News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

Goodbye or "Goodbye"? The Golden Age of Value Investing

他山之石观投资·2026/01/05 23:12

Nvidia unveils its advanced Rubin chip design

101 finance·2026/01/05 22:36

Crypto Stocks Jump as Bitcoin, Ethereum and XRP Hit Multi-Week Highs

Decrypt·2026/01/05 22:11

Boston Dynamics’s upcoming generation of humanoid robots will feature technology from Google DeepMind

101 finance·2026/01/05 22:06

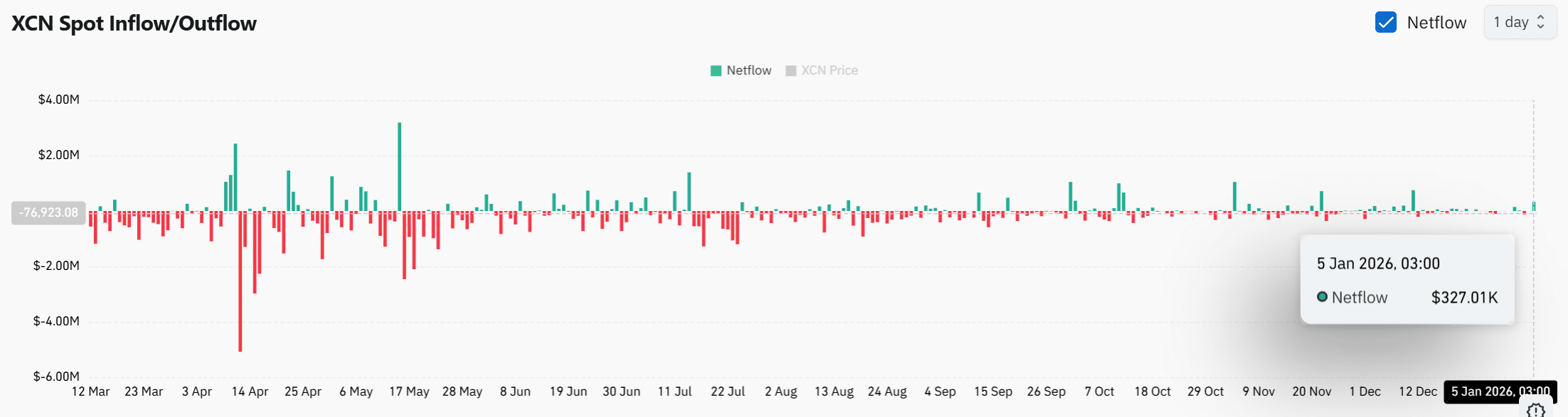

Onyxcoin breaks downtrend as XCN jumps 22% – Continuation ONLY IF…

AMBCrypto·2026/01/05 22:03

Schnorr Signatures in Bitcoin Transactions

BlockchainReporter·2026/01/05 22:00

AUD/JPY Price Forecast: Slips as BoJ’s Ueda signals rate hikes

101 finance·2026/01/05 21:42

Novo Nordisk Launches $149 Wegovy Pill, Expanding Access to GLP-1 Weight-Loss Drugs

