News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

HBAR price remains stuck in a two-month downtrend, but rising inflows and bullish momentum indicators hint at a possible reversal toward $0.248.

When a platform's profits are built on the widespread losses of its participants, such a model is destined to be nothing more than a fleeting speculative frenzy.

Genuine firsthand experience always comes from those who are actively driving industry transformation.

Is it a "madman's" blueprint, or a precise map leading to the future?

After nine years of waiting, MetaMask only released a stablecoin?

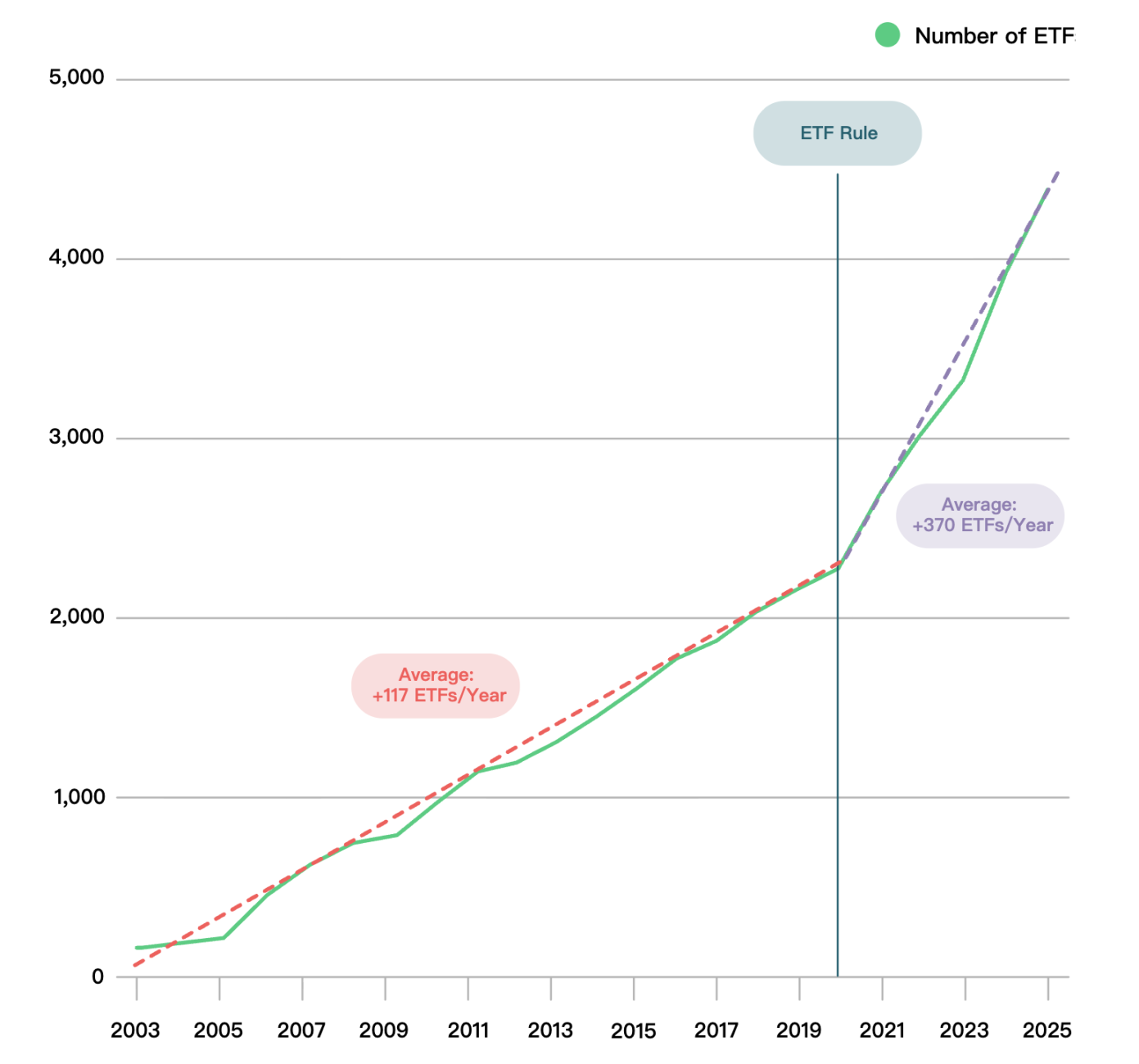

The universal listing standards could be approved as early as October, and their adoption may lead to a large influx of new crypto ETPs.

A $1 million prize pool, lasting for one month. Today, everyone's progress is reset to zero, and all participants are back to the same starting line.