News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Stunning $500 Million USDT Transfer to Aave: What This Whale Move Means for Crypto

Bitcoinworld·2025/12/16 19:27

S&P 500 Index: Why Vanguard Is Bearish on the Index

币界网·2025/12/16 19:23

Explosive Aave DAO Proposal Aims to Seize Control of Aave Labs’ IP and Equity

Bitcoinworld·2025/12/16 19:12

Gamma Prime Highlights Its Marketplace for Uncorrelated Strategies at the Tokenized Capital Summit in Abu Dhabi

BlockchainReporter·2025/12/16 19:09

SMARDEX Rebrands to Everything, Merging Liquidity, Loans and Perps into One Smart Contract

BlockchainReporter·2025/12/16 19:06

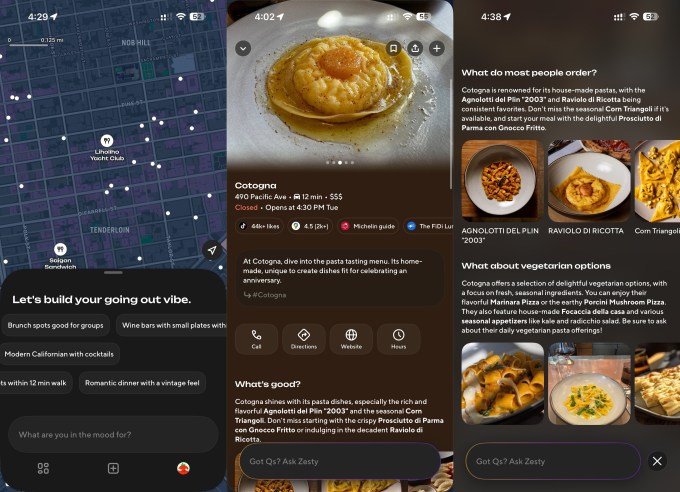

DoorDash rolls out Zesty, an AI social app for discovering new restaurants

TechCrunch·2025/12/16 18:54

Ethereum price plunges below $3,000, liquidations surge, volatility intensifies

币界网·2025/12/16 18:44

Flash

08:21

The probability of a Federal Reserve rate cut in January next year rises to 17.7%On December 28, according to CME "FedWatch" data, the probability of the Federal Reserve cutting interest rates by 25 basis points in January next year has slightly rebounded to 17.7%, while the probability of keeping rates unchanged is 82.3%. The probability that the Federal Reserve will keep rates unchanged until March next year is 46.7%, the probability of a cumulative 25 basis point rate cut is 45.6%, and the probability of a cumulative 50 basis point rate cut is 7.7%. The next two FOMC meeting dates are January 28, 2026, and March 18, 2026, respectively.

07:46

Top 10 Financial News in Hong Kong for 2025: "Hong Kong's Development of a Digital Economy and Improvement of the Virtual Asset Regulatory Framework" Ranks ThirdBlockBeats News, on December 28, Wen Wei Po released the "Top Ten Financial News in Hong Kong 2025", among which "Development of Digital Economy and Improvement of Virtual Asset Regulatory Framework" ranked third. The introduction of the "Stablecoin Ordinance" further improves Hong Kong's regulatory framework for digital asset activities. The market expects that stablecoin licenses will be issued as early as the beginning of 2026, and the launch of a Hong Kong dollar stablecoin is expected to benefit real commercial trade and cross-border transactions. In addition, "Crypto Frenzy Pushes Bitcoin to a New High of $125,600" ranked eighth. Trump's high-profile support for bitcoin has led its price to repeatedly reach new all-time highs this year. However, it has since pulled back and once fell to around $85,000, a drop of more than 30% from its peak.

07:45

Hong Kong's Top 10 Financial News in 2025: "Hong Kong's Digital Economy Development Sees Enhanced Virtual Asset Regulatory Framework" Ranks ThirdBlockBeats News, December 28th, The Wen Wei Po published the "Top Ten Financial News of Hong Kong 2025", in which "Development of the digital economy virtual asset regulatory framework tends to be perfected" ranked third. The "Stablecoin Regulation" was introduced to further improve the regulatory framework for digital asset activities in Hong Kong. The market expects that a stablecoin license will be issued in early 2026, and the Hong Kong dollar stablecoin is expected to be launched, which will be conducive to actual commercial trade and cross-border transactions.

In addition, "Cryptocurrency frenzy drives Bitcoin to a new high of $125,600" ranked eighth. Trump's vocal support for Bitcoin has repeatedly pushed its price to new all-time highs this year. However, it has since fallen back and at one point dropped to around $85,000, a drop of over 30% from its peak.

News