News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Elizabeth Warren Sounds Alarm on Trump's Crypto Dealings, PancakeSwap

Decrypt·2025/12/16 21:56

Why is the Bank of Japan so important to Bitcoin?

币界网·2025/12/16 21:52

Exodus launches digital dollars powered by MoonPay, joining the stablecoin race.

币界网·2025/12/16 21:35

Yen carry trade unwinding impacts global markets, putting pressure on bitcoin.

币界网·2025/12/16 21:14

Do Kwon’s Sentence: Could a Shorter Prison Term Await in South Korea?

Bitcoinworld·2025/12/16 20:57

JP Morgan’s move to Ethereum proves Wall Street is quietly hijacking the digital dollar from crypto natives

CryptoSlate·2025/12/16 20:51

Solana News: Network Begins Testing Post-Quantum Cryptography

币界网·2025/12/16 20:44

Flash

08:36

A whale sold 27.2 million ARC accumulated a month ago, suspected to have triggered the price drop.According to TechFlow, on December 28, Arkham monitoring data showed that about five hours ago, a certain whale completely sold off a total of approximately 27.2 million AR, worth about $1.2 million. The related exit transactions were executed near its breakeven point. However, the price of ARC subsequently dropped sharply and once fell below $0.04. It has since slightly rebounded to $0.04185, with a 24-hour decline of 10.2%.

08:21

The probability of a Federal Reserve rate cut in January next year rises to 17.7%On December 28, according to CME "FedWatch" data, the probability of the Federal Reserve cutting interest rates by 25 basis points in January next year has slightly rebounded to 17.7%, while the probability of keeping rates unchanged is 82.3%. The probability that the Federal Reserve will keep rates unchanged until March next year is 46.7%, the probability of a cumulative 25 basis point rate cut is 45.6%, and the probability of a cumulative 50 basis point rate cut is 7.7%. The next two FOMC meeting dates are January 28, 2026, and March 18, 2026, respectively.

07:46

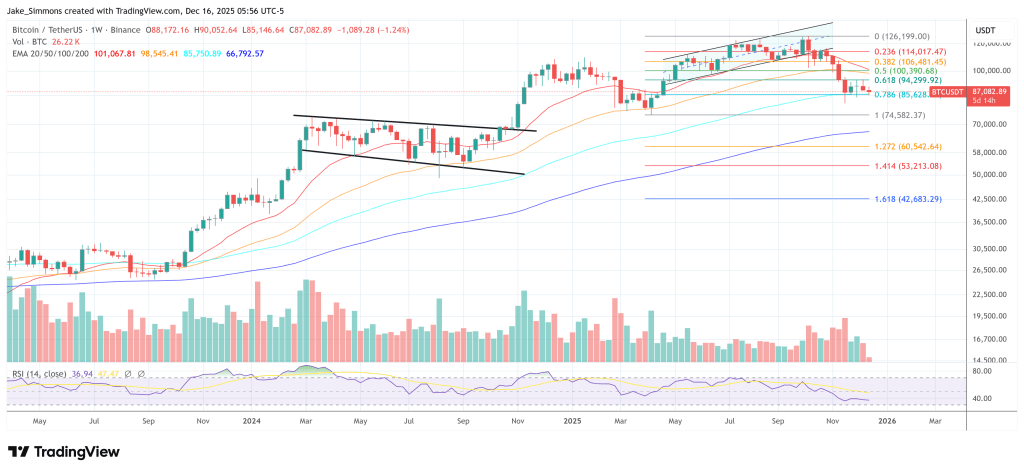

Top 10 Financial News in Hong Kong for 2025: "Hong Kong's Development of a Digital Economy and Improvement of the Virtual Asset Regulatory Framework" Ranks ThirdBlockBeats News, on December 28, Wen Wei Po released the "Top Ten Financial News in Hong Kong 2025", among which "Development of Digital Economy and Improvement of Virtual Asset Regulatory Framework" ranked third. The introduction of the "Stablecoin Ordinance" further improves Hong Kong's regulatory framework for digital asset activities. The market expects that stablecoin licenses will be issued as early as the beginning of 2026, and the launch of a Hong Kong dollar stablecoin is expected to benefit real commercial trade and cross-border transactions. In addition, "Crypto Frenzy Pushes Bitcoin to a New High of $125,600" ranked eighth. Trump's high-profile support for bitcoin has led its price to repeatedly reach new all-time highs this year. However, it has since pulled back and once fell to around $85,000, a drop of more than 30% from its peak.

News