Decrypt·2026/01/05 21:09

Goldman Sachs Makes Bullish Statement on Cryptocurrencies Amid Bitcoin’s Rise

BitcoinSistemi·2026/01/05 21:09

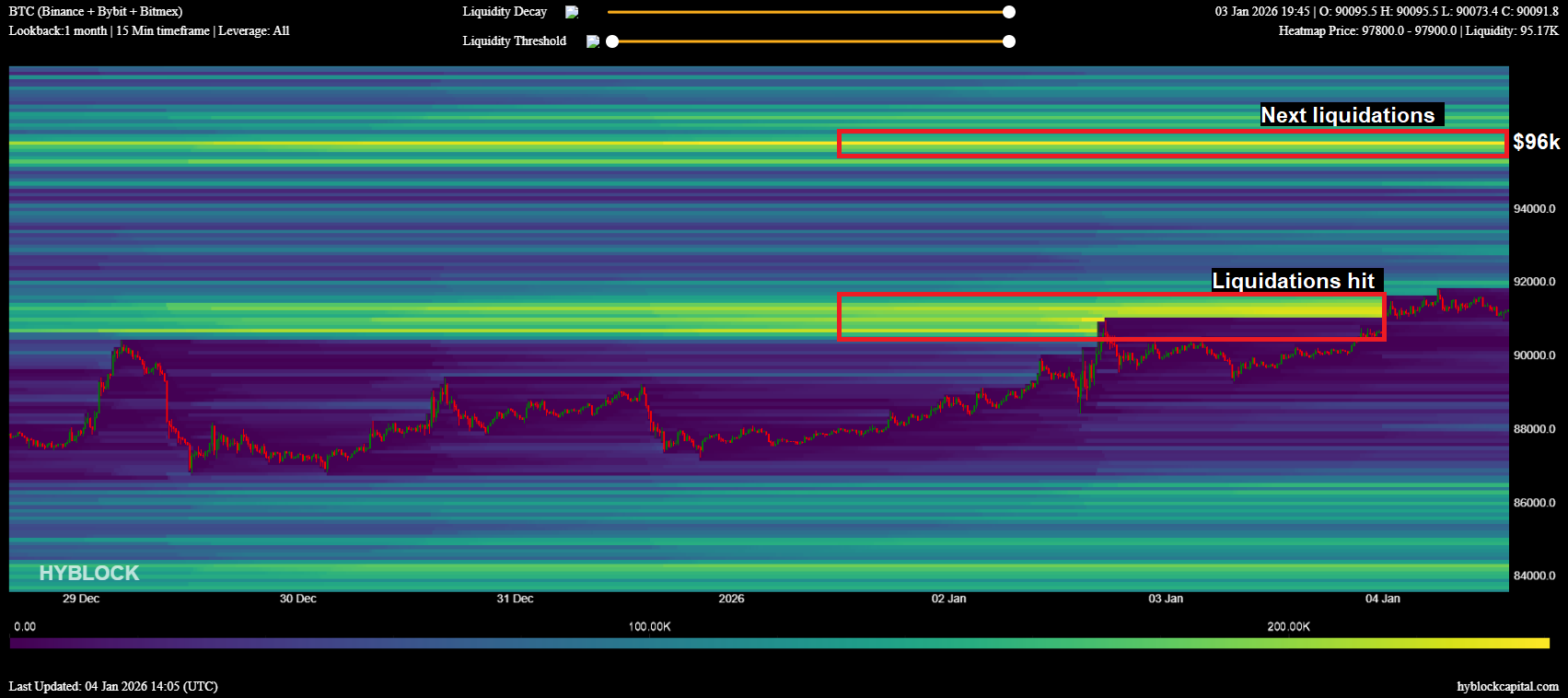

Bitcoin and Ethereum look bullish: But they face the same pre-breakout risk

AMBCrypto·2026/01/05 21:03

Flash

07:15

Data: If ETH falls below $2,986, the cumulative long liquidation intensity on major CEXs will reach $947 millions.ChainCatcher News, according to Coinglass data, if ETH falls below $2,986, the cumulative long liquidation intensity on major CEXs will reach $947 millions. Conversely, if ETH breaks above $3,287, the cumulative short liquidation intensity on major CEXs will reach $735 millions.

07:15

A swing whale enters the market to short ETH, with an average entry price of $3,142.76, having previously made a profit of $21.84 million.According to Odaily, on-chain data shows that swing trader pension-usdt.eth deposited 29,999,699 USDC into its contract account and opened a new 3x leveraged ETH short position. Currently, the size of its ETH short position has increased to 762.3 ETH (approximately $2.397 million). This address has completed about 70 transactions in total, with total profits reaching $21.84 million.

07:15

Swing whale "pension-usdt.eth" opened a short position on ETH at an average entry price of $3,142.76On January 4, the swing whale "pension-usdt.eth" shorted 247.78 ETH (approximately $778,000) with 3x leverage within 5 minutes, with an average entry price of $3,142.76. According to Hyperinsight monitoring, this address has completed about 70 transactions in total, with cumulative profits reaching $21.84 million.

News