News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

Nvidia Introduces Alpamayo AI for Self-Driving Cars: A 'Chat-GPT Breakthrough' in Automotive Technology

101 finance·2026/01/06 07:51

Disney's 'Avatar: Fire and Ash' Surpasses $1 Billion in Just 18 Days — But Will It Boost the Stock Price?

101 finance·2026/01/06 07:51

Move Aside, Pelosi: This Lawmaker Achieved 2025’s Top Market Performance With a 52% Increase

101 finance·2026/01/06 07:51

Bitcoin ETFs Post Largest Inflow since October Crash: Here’s What’s Important

Coinspeaker·2026/01/06 07:33

Venezuela’s Hidden Bitcoin Could Trigger a Major Supply Lock-Up

CoinEdition·2026/01/06 07:30

XRP Price Jumps 13% Leading Crypto Market Rally, Charts Turn Bullish

Coinspeaker·2026/01/06 07:24

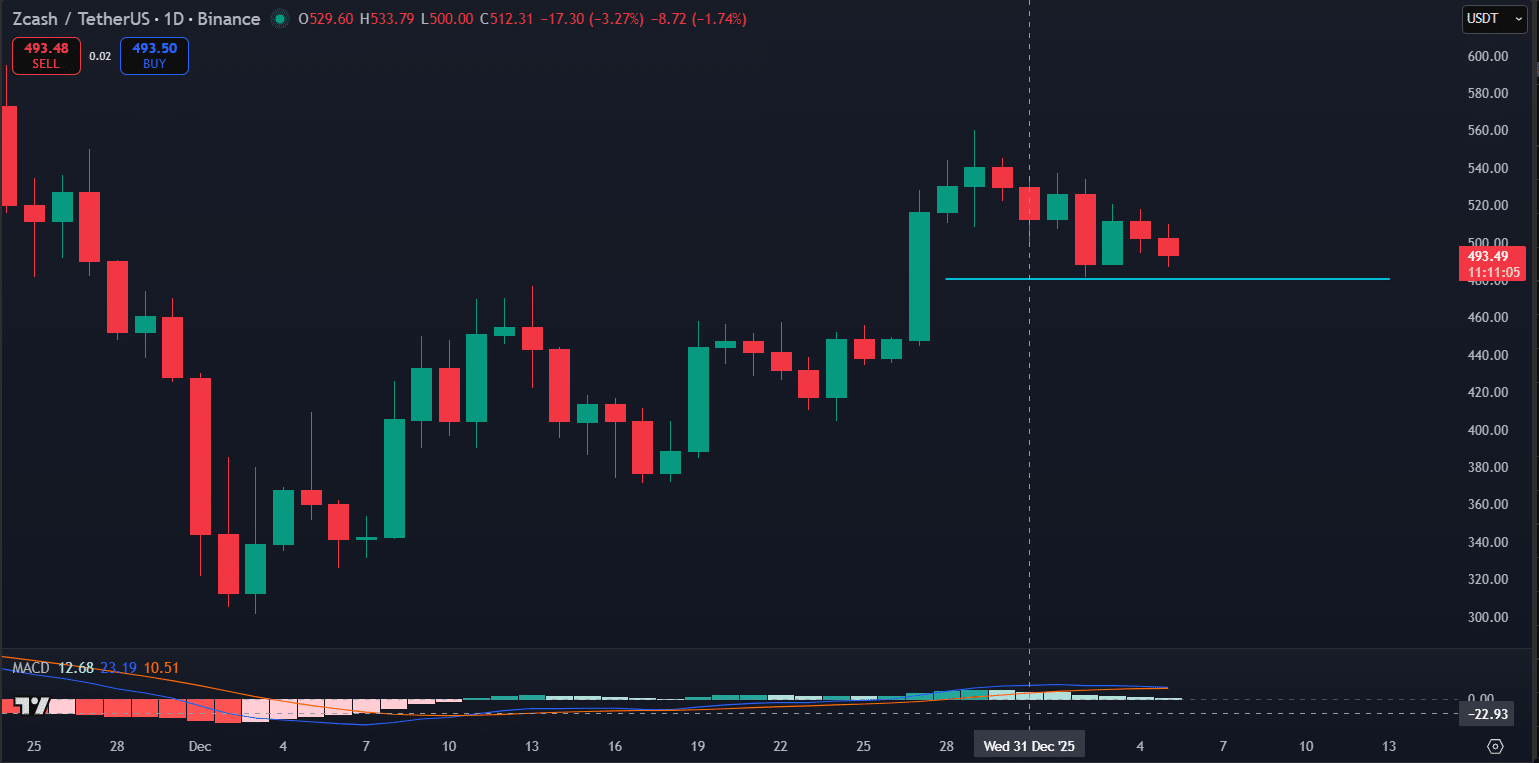

Zcash: Why ZEC keeps failing at $520 despite brief rebounds

AMBCrypto·2026/01/06 07:03

CheersLand Expands Web3 Identity Vision Through Strategic Partnership With Snowball Money

BlockchainReporter·2026/01/06 07:00

Flash

04:49

Excluding Stablecoins, RWA Market Cap Surpasses $20 Billion, Reaching All-Time HighBlockBeats News, January 12th, Tokenized digital securities platform Securitize cited data from the X platform to show that the market value of RWAs (Real World Assets) excluding stablecoins has exceeded $20 billion, hitting a new all-time high. This demonstrates investors' continued interest in the tokenization of traditional assets, with the tokenized U.S. Treasury market being particularly strong, with a market value of over $8.87 billion. Additionally, BlackRock's BUILD Fund currently has a market value of $1.73 billion.

04:36

"Strategy Counterparty" opens a new long position in kPEPE, with its total position size once again surpassing $300 million.PANews reported on January 12 that, according to Hyperbot data, the "Strategy Counterparty" continued to increase its long positions this morning, with the total position size once again surpassing $300 million. In addition, it has just opened a new long position in kPEPE and has built up to 336 million ZEC (approximately $2 million). This whale still holds long positions in BTC, ETH, SOL, XRP, and ZEC, with a total profit and loss of about +$5.62 million in the past day and about +$14.1 million in the past month. This address started building positions in December last year, and the current account balance is about $35.8 million. After opening the account, it successively increased short positions in mainstream coins such as BTC and ETH, and was once the largest BTC short on-chain, comparable to the listed company Strategy Counterparty that persistently buys BTC. Last week, it shifted from bearish to bullish.

04:31

Data: The market value of non-stablecoin RWA surpasses $20 billion, reaching a new all-time highAccording to Odaily, tokenized digital securities platform Securitize cited data from rwa.xyz on X, showing that the market capitalization of RWA (real world assets), excluding stablecoins, has surpassed $20 billion, reaching a new all-time high. This demonstrates investors' continued interest in the blockchainization of traditional assets, with the tokenized US Treasury market standing out in particular, as its market cap has exceeded $8.87 billion. In addition, BlackRock's BUILD fund currently has a market cap of $1.73 billion.

News