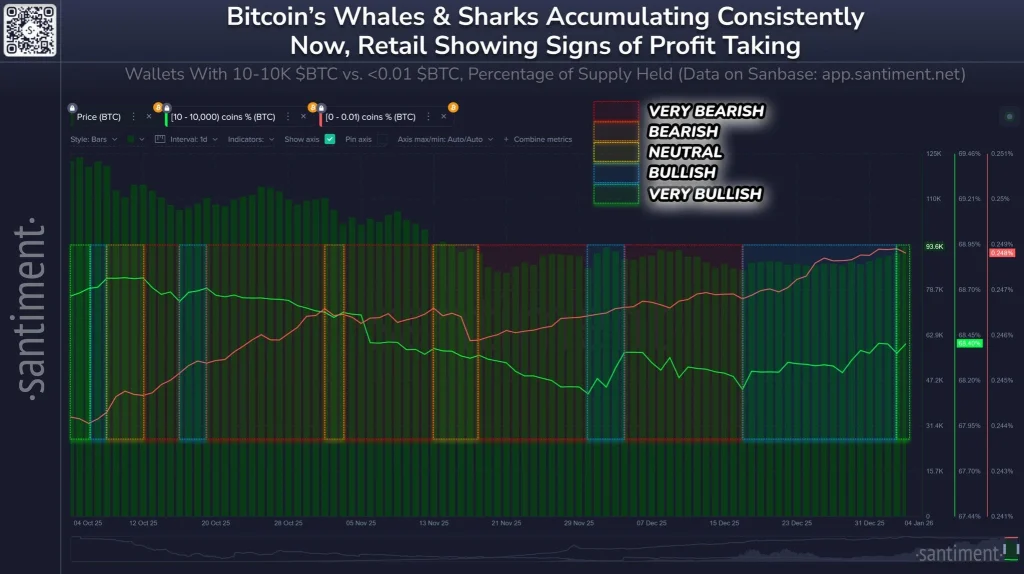

Bitcoin Price Hits $94k Fueled By Whale Accumulation and Retail Profit-taking

Coinpedia·2026/01/05 20:30

Bitcoin Core Development Surges as Global Contributor Count Reverses Downward Trend

DeFi Planet·2026/01/05 20:30

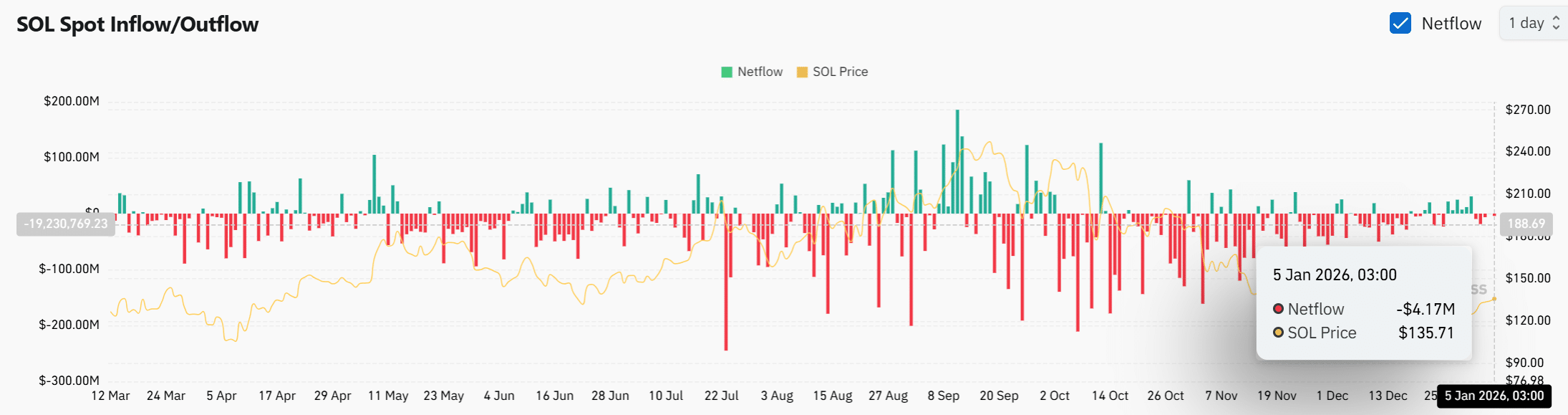

Solana: Smart money turns bullish – Now SOL’s price must prove it

AMBCrypto·2026/01/05 20:03

Outlook 2026: Currency markets are expected to be calmer compared to 2025

101 finance·2026/01/05 19:30

$30M Paraguay Fire Sale Is The Last Step In Bitfarms’ LATAM Exit – Kriptoworld.com

Kriptoworld·2026/01/05 19:12

Claims Circulate That the US Could Seize Venezuela’s Bitcoin Holdings – Ethereum, Solana, and XRP Commentary Also Included

BitcoinSistemi·2026/01/05 19:09

Bitcoin Nears $93,000 as Trump’s Latin America Rhetoric Fuels Geopolitical Jitters

DeFi Planet·2026/01/05 19:06

Flash

15:24

The hype around Chinese Meme tokens has temporarily subsided, with the market caps of "Wo Ta Ma Lai Le," "Lao Zi," and others experiencing significant pullbacks.BlockBeats News, January 11, according to data, several popular Chinese Meme tokens on BNB Chain have experienced significant corrections after a general price surge. Specifically: “我踏马来了” market cap dropped from a peak of $52 million to $28 million, down about 46% from its high; “老子” market cap dropped from a peak of $18 million to $11 million, down about 39% from its high; “人生 K 线” market cap dropped from a peak of $41 million to $16 million, down about 60% from its high; “币安人生” market cap dropped from today’s peak of $188 million to $153 million, down about 18%; “哈基米” market cap dropped from today’s peak of $48 million to $36 million, down about 25%; “爱你老己” market cap dropped from a peak of $2.9 million to $1.8 million, down about 38% from its high; “金铲子” market cap dropped from a peak of $3 million to $700,000, down about 39% from its high. BlockBeats reminds users that most Meme coins have no real use cases and their prices are highly volatile. Please invest with caution.

14:53

The Russian Patent Office has approved Tether's trademark registration for its Hadron tokenization platformBlockBeats News, January 11th, the Russian Patent Office has approved the registration of a trademark for Tether, the issuer of the USDT stablecoin, for its Hadron tokenization platform. Tether submitted the application to the Federal Service for Intellectual Property of Russia in October 2025 and received approval this month.

Hadron is a tokenization platform launched by Tether in November 2024, supporting the tokenization of real-world assets such as stocks, bonds, points, and commodities, allowing businesses to issue digital tokens on the blockchain network. The newly approved trademark in Russia is valid until October 3, 2035, covering blockchain financial services, cryptocurrency trading and exchange, crypto payment processing, and related advisory services.

14:23

「Buddy」 ETH Long Position Sees Over $2 Million Drawdown from Peak Profits, Entry Price at $3,138.43BlockBeats News, January 11, according to on-chain analyst Auntie Ai (@ai_9684xtpa), "Brother Whale" Huang Licheng currently holds a $34 million worth of ETH long position, with a profit-taking of over $2 million since ETH's peak on January 7, and the current position's entry price is $3,138.43.

He also holds a $250,000 worth of HYPE long position at an entry price of $24.4.

News