News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

Japan sees first decline in cash in circulation in 18 years in 2025 as BOJ ends stimulus measures

101 finance·2026/01/06 05:45

Ledger Customers Face Renewed Privacy Risks After Global-e Data Exposure

CoinEdition·2026/01/06 05:42

$VIRTUAL Surges to Top of Crypto Gainers: Here’s What Sparked the Run

Cryptotale·2026/01/06 05:24

Gold climbs to its highest level in a week as investors seek safety and anticipate Fed rate reductions

101 finance·2026/01/06 05:18

EUR/JPY Outlook: Advances toward 183.50 amid BoJ rate hike ambiguity, bullish momentum remains

101 finance·2026/01/06 05:18

Bitcoin Gains Momentum as Traders Look for Confirmation

Decrypt·2026/01/06 05:10

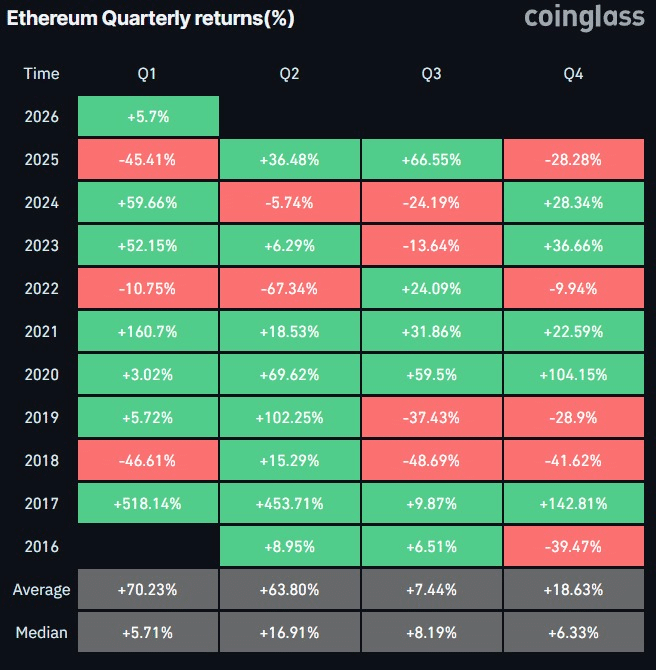

Assessing Ethereum whale’s $63M short bet and what’s next for ETH’s price

AMBCrypto·2026/01/06 05:03

EUR/JPY remains elevated around 183.50 as markets await Germany’s preliminary CPI figures

101 finance·2026/01/06 04:57

USD/INR starts the day on a weaker note as the appeal for the US Dollar as a safe haven fades

101 finance·2026/01/06 04:57

Research Report|In-Depth Analysis and Market Cap of Brevis Network (BREV)

Bitget·2026/01/06 04:33

Flash

07:20

A major whale makes a 3x long on PEPE, with unrealized profits exceeding $2 millionAccording to Odaily, Onchain Lens monitoring shows that two days ago, a whale (0x727...1e2c) opened a 3x leveraged long position on PEPE, currently with an unrealized profit of over $2 million. Previously, this whale had traded ETH and closed the position at a loss of $488,069.

07:20

Solana ecosystem US stock tokenization platform BackedFi's assets approach $1 billionAccording to Odaily, Solana Daily posted on X that the RWA on-chain platform BackedFi has tokenized stocks worth nearly 1 billion USD on the Solana network.

07:17

WLFI: Unlocking part of the treasury funds for USD1 incentive passed governance proposal with 77.75% approvalAccording to Odaily, WLFI officially announced on the X platform that the governance proposal to use part of the unlocked treasury funds to incentivize USD1 adoption has been approved, with 77.75% of votes in favor.

News