News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

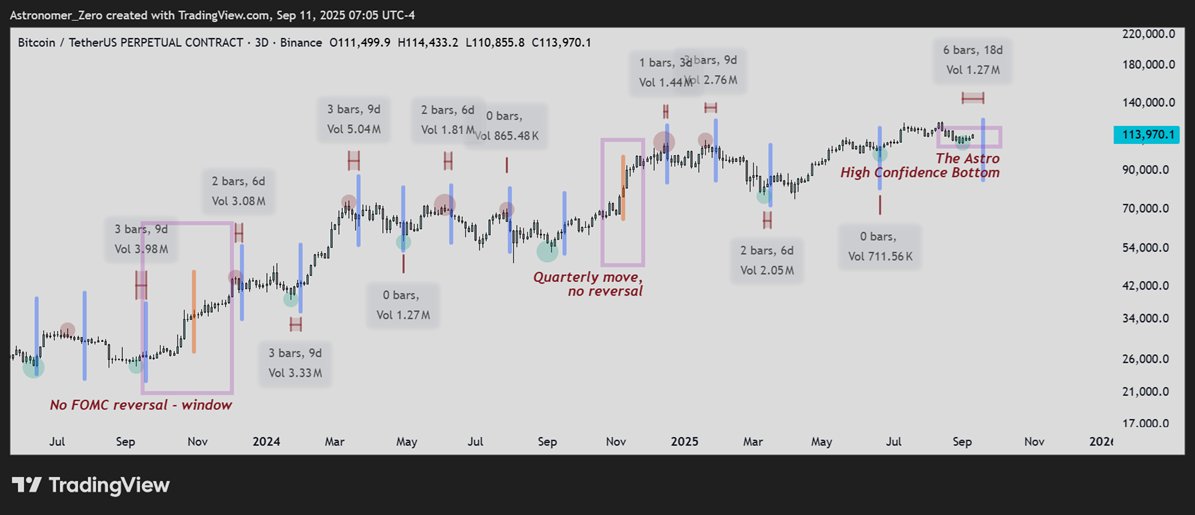

Bitcoin Bears Shaken—Analyst Says Local Bottom 90% Likely Set

CryptoNewsNet·2025/09/13 05:57

Bitcoin: Headed for New Highs by Year-End?

Cointribune·2025/09/13 05:51

Tether Launches USA₮ Stablecoin

Cryptoticker·2025/09/13 05:42

Shibarium Bridge Attack Halted, Funds Moved to Multi-Sig Wallet

Cryptotale·2025/09/13 05:30

Ethereum’s Path to $5,000 Clears, as Exchange Supply Hits YTD Low, ETF Flows Rebound

Ethereum’s rally gains strength as exchange supply dwindles and ETF inflows surge, setting the stage for a $5,000 breakout.

BeInCrypto·2025/09/13 05:30

Julian Figueroa lost 14 BTC worth $1.6 million: he says millions of others will make the same mistakes

CryptoSlate·2025/09/13 05:16

XRP Breaks Resistance, Eyes $3.60 as SEC Ruling Approaches

Cryptotale·2025/09/13 05:00

Conversation with Plume Founder Chris Yin: How to Build a Crypto-Native RWA Ecosystem?

ChainFeeds·2025/09/13 04:32

Interview with CoinFund President: The Digital Asset Treasury (DAT) Boom Has Only Just Begun

ChainFeeds·2025/09/13 04:32

2 million ETH squeezed into the staking withdrawal queue, what exactly happened?

ChainFeeds·2025/09/13 04:32

Flash

05:18

Magic Eden launches Season 4, which will run until January 31.Foresight News reported that the multi-chain trading platform Magic Eden announced on Twitter that its fourth season has begun and will run until January 31.

05:13

Zhang Zhengwen: Short-term controversies will eventually pass, focus on Neo’s continuous development and long-term growthBlockBeats News, on January 1, Erik Zhang, one of the two co-founders of NEO, stated that he hopes everyone will refocus on what is most important for Neo: continuous development and long-term growth. He is actively promoting the design and research of Neo 4 to ensure it aligns with the roadmap. At the same time, efforts are being made to advance ecosystem development and external collaborations, with ongoing commitment to application adoption, real-world assets (RWA), stablecoins, and cross-chain interoperability, so that protocol-level improvements can be translated into practical applications and sustainable growth. Short-term controversies will eventually pass; what truly determines Neo's future direction is continuous delivery, active collaboration, and real-world application.

05:12

Zhang Zhen Wen: The short-term controversy will eventually pass, focusing on the ongoing construction and long-term development of NeoBlockBeats News, January 1st, one of the two co-founders of NEO, Erik Zhang, expressed his hope that everyone would refocus on the most important thing for Neo: continuous construction and long-term development. He is actively pushing forward the design and research work for Neo 4 to ensure its alignment with the roadmap. At the same time, efforts are being made to advance ecosystem development and external cooperation, focusing on application adoption, real-world assets (RWA), stablecoins, and cross-chain interoperability, in order to translate protocol-level improvements into real-world applications and sustainable growth.

Short-term controversies will eventually pass, and what will truly determine Neo's future direction is continuous delivery, active collaboration, and real-world applications.

News